Key Moments:

- The Pakistan Stock Exchange closed for one hour on Thursday due to overwhelming negative sentiment.

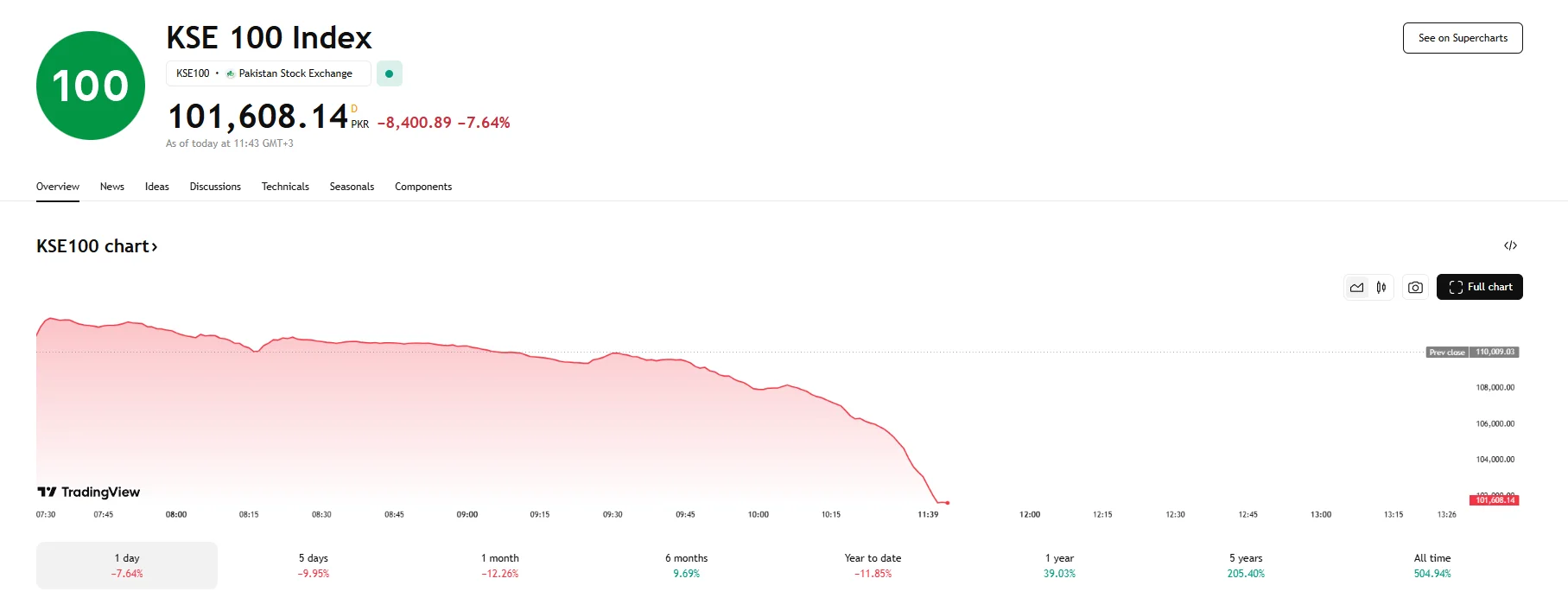

- The sell-off resumed upon its reopening, with Pakistan’s benchmark KSE 100 shedding around 8.400 basis points, while the KSE 30 plummeted by more than 7%.

- Pakistan’s military reported downing 12 drones from India after cross-border airstrikes

Market Disruption Amid Rising Geopolitical Tensions

Equities in Pakistan faced sharp turbulence on Thursday, prompting a one-hour trading halt at the Pakistan Stock Exchange after reports surfaced of drones being shot down in major cities such as Karachi and Lahore, according to an official market notification. The pause lasted from 12:34:15 PM to 13:39:15 GMT+5 (13:34:15 PM pre-open), and upon reopening, stocks resumed their downward momentum. The KSE 100 Index fell 7.64%, suffering a loss of around 8,400 basis points, while the KSE 30 index also dropped by over 7%.

Cnergyico and the Pakistan International Bulk Terminal experienced the sharpest decline, as both stocks dropped over 12%. Meanwhile, Yousaf Weaving Mills Limited and Agritech LTD were among the many entities that saw their share prices plummet by around 10%.

The sell-off reflects escalating concerns following heightened cross-border military activity. Pakistan’s armed forces announced they had intercepted and destroyed 12 drones originating from India that had breached the country’s airspace. These developments followed Indian strikes on multiple locations in Pakistan, fueling fears over a broader conflict between the two nations, particularly due to them both being armed with nuclear weapons.

The instability also rippled through Pakistan’s international debt markets. According to data provided by Tradeweb, the country’s 2036 maturity sovereign bond dropped by over 1 cent and traded at 73.8 cents to the dollar.