Key moments

- In 2025’s first quarter, the South Korean GDP shrank by 0.2%. Other benchmarks also fell, including investment figures, which dropped 3.2%. These contractions defied forecasts that had anticipated a marginal expansion for the quarter.

- Economist Hyosung Kwon attributed this decline to political tensions and US tariff policies.

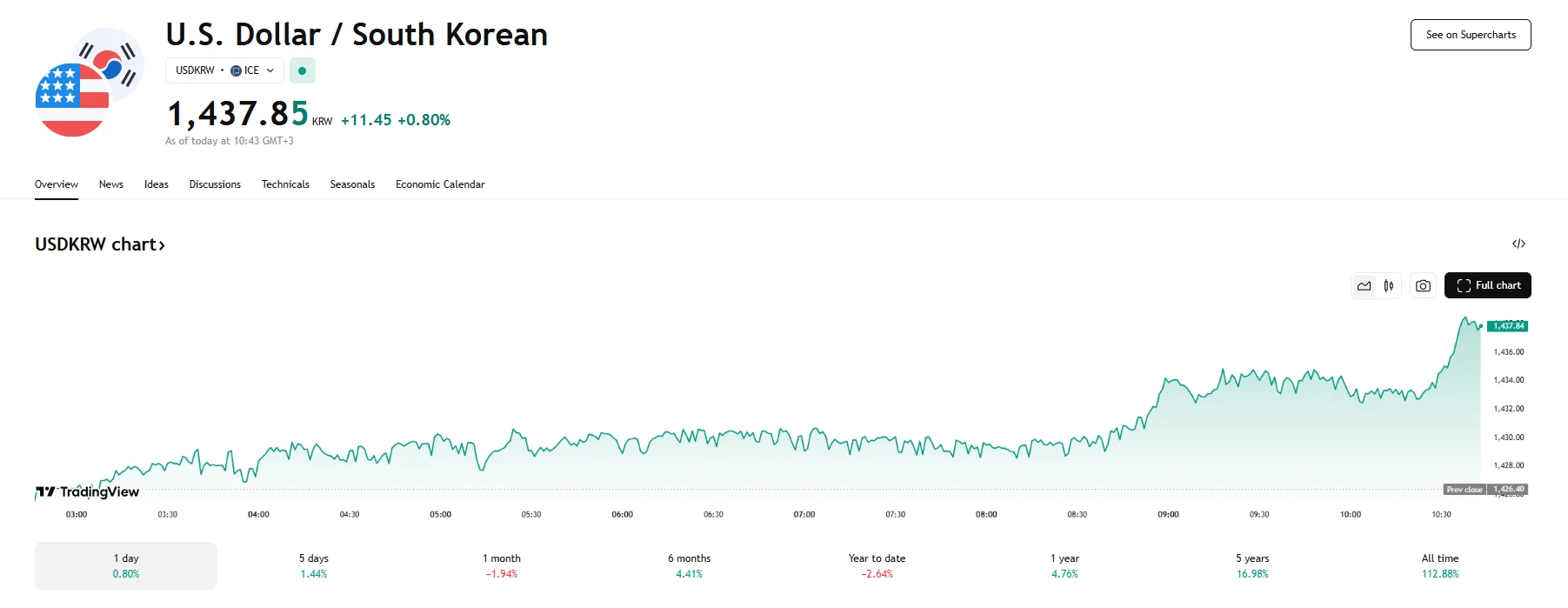

- The Korean won slipped, with the USD/KRW pair climbing 0.8% to reach 1,437.85.

GDP Downturn Weighs on Won

South Korea’s economy experienced an unforeseen setback in the initial three months of 2025, registering a contraction that marked the first such decline since the fourth quarter of 2020. According to the latest data, the nation’s gross domestic product (GDP) decreased by 0.2% compared to Q1 2024. On an annual basis, the economy also saw a modest dip of 0.1%, falling short of analysts’ projections for slight growth in both instances.

Following the figures’ publication, the South Korean won depreciated against the US dollar. This was reflected in the USD/KRW pair’s exchange rate, which rose 0.8% and hit 1,437.85.

A breakdown of South Korea’s financial performance paints a picture of weakness across the board. Consumer spending, a vital engine for domestic demand, edged down by 0.1%. Government expenditure also saw a slight decrease of 0.1%. Investment figures showed more significant declines, with construction investment plunging notably by 3.2%. Corporate spending on machinery and equipment also dipped by 2.1%, with purchases decreasing across sectors like the semiconductor industry.

The nation’s crucial export sector, which is highly sensitive to global trade policies, also registered a decline of 1.1%. Similarly, imports dropped by 2% as domestic demand fell, especially when it came to energy commodities.

Explaining the forces behind this unexpected economic shrinkage, Bloomberg Economics’ Hyosung Kwon focused on two key factors that played a role in the contraction. He argued that former President Yoon Suk Yeol’s unsuccessful attempt to impose martial law, along with apprehensions surrounding potential shifts in United States trade policies, dealt blows to the South Korean economy and impacted sentiment. He continued, stating that 2025’s Q2 is likely to witness South Korea stage a recovery as political uncertainty diminishes, although he did caution that US tariffs would continue exerting pressure on external demand.