Key Moments:

- MSCI Asia-Pacific index outside Japan gained more than 1%.

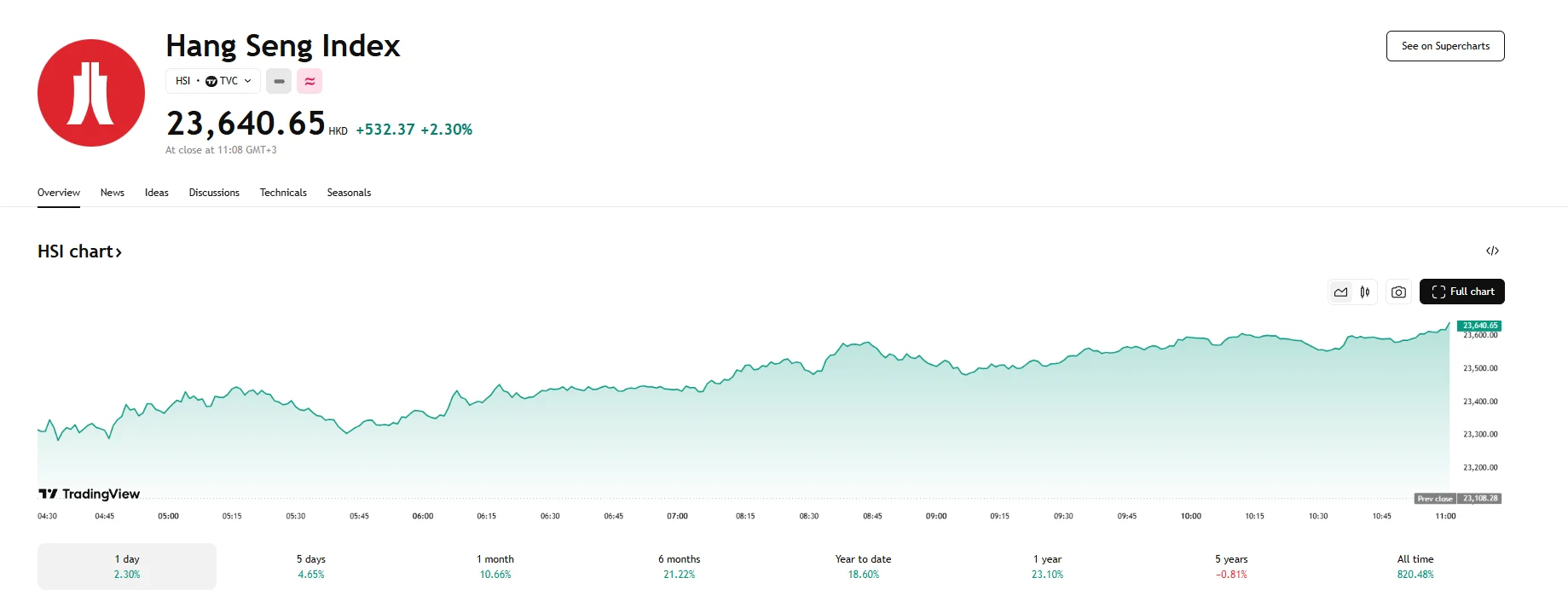

- Taiwan’s TWSE:TAIEX and Hong Kong’s Hang Heng indices surged over 2%, with the former hitting a four-month high.

- Markets expect the US Federal Reserve to cut interest rates twice by the end of 2025.

Regional Markets Advance After Softer US Inflation Reading

Asian equity markets rose sharply on Wednesday, buoyed by a weaker-than-expected US inflation report that strengthened expectations of further interest rate cuts by the Federal Reserve. Moreover, a recently announced agreement between Washington and Beijing revealed that the respective trade partners’ tariffs have been slashed by 115%, easing investor concerns. This served to boost risk appetite.

The MSCI broad index of Asia-Pacific shares, excluding Japan, posted a gain of over 1%, as investors welcomed the potential for a more accommodative US monetary policy stance. As for Japan, its Nikkei 225 did contract slightly, dropping 0.14% to 38,128.06.

Equities in Hong Kong and Taiwan Jump More Than 2%

Taiwan’s benchmark index rose 2.12% to 21,782.87, reaching a high not seen in four months. Indonesian equities, measured by the IDX Composite Index, also jumped over 2%, touching their strongest level since early February as trading resumed following a two-day public holiday. Investors used the opportunity to respond to developments in the US-China trade relationship over the weekend.

Hong Kong’s Hang Seng Index also closed with gains, climbing 2.30% to 23,640.65, while the Chinese SSE Composite advanced 0.86%. Another index to rise higher was the KOSPI, as Korean shares gained by 1.23% on Wednesday.

Meanwhile, Thai and Malaysian shares traded mostly flat. In response to ongoing trade discussions, Thailand’s Minister of Finance, Pichai Chunhavajira, stated that the nation had assured US officials of its efforts to crack down on illegal shipments, expand imports from the US, and improve access to Thai markets. These measures are aimed at reducing the risk of facing punitive trade measures from Washington.