Key moments

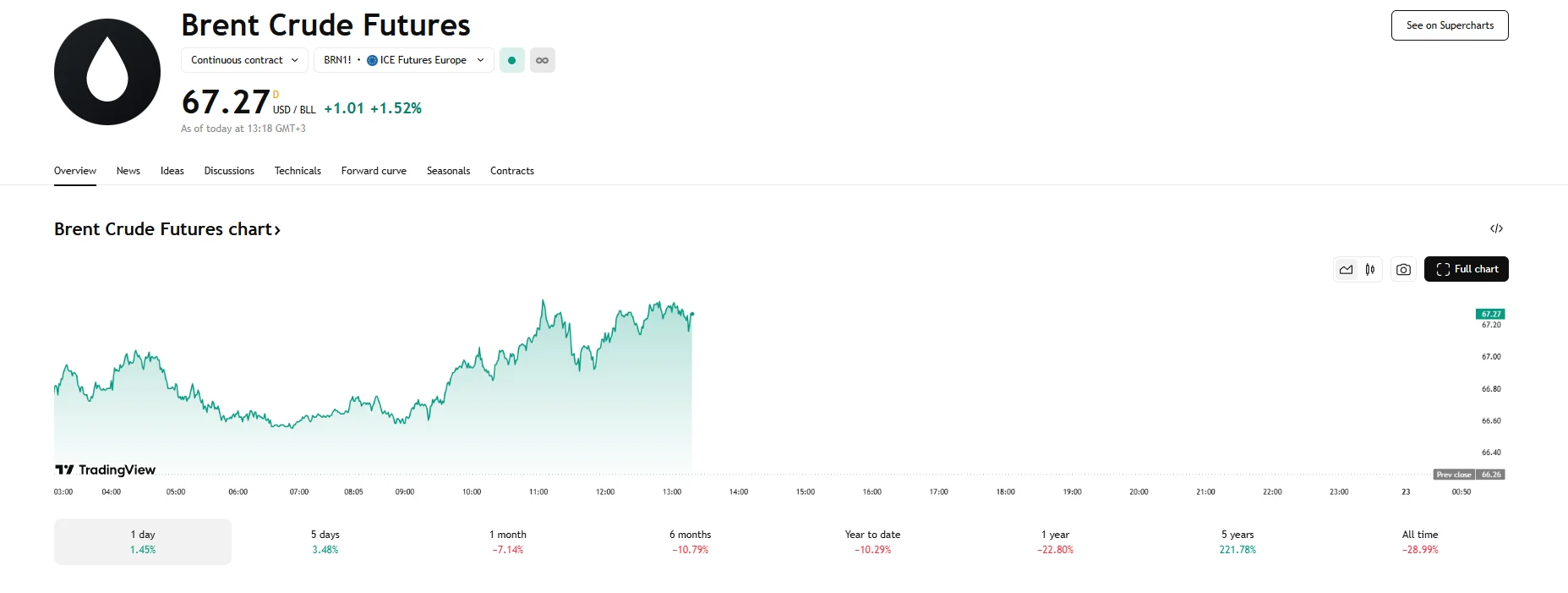

- Brent crude futures rose by a notable 1.52% to $67.27 on Tuesday.

