Key moments

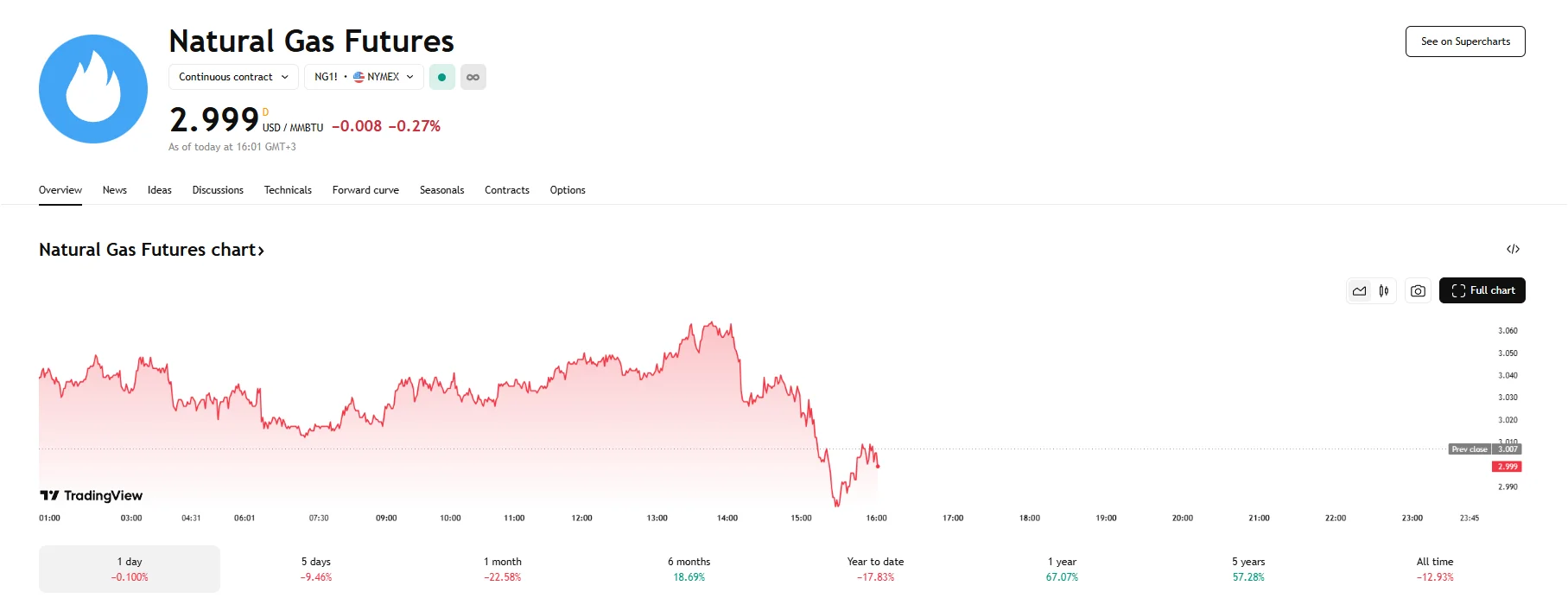

- US natgas futures slipped 0.27%, hitting $2.9.

- Unseasonably warm temperatures across key US regions are significantly lowering heating demand.

