Key Moments:

- Erste Group acquired 49% of Santander Bank Polska for €6.8 billion in an all-cash deal

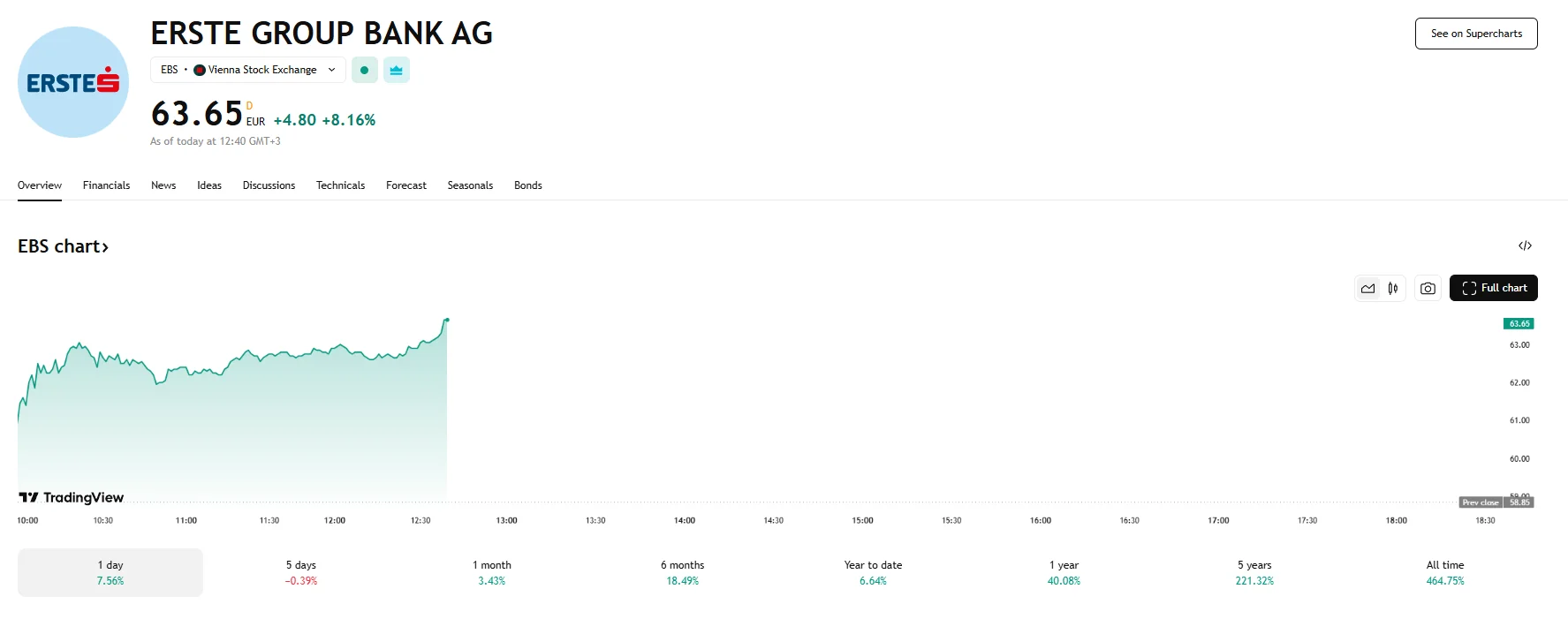

- Erste Group’s stock price surged on Monday, climbing 8.16% to €63.65.

- The Austrian lender also purchased 50% of Santander’s Polish asset management unit for €200 million.

Major Polish Banking Stake Changes Hands

Austria’s Erste Group has acquired a 49% stake in Santander Bank Polska for €6.8 billion ($7.7 billion), as jointly announced by Erste and Banco Santander. The transaction, executed at 584 zlotys ($155) per share, values the Polish bank at approximately twice its tangible book value per share for Q1, excluding a declared dividend of 46.37 zlotys per share. This places the total valuation of Santander Bank Polska at €13.88 billion. In the wake of the announcement, shares of Santander Bank Polska declined by about 4.7%. Meanwhile, Erste Group’s shares jumped by 8.16% as the price reached $63.65.

Asset Management and CIB Partnership Deepen Ties

Beyond the equity acquisition, Erste also secured a 50% stake in Santander’s Polish asset management business for an additional €200 million. This partnership extends further into Corporate & Investment Banking (CIB). Under a newly formed cooperation framework, Erste will gain access to Santander’s global payments platform and referral-based CIB services across Europe and elsewhere.

The alliance is designed to enhance client offerings for both financial institutions, particularly by providing localized solutions backed by global resources. Santander and Erste intend to act as preferred partners within the CIB space, jointly pursuing new business opportunities and client engagements via this collaborative model.

Strategic Intent and Capital Allocation

Santander, which will retain a 13% stake in Santander Bank Polska after the deal, plans to channel 50% of the capital raised (roughly €3.2 billion) toward accelerating its existing share repurchasing goals for 2025 and 2026. The bank is expected to utilize the remainder to fuel organic growth across its European and American operations.

Santander has stated that the divested capital will help enhance value creation for shareholders and clients, while also increasing the bank’s flexibility in high-growth markets. Additionally, Santander is pursuing full ownership of Santander Consumer Bank Polska as part of its strategic repositioning.