Key Moments:

- Weak oil prices and lower spending tanked Chevron’s net income to the $3.5 billion mark.

- Adjusted earnings per share came in at $2.18, slightly below analyst estimates, while capital expenditures fell by approximately 5% year-over-year

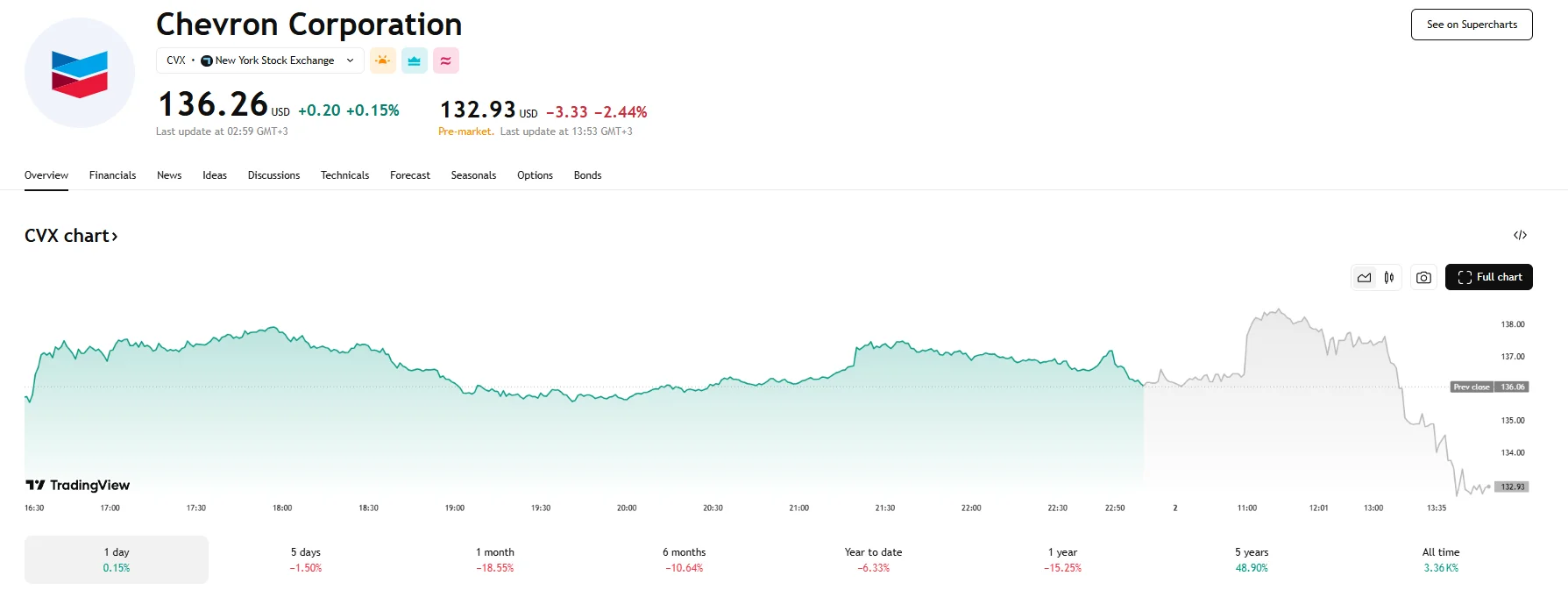

- Market sentiment was dampened by the figures, with Chevron’s stock falling 2.44% in the pre-market trading session.

Low Oil Prices Take a Bite Out of Profits

Shares of Chevron slipped during Friday’s pre-market trading hours after the energy giant reported a sharp year-over-year drop in quarterly profit. The contraction, which witnessed the share price slip 2.44% to $132.93, was largely driven by US oil benchmarks’ roughly 18% price drop in 2025, which has pressured margins across the industry.

Quarterly Financial Highlights

For the most recent quarter, Chevron posted net income of $3.5 billion, translating to $2 per share. This marked a significant decline from the $5.5 billion ($2.97 per share) it recorded during the same period last year. On an adjusted basis, excluding one-off items, earnings per share hit $2.18.

Revenue Misses Wall Street Estimates

Revenue totaled $47.61 billion in the quarter, falling short of the $48.09 billion consensus estimate that was observed in an analyst survey conducted by LSEG. The shortfall underscores the impact of softer crude prices as market sentiment adjusts to the dual effect of anticipated demand pressures and increased output from OPEC+.

Spending and Shareholder Returns

Chevron also reported a decline in capital investments, with spending amounting to $3.9 billion over the quarter compared to $4.1 billion a year earlier. The figures reflect a reduction of approximately 5%. Meanwhile, shareholder returns remained robust, with $6.9 billion in total being distributed through dividends and buybacks.

Market Drivers and Outlook

Current market dynamics have been shaped by expectations that President Donald Trump’s tariff policies may curb demand as OPEC+ moves toward increasing supply. These factors have combined to pressure prices and, in turn, earnings for upstream operators like Chevron.