Key moments

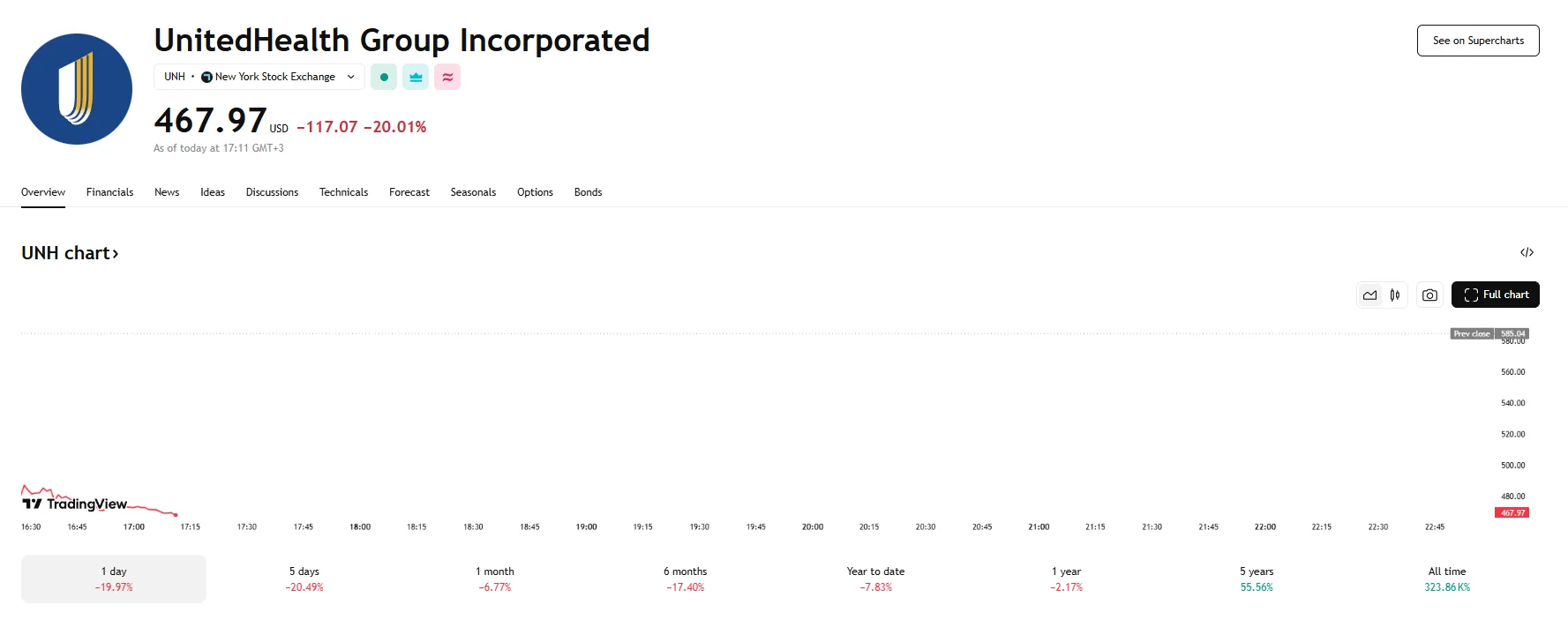

- UnitedHealth’s share price sank 20% on Thursday.

- Its stock declined after key financial figures in the company’s Q1 financial report failed to align with prior market forecasts. Moreover, the company also adjusted its EPS guidance, which is now expected to fall between $26 to $26.50 in 2025.

- CEO Andrew Witty told investors that management was diligently working to resolve the identified issues.

CEO Vows Action as UnitedHealth Stock Tanks on Weakened Guidance

UnitedHealth’s stock suffered a substantial decline after Thursday’s opening bell, with shares tumbling a substantial 20%, reaching $467.97. This sharp decline reflected a sudden erosion of investor confidence in the stock following the release of the health insurance giant’s financial performance report for the first quarter of 2025.

UnitedHealth’s reported Q1 earnings were lower than what financial analysts had anticipated. The company disclosed adjusted earnings per share (EPS) of $7.20, a figure that did not meet the estimate of $7.27 to $7.30 projected by various financial data providers. Furthermore, the company’s revenue for the quarter ending March 31st hit $109.58 billion YoY, while market expectations had hovered around $111.5 billion and $111.6 billion.

Adding to the negative sentiment surrounding the stock was UnitedHealth’s decision to revise its financial outlook for the entirety of 2025. The company now forecasts an EPS between $26 to $26.50, a substantial downward adjustment from the previous guidance range of $29.50 to $30. This caught many investors off guard and fueled concerns about the underlying health of the company’s various business segments.

The issues contributing to this lowered guidance appear to be multifaceted. One factor had to do with UnitedHealth’s Medicare Advantage branch, as an unexpected surge in healthcare activity within this segment resulted in unexpectedly high costs. Additionally, leadership acknowledged the ongoing impact of funding cuts imposed on Medicare prior to the 2024 elections, which exerted pressure on profitability. The company’s Optum Health services division was hit particularly hard by these reductions in funding.

UnitedHealth’s Chief Executive Officer, Andrew Witty, stated that the company “did not perform up to expectations” during the first quarter. He characterized UnitedHealth’s performance as “unusual and unacceptable” and assured investors that the management team was actively addressing the identified challenges to improve the company’s performance in the future.