Key moments

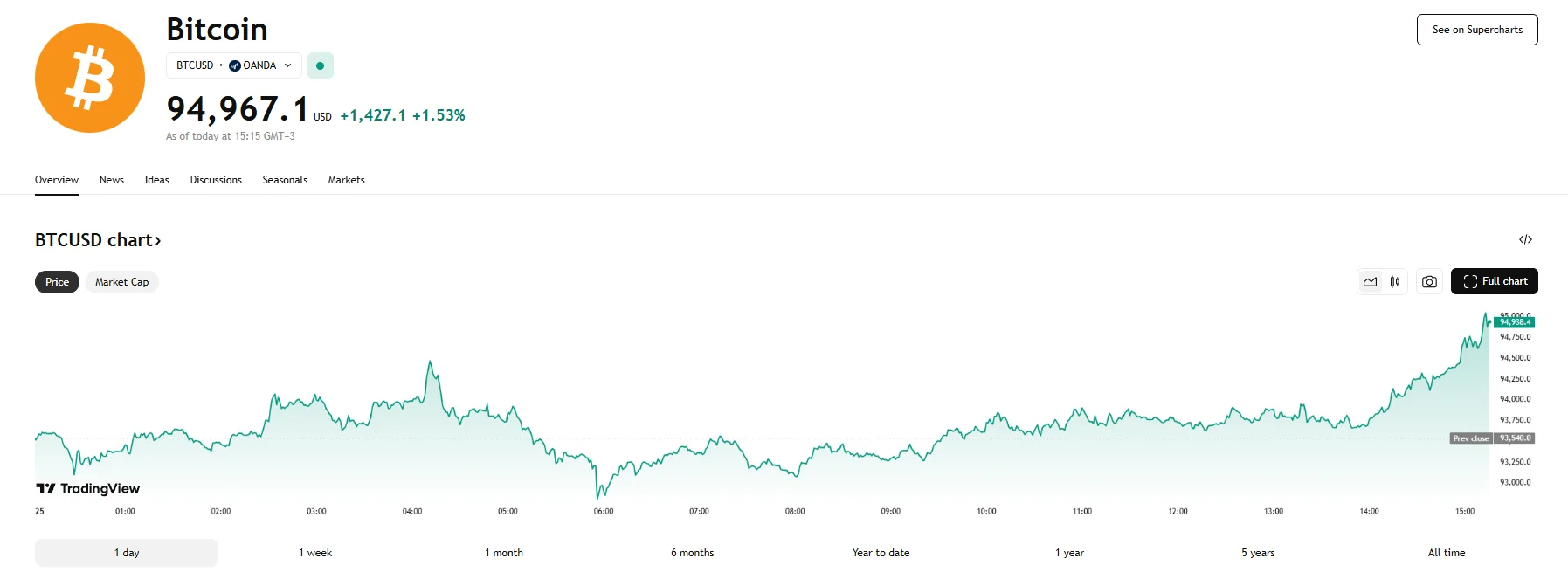

- Bitcoin recorded a gain of 1.53% on Friday, reaching $94,967.

- Significant whale activity was observed during the rally, as suggested by Glassnode data.

- Today’s value appreciation happens after another day of significant inflows into Bitcoin ETFs, which exceeded $440 million.

Bitcoin Climbs Amid Whale Accumulation and ETF Support

Bitcoin’s price demonstrated renewed upward momentum on Friday, decisively breaking past the $94,000 threshold. The leading cryptocurrency registered a notable climb of 1.53%, reaching a high of $94,967 and briefly hitting the $95,000 mark. This surge in value can be attributed to a confluence of factors, indicating strong underlying demand and positive market sentiment.

Analysis of on-chain data from Glassnode has provided intriguing insights into the dynamics fueling this rally, particularly when it comes to whales possessing over 10,000 BTC. According to Glassnode’s proprietary Accumulation Trend Score, which weighs the balance changes and size of investor wallets, these influential investors have demonstrated a clear preference for accumulating more Bitcoin during this recent price ascent, thereby bolstering the upward price pressure.

Further underscoring the conviction of Bitcoin holders is data from CryptoQuant, which highlighted the largest outflow of Bitcoin from centralized exchanges in the past two years, when analyzed using a 100-day moving average. This significant movement of Bitcoin off exchanges is typically interpreted as a preference for long-term holding in private custody, rather than immediate trading, signaling a strong belief in Bitcoin’s future value appreciation.

Adding another layer to the market’s complexity is the substantial expiration of Bitcoin and Ethereum options contracts today, valued at a total of $8.05 billion. Figures from Deribit, a major cryptocurrency derivatives exchange, indicate that Bitcoin options constitute a significant $7.24 billion of this total. The expiration of such a large volume of options can often introduce short-term volatility into the market as traders adjust their positions. The put-to-call ratio for the expiring Bitcoin options stands at 0.73, suggesting a slight prevalence of call options over put options. The “maximum pain point,” the price at which the greatest number of option holders would experience financial losses, has been identified as $86,000. Interestingly, Deribit analysts also note the highest open interest for Bitcoin options around the $100,000 strike price, suggesting that markets expect Bitcoin to reach this figure in the near future.

The current price surge also follows a day of significant inflows into US-based Bitcoin exchange-traded funds (ETFs). SoSoValue has shown that these ETFs collectively absorbed $442 million, marking their fifth consecutive day of positive net flows. Leading these inflows was BlackRock’s IBIT, which enjoyed the largest single-day inflow of $327.3 million. This consistent demand for Bitcoin exposure through ETFs further validates institutional interest and contributes to the overall positive price action. The robust ETF inflows suggest that traditional investors are increasingly comfortable allocating capital to Bitcoin, providing a steady stream of demand that supports higher prices.