Key Moments:

- Novo Nordisk’s total revenue for Q1 2025 rose 18% year-over-year to 78.1 billion Danish crowns.

- The company lowered its full-year guidance for both sales and operating profit due to US market challenges.

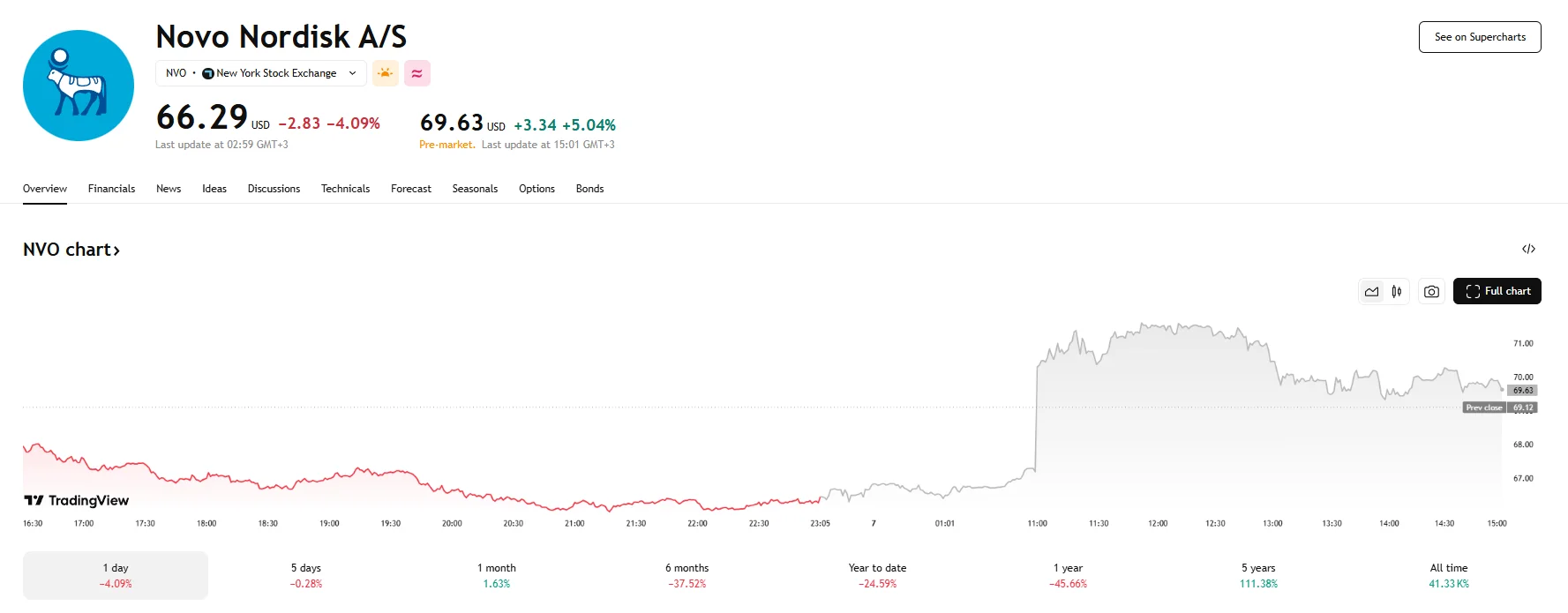

- Shares on the NYSE climbed over 5% during pre-market hours despite guidance revisions.

Q1 Growth Defies Weaker US Demand

Novo Nordisk reported solid financial results for the first quarter of 2025, with revenue increasing 18% over the same period a year prior. Despite facing reduced demand for its GLP-1RA treatments in the US, the company posted total revenues of 78.1 billion Danish crowns ($11.9 billion), while operating profit reached 38.8 billion Danish crowns, representing a 20% increase.

The company’s diabetes and obesity care division continued to drive the majority of overall revenue. This unit generated 73.5 billion Danish crowns in Q1 2025, led by demand for the GLP-1RA-based treatments Wegovy and Ozempic. Obesity-related sales surged 65% compared to Q1 2024, while diabetes-related revenue saw an increase of 11%.

This robust performance helped lift the company’s New York Stock Exchange shares, which rose around 5% prior to the opening bell. The price reached $69.62, up from yesterday’s closing price of $66.29. As for its Nasdaq Copenhagen listing, the Novo Nordisk B A/S stock surged 4.0%.

Outlook Lowered on US Compounding Pressure

Despite its strong quarterly performance, Novo Nordisk scaled back its full-year 2025 outlook. In contrast to the previous 16-24% estimate, Novo Nordisk now expects sales growth to range from 13% to 21%. Similarly, projected operating profit growth was revised from a 19%-27% range to 16%-24%.

This revision was attributed to the “less-than-expected market penetration of their branded GLP-1RA treatments in the United States,” a situation CEO Lars Fruergaard Jørgensen said was influenced by compounded GLP-1RAs. Compounded versions of semaglutide, produced by pharmacies when shortages of Novo Nordisk-branded drugs emerged in early 2022, have undercut branded offerings and reduced Novo Nordisk’s market share in the US. Jørgensen further stated that the company is “actively focused on preventing unlawful and unsafe compounding and on efforts to expand patient access to our GLP-1RA treatments.”