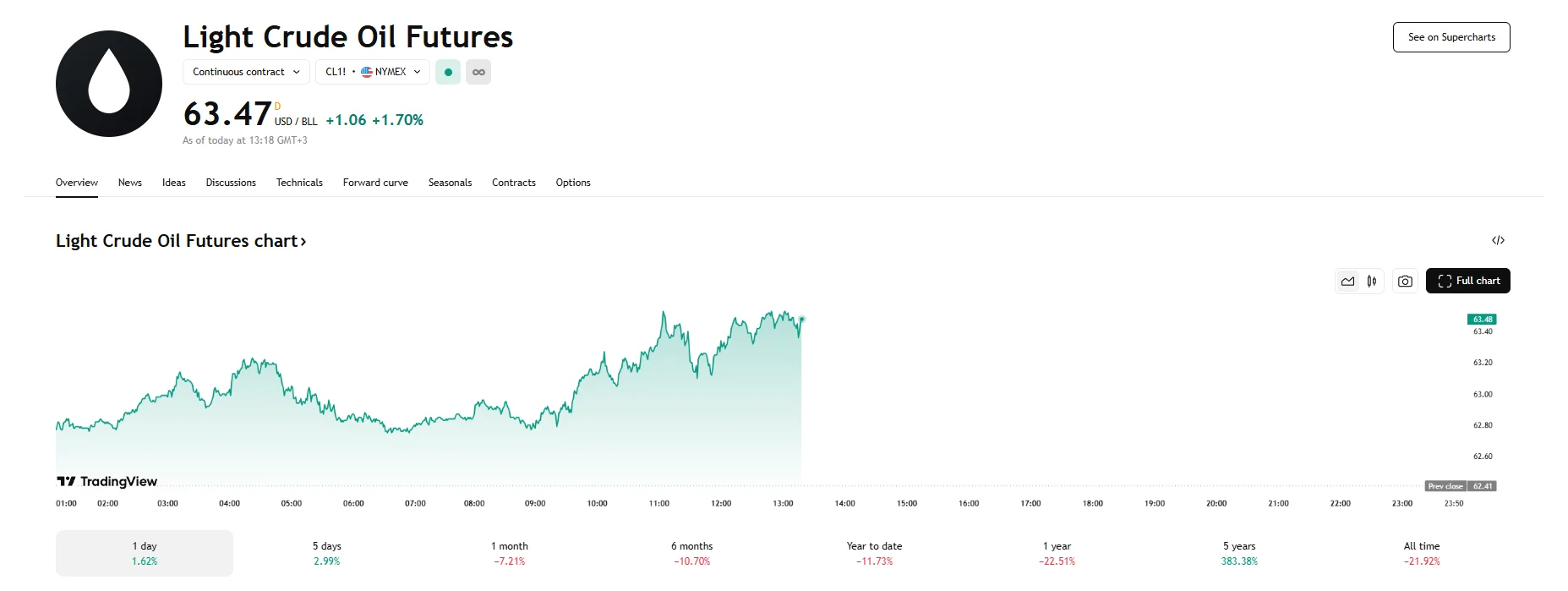

- US WTI futures also enjoyed gains, climbing 1.70% to $63.47.

- According to Nissan Securities Investment’s chief analyst, Hiroyuki Kikukawa, these gains were the result of investors covering their short positions.

Short-Covering Fuels Crude Oil Futures’ Rise

Energy markets staged a modest recovery Tuesday as crude futures climbed more than 1.5%, rebounding from Monday’s sharp decline. The upward movement came as traders adjusted positions amid lingering concerns about global economic stability and energy demand.

This rebound saw both major benchmarks register gains, with futures contracts for Brent Crude demonstrating a notable increase of 1.52%, elevating the price to $67.27 per barrel. Similarly, US West Texas Intermediate (WTI) futures also exhibited strong upward momentum, climbing by 1.70% to reach $63.47. This recovery followed a sharp decline of over 2% in both Brent and WTI on Monday, a drop primarily attributed to emerging signals of potential progress in discussions regarding the US-Iran nuclear program, which raised the possibility of increased global oil supply.

Market analyst Hiroyuki Kikukawa cited short-covering as the main driver behind Tuesday’s bounce rather than fundamental improvements in market conditions. Short-covering occurs when investors who had previously bet on lower prices buy-back contracts to limit their losses following the prior day’s sharp downturn. However, despite this technical rebound, concerns regarding the broader economic outlook and the direction of US monetary policy continue to weigh on market sentiment, potentially limiting the extent of further price gains.

One key factor is the ongoing tension surrounding international trade, particularly the trade disputes initiated by the United States as they have exacerbated fears of a potential economic slowdown. Given that economic activity is a primary driver of energy consumption, any significant deceleration in global growth would likely translate to reduced demand for oil, thereby putting downward pressure on prices.

Furthermore, the assertive stance of US President Donald Trump towards the Federal Reserve and its monetary policy decisions have contributed to market uncertainty. His repeated public criticism of Fed Chair Jerome Powell, coupled with demands for prompt interest rate cuts, has sparked concerns about the independence of the central bank. Such political pressure on monetary policy has contributed to a weakening of the US dollar, which fell to a three-year low. A weaker dollar can sometimes provide a marginal boost to dollar-denominated commodities like oil, but the overarching uncertainty stemming from the situation appears to be a net negative for market stability.