Key Moments:

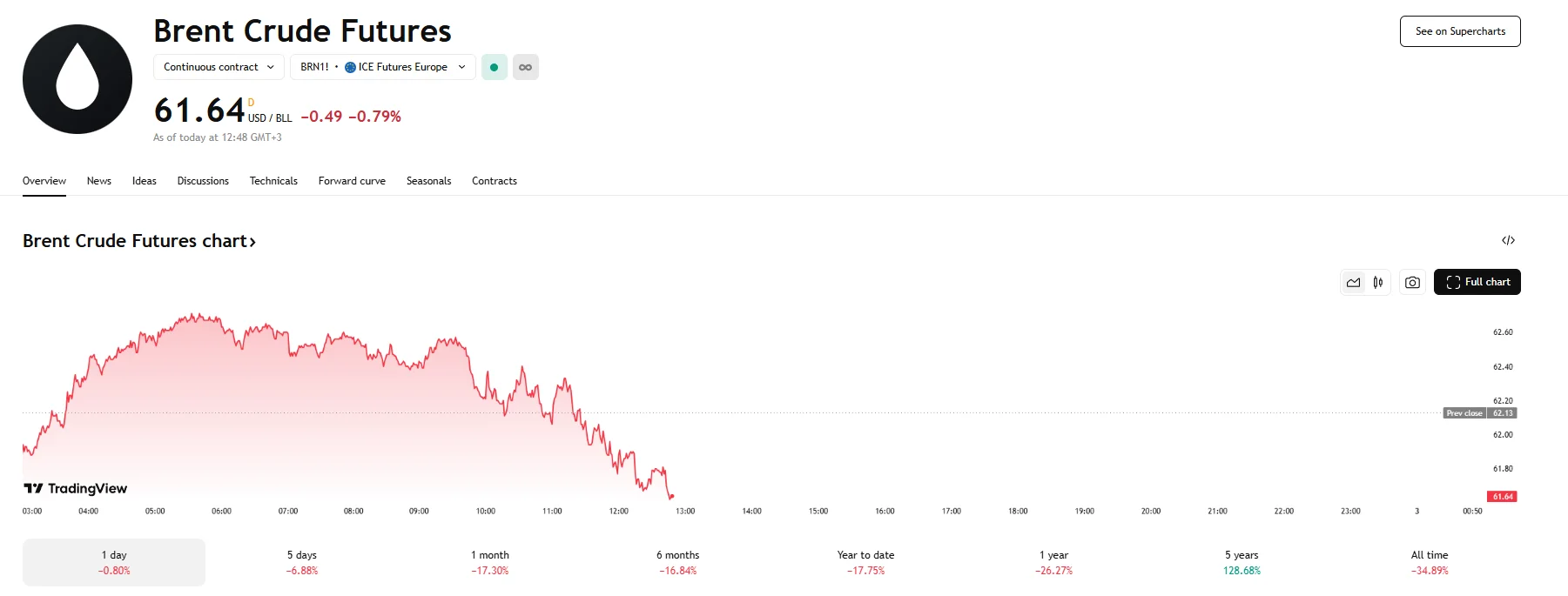

- Brent crude futures fell almost 0,8% on Friday, reaching $61.64 per barrel.

