Key Moments:

- Disney’s EPS beat analyst estimates and reached $1.45. Revenue climbed to $23.62 billion, topping the forecasted $23.17 billion

- The company raised its fiscal year adjusted EPS guidance to $5.75, signaling a 16% gain over fiscal 2024.

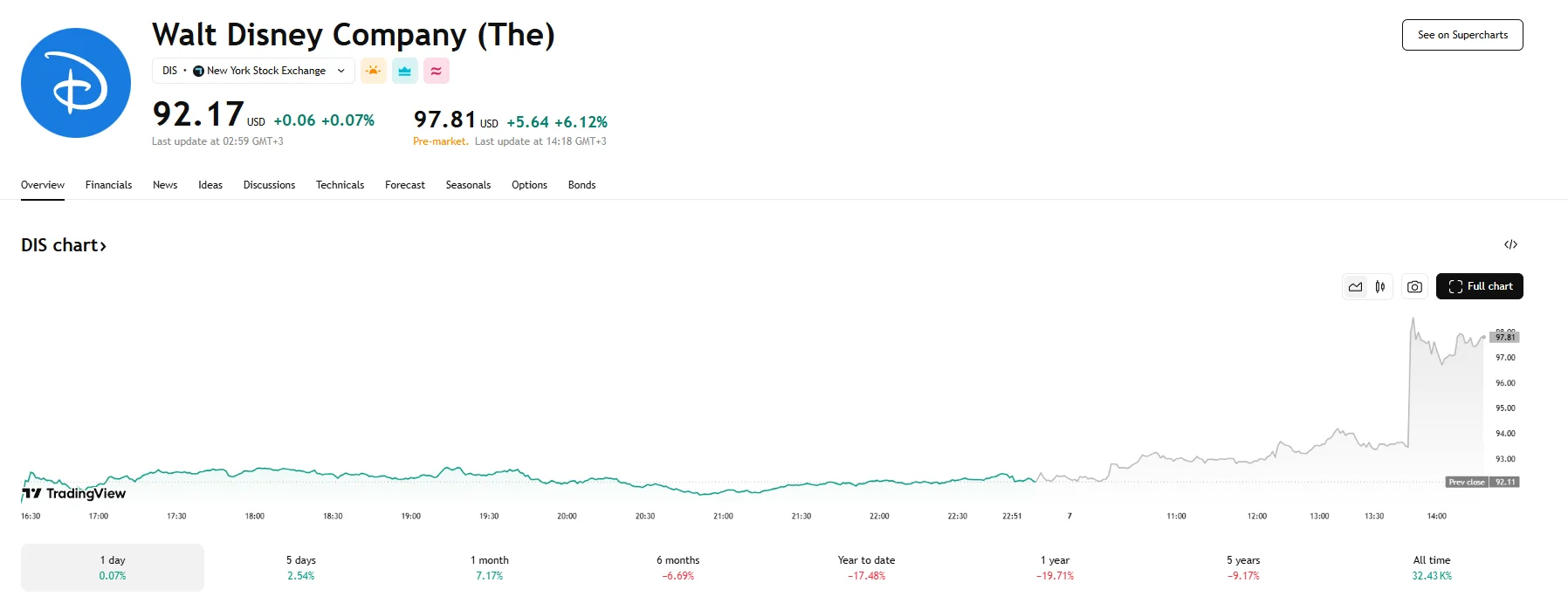

- Disney’s stock soared 6.12% before Wednesday’s opening bell.

Stronger-Than-Expected Q2 Results

Wednesday witnessed The Walt Disney Company report second-quarter results that exceeded analyst expectations. Adjusted earnings per share came in at $1.45, while revenue reached $23.62 billion. In comparison, analysts polled by Visible Alpha had forecast an EPS of $1.20 on $23.17 billion in revenue.

Following the report’s release, Disney’s pre-market stock price figures advanced by over 6%, reaching $96.81. Prior to the announcement, the share price had declined roughly 17% since the beginning of the year, and had closed at $92,17 on Tuesday.

Subscriber Growth and Upbeat Forward Guidance

Apart from the overall revenue and EPS figures, Disney+ subscriber numbers also outperformed expectations. The company had anticipated a slight drop from the 124.6 million figure in the first quarter. However, its latest financial report cited a subscriber count increase of 1.4 million to 126.0 million. This result also outpaced analyst forecasts of 123.6 million.

Alongside its earnings release, Disney provided an updated full-year forecast, boosting its adjusted EPS projection to $5.75. This target serves as a 16% increase over the previous fiscal year. CEO Bob Iger cited strong momentum across key business areas, including upcoming film releases, a new direct-to-consumer launch for ESPN, and growing expansion efforts in the Experiences division. “Overall, we remain optimistic about the direction of the company and our outlook for the remainder of the fiscal year,” he added. In terms of Disney+ subscriptions, the company expects a “modest” increase in 2025’s Q3.

Despite the optimistic earnings and guidance, Disney noted that it would continue watching broader macroeconomic trends that might impact the business, acknowledging that uncertainties remain in the operating environment for the rest of the year.