Key Moments:

- Stock futures rose slightly on Wednesday.

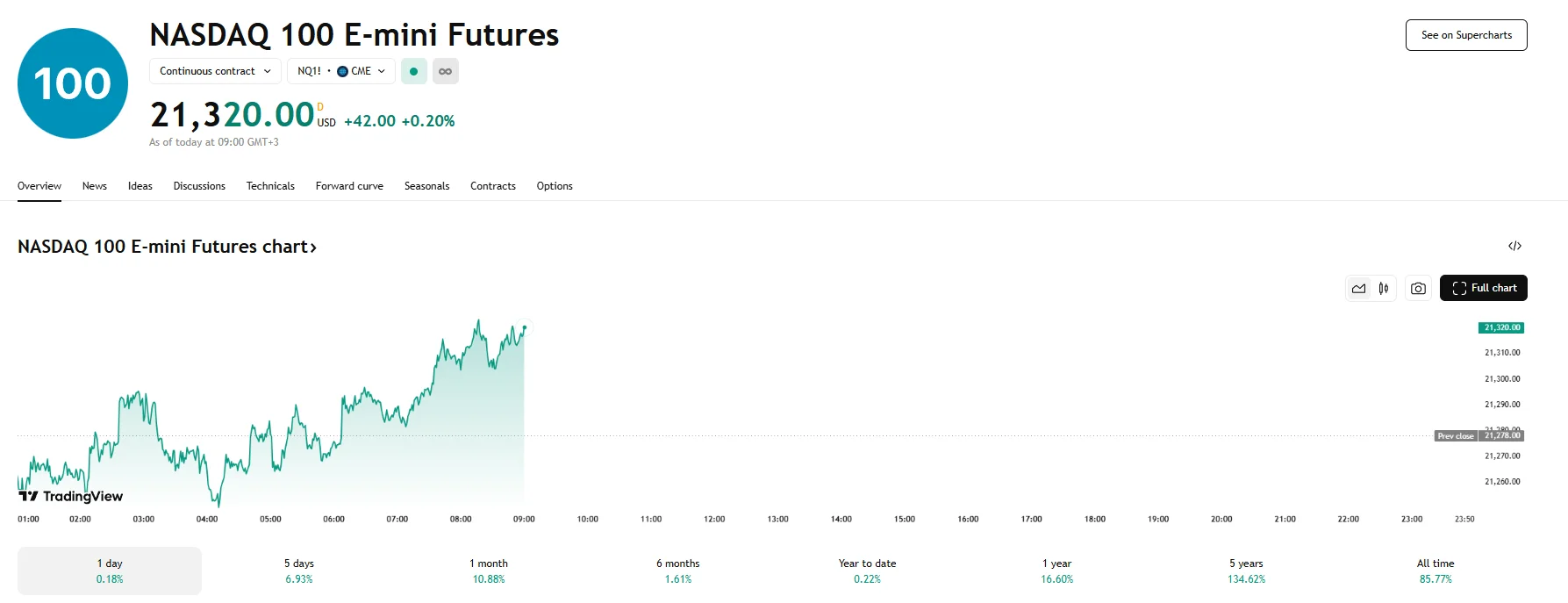

- Nasdaq 100 e-minis went up 0.20%, while S&P 500 and Dow Jones futures remained relatively flat with marginal gains.

- April’s cooler inflation data and a pause in US-China tariffs buoyed investor sentiment.

Futures Open Quiet as Markets Attempt to Build Momentum

US stock futures signaled modest gains on Wednesday after Wall Street rebounded strongly, recovering all losses recorded in 2025 for the S&P 500. E-mini contracts linked to the Nasdaq 100 rose 0.20%, but S&P 500 futures barely climbed to 5,909.25. Dow Jones futures also stayed relatively unchanged at 42,244.

This activity followed a mostly upbeat performance on Tuesday, as the S&P 500 index climbed 0.72% to close at 5,886.54. The Nasdaq 100 advanced by over 300 points, with this 1.58% gain marking its fifth consecutive positive session. Meanwhile, the Dow Jones was dragged lower by weakness in UnitedHealth, as its stock plummeted following news of the resignation of its now former CEO Andrew Witty, and the company’s withdrawal of its 2025 guidance. The Dow ultimately ended the session with a 0.64% loss.

Tariff News and Tech Surge Fuel Optimism

The broader rally was bolstered by easing trade tensions, as investors responded positively to the announcement of a 90-day tariff reduction agreement between the US and China. The new duties include a 10% tariff on US goods and a 30% levy on imports from China. A report revealing that US consumer prices in April experienced their smallest annual increase in several years eased fears of inflation and served to bolster market sentiment.

Technology stocks led gains. The sector advanced by over 2%, and a notable gainer was Nvidia, whose share price surged by more than 5% following reports that over 18,000 AI chips would be delivered to Saudi Arabia. Apple also witnessed its stock climb, notching four consecutive gains by climbing 1%. Beyond tech, Goldman Sachs and Disney have also booked multi-day streaks.