Key Moments:

- Eurozone GDP climbed 0.4% in Q1 2025, outperforming forecasts and doubling the previous quarter’s rate

- Ireland led quarterly growth with a 3.2% expansion. Germany exited recession with 0.2% growth

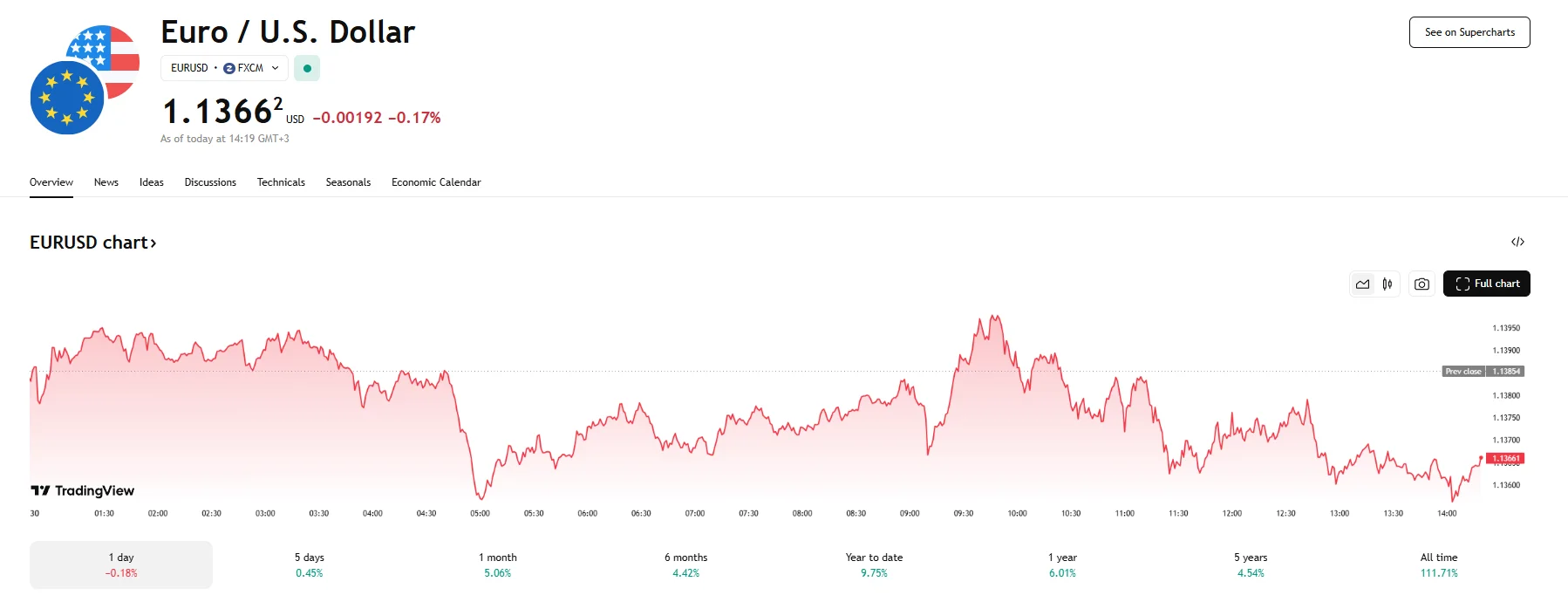

- The EUR/USD pair fell 0.17% on Wednesday.

Economic Momentum Rebounds Across the Eurozone

As revealed by the latest Eurostat data, the Eurozone’s economy expanded by 0.4% in the first quarter of 2025, signaling a stronger-than-expected performance. The quarterly result not only exceeded forecasts of 0.2% growth but also marked an acceleration from the 0.2% gain seen in Q4 2024. This marks the fifth straight quarter of positive growth across Europe.

Annually, the region’s seasonally adjusted GDP saw an increase of 1.2%, matching growth from the previous quarter. The news offered cautious relief to policymakers contending with persistent inflationary pressures and elevated interest rates.

Euro Stagnates

Q1’s promising figures failed to bolster the EUR/USD pair, which suffered a downward movement during Wednesday’s trading hours. The euro depreciated by 0.17% against the dollar, and the exchange rate generally stayed below the 1.1400 threshold.

EU-Wide Expansion Slows Slightly

Across the broader European Union, economic output grew 0.3% in the first three months of 2025, easing slightly from the 0.4% expansion achieved in 2024’s final quarter. On an annual basis, the bloc’s GDP growth did not accelerate and remained at 1.4%.

Top and Bottom Performers Among Member States

Ireland’s GDP grew by 3.2%, making it the top performer. Spain also reported notable growth, advancing 0.6% quarter-on-quarter. Lithuania’s GDP figures mirrored those of Spain, while Czechia managed a slightly more modest climb of 0.5%. Belgium followed, with its GDP growth rate climbing by 0.4%.

Germany, the Eurozone’s largest economy, ended a brief downturn with 0.2% growth, in line with analyst projections. In contrast, France recorded a slight 0.1% expansion, beating its prior quarter’s contraction but missing the anticipated 0.2%. Estonia, Finland, and the Netherlands also stayed relatively flat with growth of just 0.1%. Hungary was the only EU economy to falter, shrinking by 0.2% in the quarter.

Markets Cautious Ahead of U.S. Data Releases

Market reactions were restrained following the GDP release, as investors focused on forthcoming economic figures from the US. In fixed income, German 10-year Bund yields dipped to 2.46%.

European equity markets were mixed. The Euro STOXX 50 rose a mere 0.19% to 5,171.56 after an earlier slip, weighed down by losses in Spain’s banking sector. Banco Santander fell 5% and BBVA slid 2.19%, despite BBVA’s earnings exceeding expectations.

Deutsche Bank dropped 2% amid investor concerns over trade-related risks, though the bank had delivered strong quarterly results. However, Germany’s DAX generally bucked the bearish trend thanks to solid gains from Deutsche Post and Rheinmetall, with the index climbing by advancing 0.7%.