Key Moments:

- Shell reported $5.58 billion in Q1 adjusted earnings, exceeding the expected $4.96 billion. Refining margins fell to $6.2 per barrel from $12 a year earlier.

- The company announced a $3.5 billion share buyback over the next three months

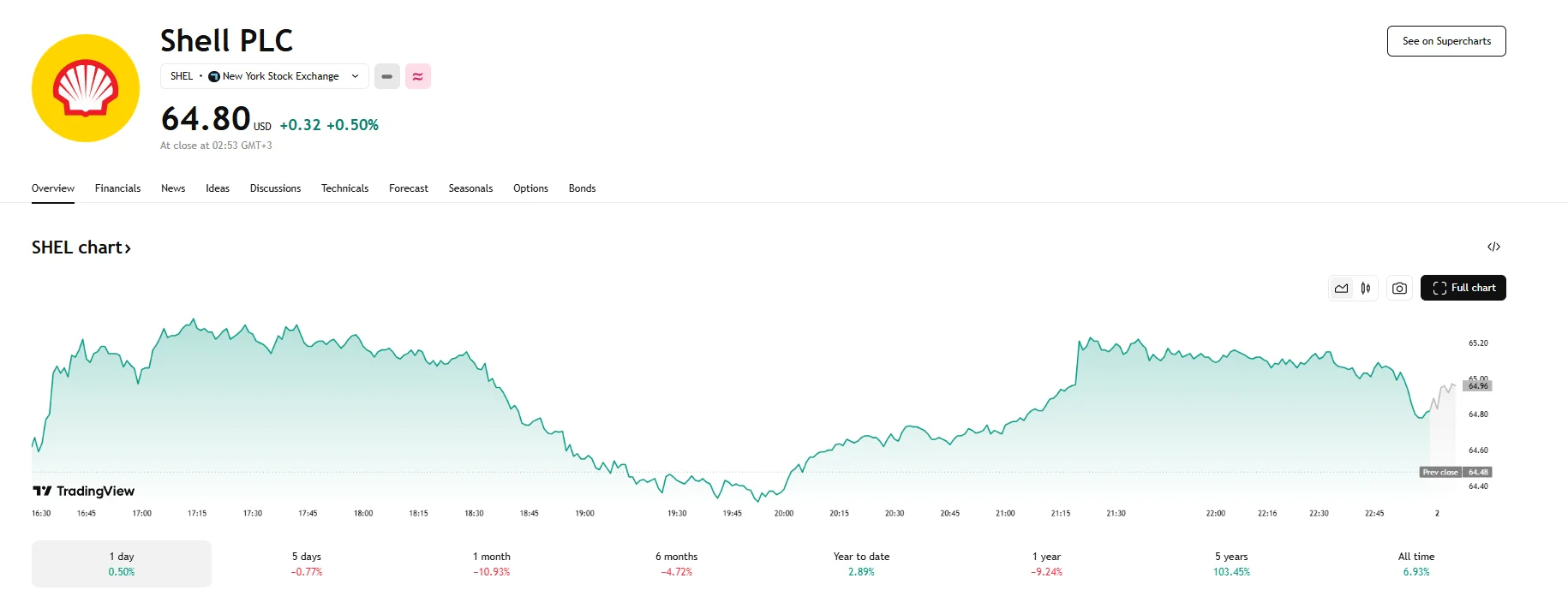

- Shell’s stock price rose slightly to $64.96 on the NYSE during pre-market trading.

Profit Surpasses Analyst Estimates Amid Slower Market Conditions

Shell posted adjusted earnings of $5.58 billion for the first quarter, outpacing the $4.96 billion average forecast from analysts surveyed by the company. The result represents a 28% decline from the $7.73 billion achieved in 2024, driven by lower oil prices and the company’s indicative refining margin registering at $6.2 per barrel in 2025’s first quarter.

The aforementioned figure is down sharply from last year’s $12 per barrel but showed an uptick from $5.5 per barrel reported in late 2024. As for Brent crude prices, they hovered near $75 during Q1 2025, down from 2024’s $87 per barrel. In addition, the company’s debt-to-equity ratio, or gearing ratio, has reached 18.7%. The company also noted that the expiration of hedging contracts had an effect on gas trading; however, performance remained in line with the previous quarter.

Shell’s stock performance has been mixed recently, with the company’s LSE listing dropping 0.16% on May 1st, while shares on the NYSE rose by 0.50% to $64.80. Thus far, it appears that pre-market figures are up slightly on Friday, reaching $64.96.

Continued Commitment to Capital Returns

The company reaffirmed its buyback strategy, announcing plans to repurchase $3.5 billion in shares over the coming three months. This marks the fourteenth straight quarter in which Shell has executed a buyback program of $3 billion or higher, a move that sets it apart from competitor BP, which has reduced buybacks in an effort to strengthen its financial position.

Moreover, Shell’s gearing ratio of 18.7% stands significantly lower than the 25.7% BP has to contend with. This provides Shell with greater flexibility to maintain shareholder returns even as market conditions remain volatile.

In March, Shell outlined plans to deliver increased shareholder returns through buybacks driven by higher liquefied natural gas sales. The company also outlined plans to reduce its capital expenditures in the upcoming years. It also appears that Shell is considering the potential sale or closure of certain chemical assets.