Key Moments:

- Starbucks reported a 40% year-over-year drop in fiscal quarterly profit.

- Global same-store sales declined by 1% for the quarter.

- Shares dropped 7% in pre-market trading following the earnings release.

Disappointing Quarter Weighs on Investor Sentiment

Starbucks Corporation (NASDAQ: SBUX) disappointed shareholders with its fiscal second-quarter results, pushing its stock down 7% in pre-market activity on Wednesday. Despite meeting revenue projections, the company’s earnings per share fell notably short of analyst expectations. The coffee chain’s quarterly profit totaled $0.41 per share, compared to the consensus estimate of $0.49, reflecting a steep 40% decline from the same period last year.

Traffic Slows Across Key Markets

Although the company met its overall revenue target of $8.8 billion, the company’s core performance metrics revealed weakness. Same-store sales slipped by 1%, undercut by a 4% decline in North American transactions. That region, traditionally a stronghold for Starbucks, saw traffic fall even as its total revenue increased by 3%, buoyed largely by the addition of new store locations rather than returning customers.

CEO Voices Optimism Amid Slower Revenue Recovery

CEO Brian Niccol expressed confidence in the company’s turnaround strategy, dubbed the “Back to Starbucks” plan. While Niccol acknowledged the gap between operational progress and reported financials, he remained encouraged by internal changes. He further stated that the company’s financial results had yet to reflect its progress but added that they had real momentum. “We’re testing and learning at speed, and we’re seeing changes in our coffeehouses,” Niccol added.

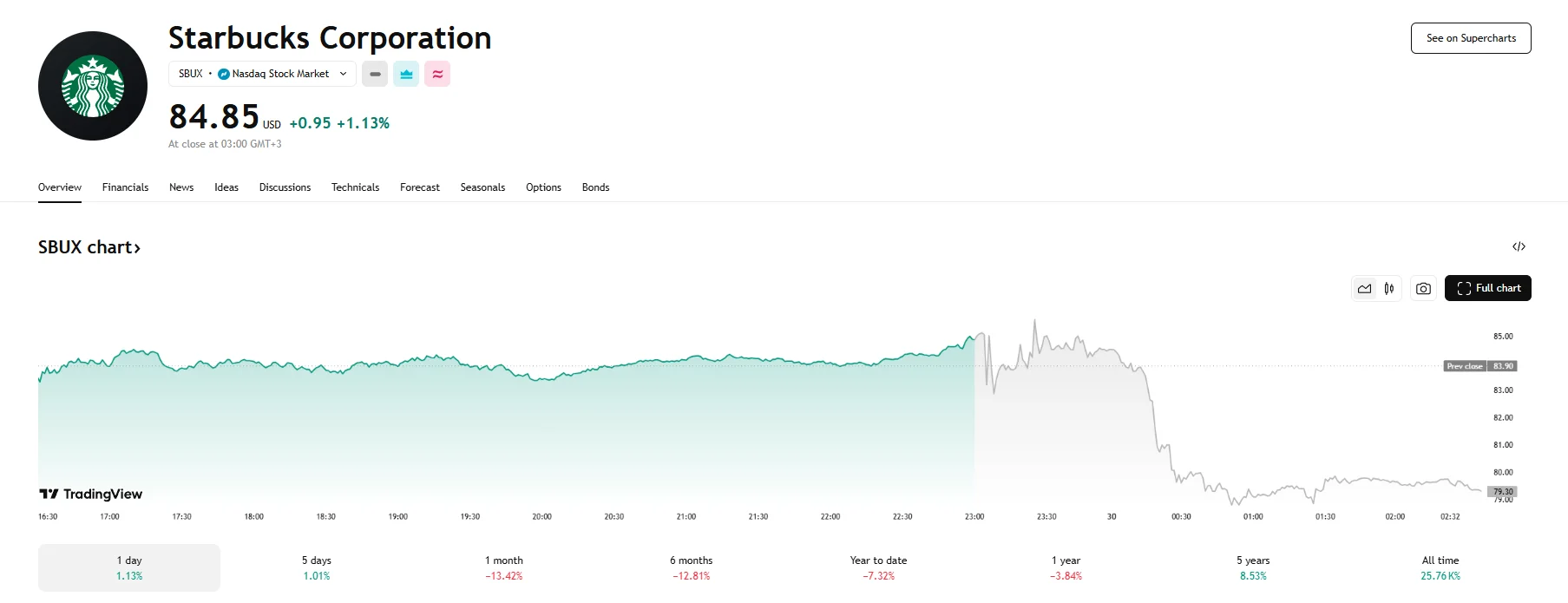

Stock Performance Lags as Execution Timeline Draws Scrutiny

Despite management’s upbeat tone, investors appear cautious. Starbucks’ stock has declined nearly 8% year to date and is down 4% over the past 12 months. Today’s pre-market hours also saw the stock drop below the $80 threshold. The underwhelming quarterly performance has exacerbated concerns that the company’s growth initiatives are not yielding results quickly enough to appease shareholders. Starbucks will need more than just strategic optimism to convince Wall Street that its next chapter is brewing strong.

Starbucks Fiscal Q2 Snapshot

| Metric | Reported | Consensus | Year-over-Year Change |

|---|---|---|---|

| Revenue | $8.8 billion | $8.89 billion | +3% |

| Earnings per Share (EPS) | $0.41 | $0.49 | -40% |

| Global Same-Store Sales | -1% | — | — |

| North America Transactions | -4% | — | — |