Key Moments:

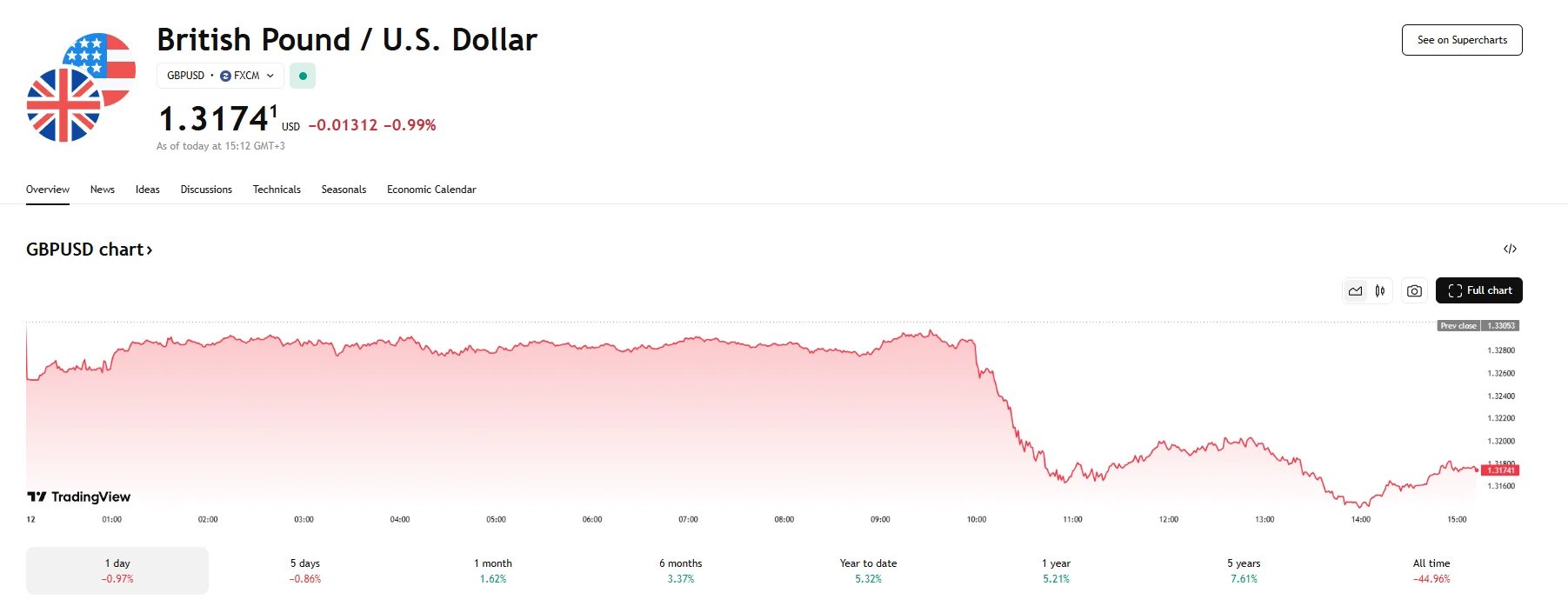

- The pound sterling fell 0.99% on Monday, hitting 1.3174.

- Washington and Beijing announced their agreement to cut tariffs by 115% for 90 days starting Wednesday.

- The US Dollar Index is rallying by over 1%.

Pound Loses Ground Against Dollar

May 12th witnessed the pound sterling depreciate significantly against the US dollar (USD), weakening near its lowest level in a month. The GBP/USD pair’s 1% decline to 1.3174 can be attributed to renewed demand for the greenback, as today’s announcement regarding the US and China’s new tariff deal bolstered markets. The US Dollar Index is now trading above the 101 threshold amid a spike of more than 1%.

Tariff Rollback Sends Global Ripple Effect

US Treasury Secretary Scott Bessent revealed on Monday that Washington and Beijing have decided to reduce import duties by 115%. Starting Wednesday, goods originating from the US will be subject to a tariff of 10% in China. As for Chinese exports to the US, a 30% levy will apply as issues related to fentanyl have not yet been resolved.

The truce between the two trade partners has revived enthusiasm across global markets, particularly lifting US dollar-denominated assets, which had suffered in the wake of retaliatory tariffs announced by Beijing. The greenback had previously declined more than 6% since US President Donald Trump introduced reciprocal duties on “Liberation Day.” The easing of trade tensions is also expected to alleviate upward pressure on US inflation expectations, a potential shift that strengthens the argument for the Federal Reserve to lower interest rates.

The GBP/USD pair now turns its attention to upcoming economic indicators. On Tuesday, traders and investors will assess both the UK employment report for 2025’s first three months and April’s US Consumer Price Index data. Current forecasts suggest that UK unemployment may have risen, while wage growth has likely tempered. Meanwhile, analysts suspect that US core inflation’s growth has accelerated.