Key Moments:

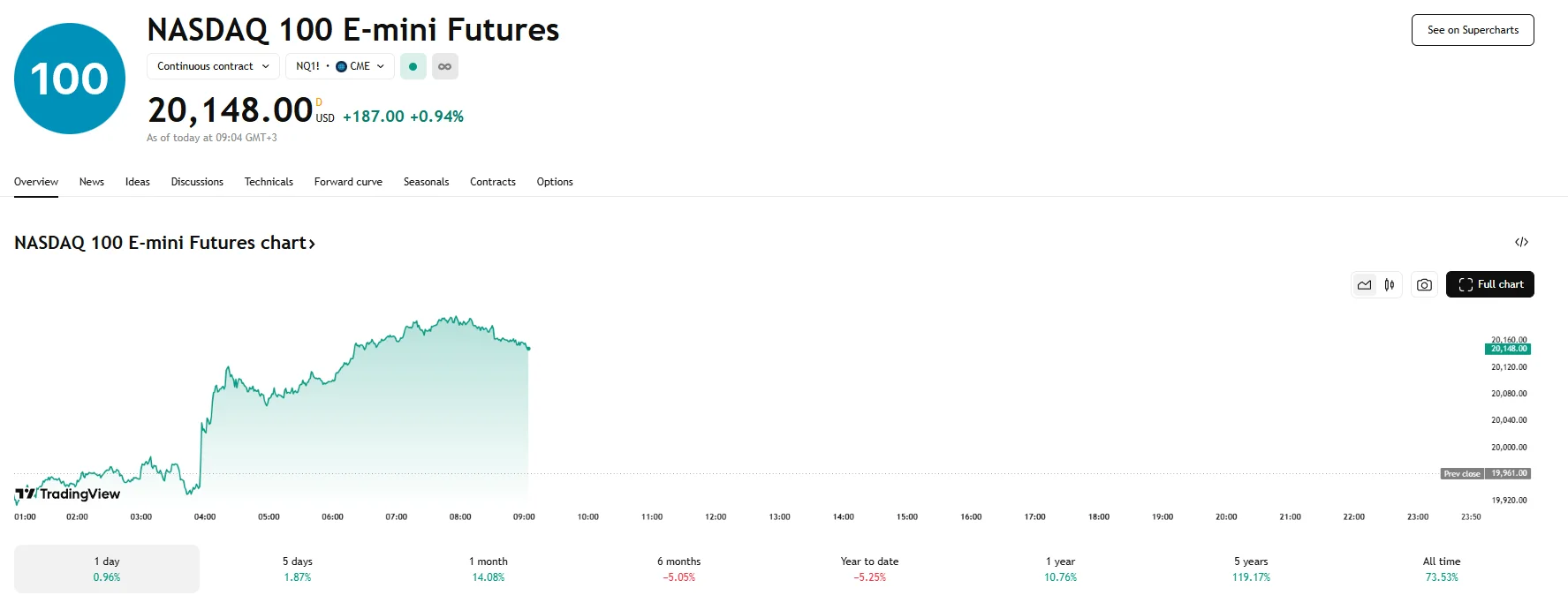

- Futures on the Nasdaq 100 index rose almost 1% on Thursday.

- S&P 500 futures climbed 0.65%, while Dow futures added 190 basis points amid a 0.46% increase.

- The Federal Reserve maintained its benchmark rate, citing growing inflation and unemployment risks.

Markets React to Cautious Fed Stance

US stock futures edged higher on Thursday as investors processed the Federal Reserve’s latest decision to hold interest rates. Following the announcement, S&P 500 futures climbed 0.65% to 5,689, while Dow Jones Industrial Average futures rose by 0.46% and hit 41,404. A surge in tech stocks saw Nasdaq 100 futures advance by almost 1%, reaching 20,148.

Today’s figures follow the generally positive Wednesday closure, when a rally in the tech space propelled both the S&P 500 and the Nasdaq 100, which rose 0.43% and 0.39%, respectively. Nvidia was one of the top performers, as its share price surged more than 3% after Bloomberg reported on potential easing of chip trade restrictions by US President Donald Trump.

Fed Recognizes Growing Economic Risks

The benchmark overnight borrowing rate remains unchanged at a range of 4.25% to 4.5%, a level the bank has maintained since December. In a statement issued after the meeting, the Fed acknowledged that uncertainty surrounding the economic outlook has risen, and further conveyed that the Committee was keenly aware of the risks on either side of its dual mandate. Moreover, the Fed assessed that the risks of both elevated unemployment and increased inflation had risen. However, it should be noted that Chair Jerome Powell tamped down speculation of a proactive rate cut in response to trade policies, stating that more data was necessary for the Fed to make a decision based on data. He also added that inflation was still above their target level.

Northlight Asset Management’s Chief Investment Officer, Chris Zaccarelli, commented on the Fed’s current position, stating that the central bank was “in a bind” as it faced concerns about both inflation and an economic downturn that would likely cause increased unemployment, pulling them towards conflicting policy responses. He also cautioned that markets would increasingly become concerned about a recession. Unless some trade agreements were reached before the tariff pause ended, he argued, they would likely witness another market decline similar to that experienced in early April.