Key moments

- ServiceNow reported earnings per share of $4.04 for Q1 2025, while its revenue reached an exceptional $3.09 billion.

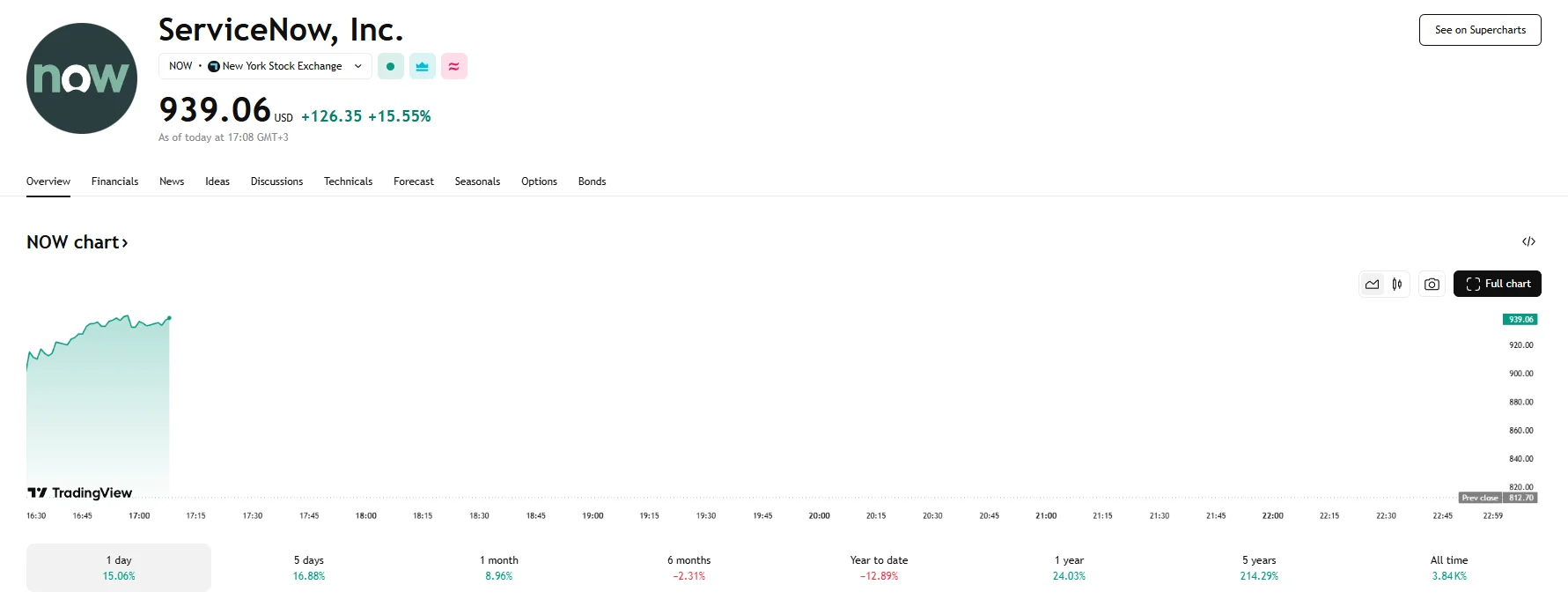

- These figures provided a notable boost to the company’s stock, which soared 15.55%.

- The Q1 results garnered positive reactions from analysts at RBC Capital and TD Cowen.

Robust Revenue Sends ServiceNow Stock Skyward by 15.55%

Shares of enterprise software company ServiceNow skyrocketed after Thursday’s opening bell as the stock price was propelled by 15.55%, almost reaching $940. The substantial increase in share value followed the release of ServiceNow’s report for the first quarter of 2025. The company’s performance exceeded what Wall Street analysts had predicted, particularly on key financial metrics.

ServiceNow revealed adjusted earnings of $4.04 per share for Q1, outperforming the analyst consensus forecast of $3.83 per share. Revenue also came in ahead of expectations, totaling $3.09 billion compared to the anticipated $3.08 billion. These figures represented robust year-over-year growth, with adjusted earnings per share increasing by 18% and revenue climbing by 18.5%.

The positive momentum extended to other indicators of the company’s future performance. Current remaining performance obligations (CRPO), a metric reflecting future revenue from existing contracts, rose by 22% to reach $10.31 billion. This figure also beat forecasts of $10.11 billion, suggesting continued strong demand and a healthy backlog of business.

According to Matthew Hedberg, an analyst at RBC Capital, “ServiceNow’s delivered a solid quarter and outlook.” The results, he pointed out, offered a degree of comfort to investors, particularly amid general market worries regarding enterprise software spending.

Similarly, TD Cowen analyst Derrick Wood described the earnings report as representing the “best scenario” for the company. Wood highlighted the strong upside seen in the first quarter results and indicated that the report helped to reduce perceived risk within ServiceNow’s federal government business segment for the remainder of 2025.

ServiceNow provided guidance for second-quarter subscription revenue in the range of $3.03 billion to $3.035 billion, slightly above forecasts. In addition, its full-year revenue estimate grew to a range between $12.64 and $12.68 billion. Management did, however, project no growth in net new annual contract value from the public sector, encompassing federal business, for the remainder of 2025. This cautious outlook stood in contrast to the overall strong results.