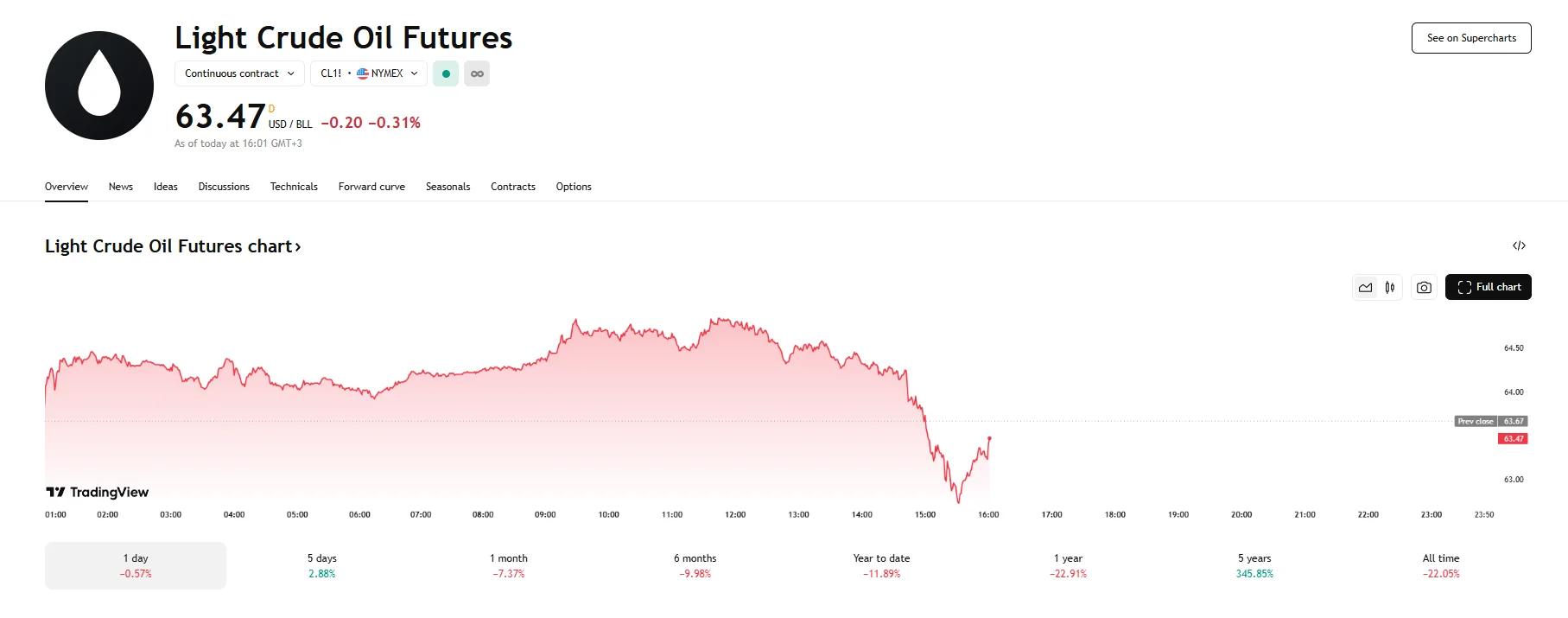

- Crude oil benchmarks also experience downturns, with each depreciating by around 0.3%.

Energy Markets Struggle, Natural Gas Reaches $2.9, Crude Oil Also Falls

US natural gas futures experienced a notable decline on Wednesday, with prices dipping below the key level of $3 per million British thermal units (MMBtu). This downward movement reflects a confluence of factors, primarily centered around comfortable spring temperatures curbing heating demand and high levels of domestic production.

The front-month natural gas contract saw a decrease, reaching $2.9, underscoring the prevailing bearish sentiment in the market. The drop extends a recent trend that has seen futures retreat from the higher figures witnessed earlier in the year.

A key driver behind the softening of natural gas prices is the unseasonably warm weather across parts of the United States. Higher temperatures, particularly in densely populated regions, diminish the need for natural gas for heating purposes, directly reducing overall demand. This reduced consumption, coupled with robust domestic natural gas production that has remained at elevated levels, contributes to an expanding surplus in storage inventories, as current demand is insufficient to absorb the available supply. This, in turn, has placed downward pressure on prices.

Beyond immediate weather patterns and supply/demand balances, shifts in longer-term demand expectations are also playing a role. Earlier in the year, there was significant market enthusiasm regarding the potential for surging natural gas demand from the power sector, fueled by the increasing energy needs of data centers and the expansion of artificial intelligence technologies. However, concerns about potential economic slowdowns and the impact of trade policies on technology sector investment have led some analysts to temper their projections for gas-fired power generation growth, particularly as renewable energy sources continue to be integrated into the grid at an increasing pace.

The weakness in energy markets on Wednesday was not confined to natural gas. Crude oil futures also edged lower, with the West Texas Intermediate (WTI) benchmark falling by 0.31% to trade around $63.47 per barrel. The international benchmark, Brent crude, experienced a similar dip, declining by 0.33% to $67.22.

The dip in crude oil prices appears to be primarily influenced by developments on the supply side, specifically concerning the actions and signals from the Organization of the Petroleum Exporting Countries (OPEC+). Despite ongoing efforts by the group to manage global supply, indications of increased output from some member countries have created downward pressure on prices.

Reports suggesting that certain producers may be prioritizing their individual output levels have fueled concerns about the cohesiveness of the supply cuts. Furthermore, the broader OPEC+ plan to gradually return some production to the market starting in April 2025 is a significant factor being watched by traders, contributing to the perception of potentially looser supply conditions in the near future.