Key Moments:

- Honeywell reported $2.51 in adjusted EPS for Q1, topping the $2.21 consensus estimate. The company raised the lower end of its full-year adjusted EPS guidance to $10.20.

- Revenue from the aerospace division surged 14% year-over-year, reaching $4.17 billion in the first quarter. Total revenue soared to $9.82 billion.

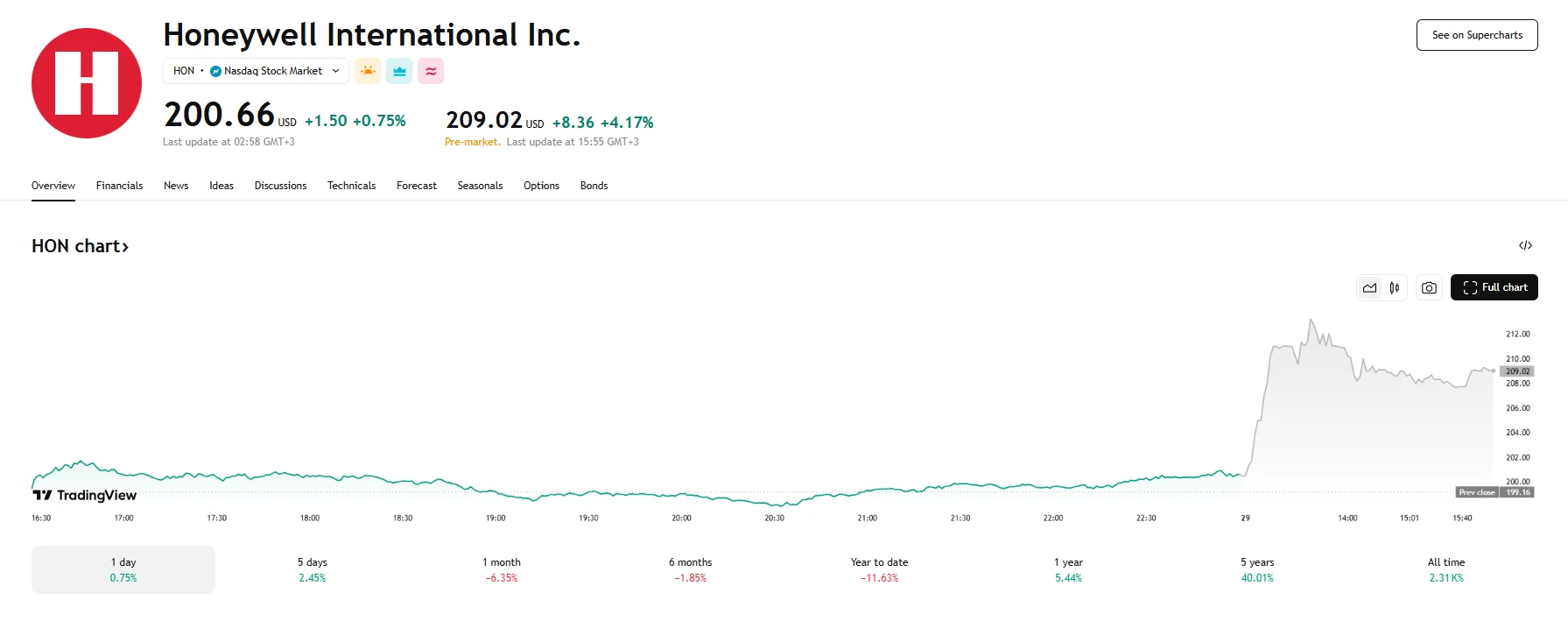

- On Tuesday, the company’s share price rose to 4.17%.

Honeywell’s Q1 Performance Exceeds Expectations

Honeywell International Inc. delivered higher-than-anticipated Q1 results on Tuesday, driven by robust demand for aircraft parts and maintenance services amid a persistent scarcity of new jets.

Supply chain challenges facing aircraft manufacturers have forced airlines to rely on aging fleets, increasing the need for Honeywell’s products and services. The surge in upkeep requirements and strong momentum in its aerospace business provided a crucial tailwind as the industrial conglomerate adapts to a complex global trade and tariff environment.

Outlook Enhanced Amid Uncertain Macroeconomic Conditions

Despite headwinds from international trade tensions,including US tariffs on aluminum, steel, and imports from China, Honeywell voiced confidence in its ability to weather the impact. The company raised the lower boundary of its full-year adjusted earnings forecast and now anticipates earnings per share to range from $10.20 to $10.50.

Honeywell slightly trimmed the upper limit of its annual sales guidance. The updated projection now caps at $40.5 billion, down slightly from the previous estimate of $40.6 billion.

Looking ahead, Honeywell continues to advance its restructuring plans, which were first announced in February. By 2026’s second half, the company will have split its aerospace division from its automation business. This move is intended to sharpen the focus of each unit and unlock long-term shareholder value.

Aerospace Remains Top Performer

The aerospace segment, Honeywell’s largest contributor to revenue, posted a 14% year-over-year increase in Q1’s sales, totaling $4.17 billion. This performance underscores the division’s central role in offsetting broader economic headwinds and solidifying Honeywell’s position in a dynamic market environment.

As shown by LSEG data, the company’s reported revenue of $9.82 billion surpassed analysts’ $9.59 billion, and it also reflected 8% growth YoY. Adjusted earnings per share came in at $2.51, also beating Wall Street’s estimate of $2.21. These figures sent shares climbing 4.17% during Tuesday’s pre-market hours, with the price hitting $209.02.