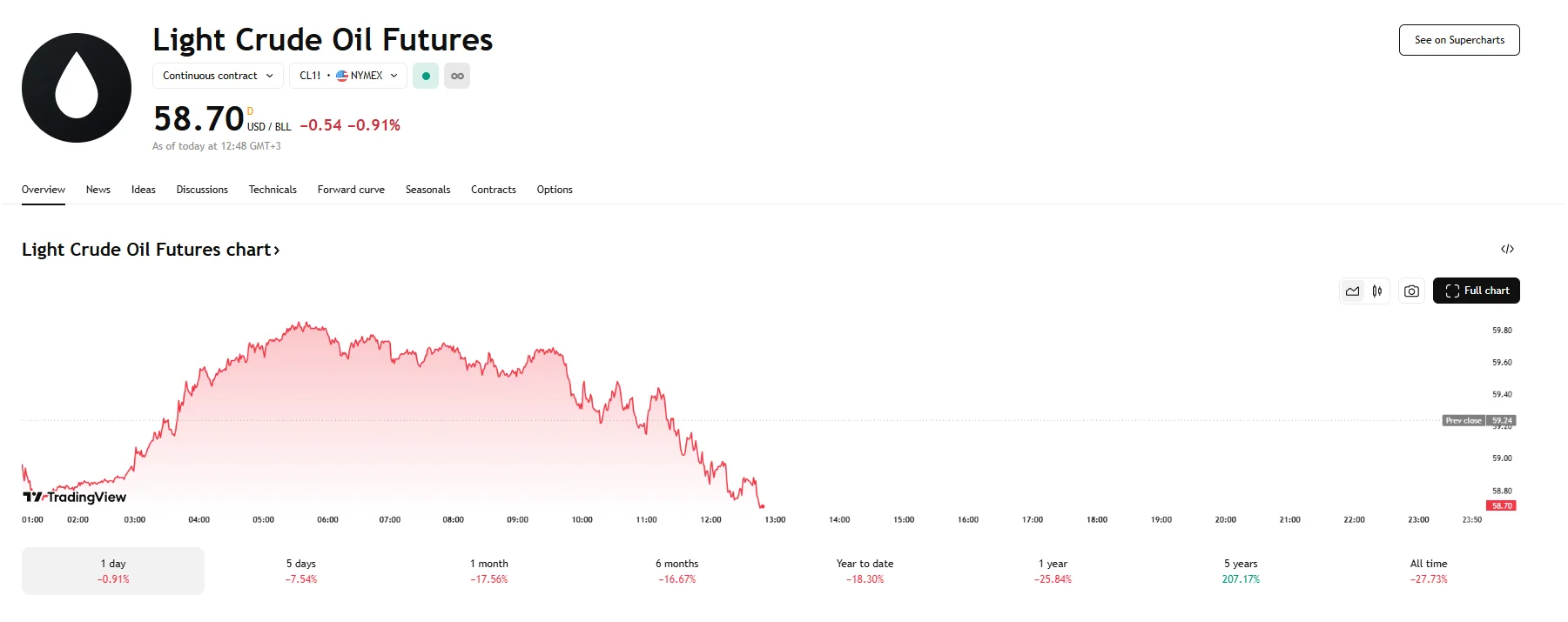

- WTI also slid downward, dropping 0.91% to $58.70.

- Markets responded cautiously to China’s reported consideration of US overtures on trade tariffs and Trump’s weighing of secondary sanctions targeting Iranian oil buyers.

Energy Futures Fall

Crude oil prices initially indicated stability on Friday as energy markets monitored growing geopolitical shifts. According to reports, China is reviewing a potential US proposal to initiate discussions over tariffs, giving rise to cautious optimism about an easing in the ongoing trade conflict between the two nations.

Despite the hopeful tone surrounding trade talks, prices struggled to gain sustained momentum and eventually suffered a drop. Brent crude futures fell below the $62 threshold as a 0.79% decline took hold, while West Texas Intermediate crude hit $58.70 per barrel.

Market sentiment was weighed down by persistent concerns that slowing global economic growth could reduce oil consumption. These fears loom large as OPEC and its allies are reportedly preparing to raise output.

As cited by Reuters, Group Head of Research at Onyx Capital Group Harry Tchilinguirian stated that a degree of optimism existed regarding US-China relations; however, he characterized these indications as merely preliminary. He described the situation concerning tariffs as highly volatile, resembling a pattern of advancement followed by a more pronounced regression.

Adding to the complex global energy landscape, US President Donald Trump might be considering imposing secondary sanctions on entities that purchase Iranian oil.