Key moments

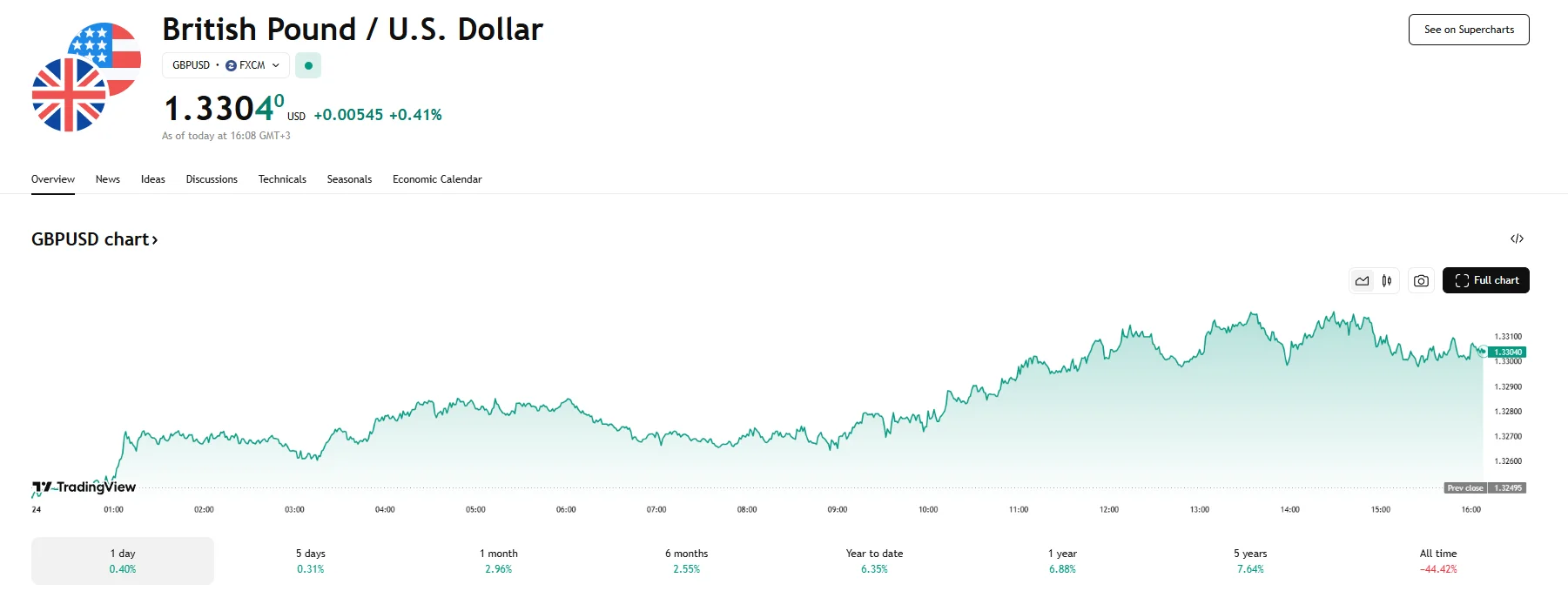

- The exchange rate between the British pound and the United States rose by 0.41% on Thursday.

- The US Dollar Index has not yet reached the 100 mark.

- Tariff uncertainties once again played a role in the dollar’s depreciation.

Pound Appreciates 0.41% Against Dollar

The GBP/USD pair has risen by 0.41%, reaching a level of 1.3304 during today’s trading session. This upward movement for sterling occurred amidst shifting dynamics in global trade sentiment and a notable softening in the US dollar’s position.

The US Dollar struggled to maintain momentum despite positive durable goods orders data, which surged by 9.2% in March. Moreover, weaker-than-expected services PMI figures of 51.2 indicated slowing growth in a key sector of the economy.

Renewed pressure on the greenback saw it struggle against a number of currencies, including the pound sterling, as comments by President Donald Trump regarding the potential reintroduction of certain tariffs within weeks continued to weigh on investor confidence during today’s trading hours. After earlier suggestions that tariffs on China might be substantially reduced, remarks hinting at reimposing reciprocal duties on other countries sparked concerns among investors. This inconsistency and the threat led some traders to pull back from the US dollar, and the US Dollar Index has continued trading below 100.

President Trump’s comments also served to revive anxieties that his approach to trade policy could negatively impact the US economy, potentially increasing the risk of a recession. Meanwhile, the British pound’s performance on Thursday appeared largely influenced by external factors, particularly the US dollar’s weakness, which left the pound susceptible to broader market sentiment. In fact, while the GBP gained against the greenback, its performance against other currencies was reportedly more subdued.

Looking ahead, market participants will be anticipating the release of the UK’s latest retail sales figures, scheduled for Friday. Economists are forecasting a potential contraction in sales growth, which could introduce fresh concerns about the momentum of the UK economy and potentially exert pressure on the pound. A stronger-than-expected reading, on the other hand, could bolster confidence in the UK economy.