Key moments

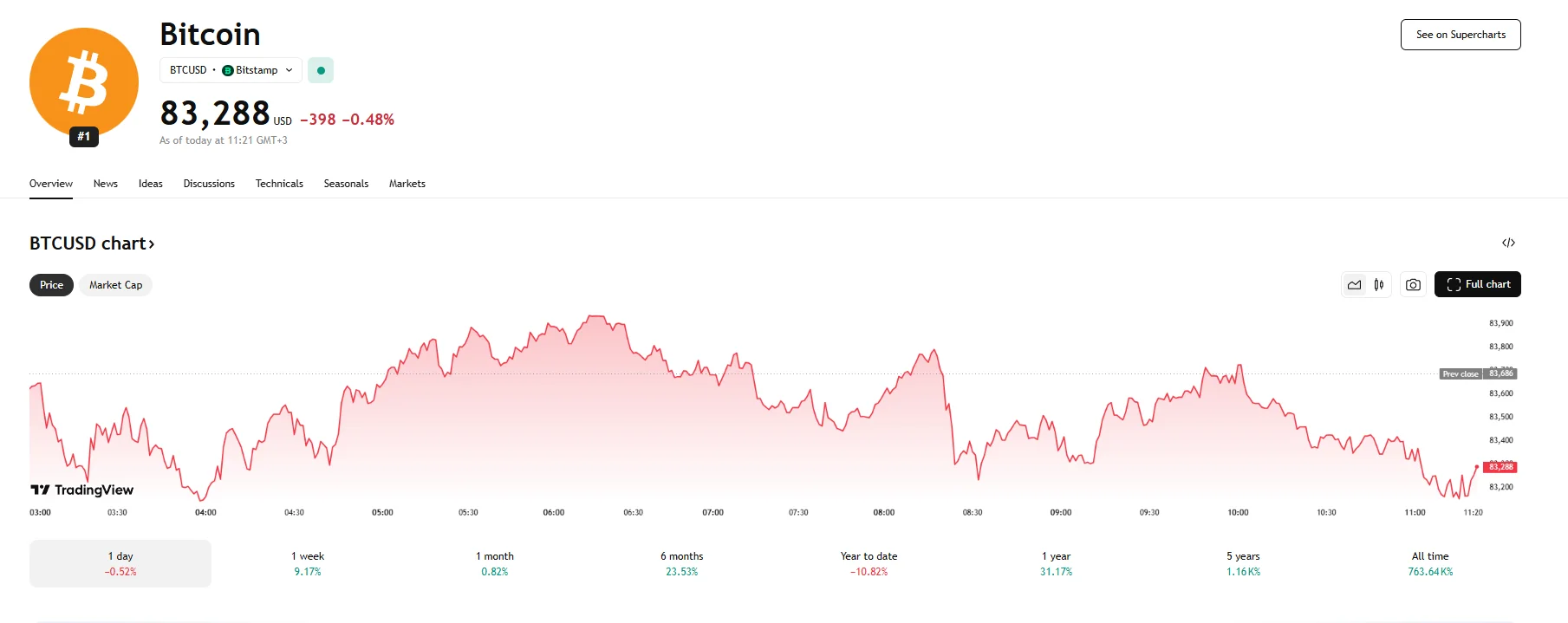

- Bitcoin’s price slipped 0.48% on Wednesday, sinking past the $84,000 mark.

- The inconsistent approach of the US administration toward tariffs weighed on global markets and the cryptocurrency sphere.

- According to CoinShares, last week saw Bitcoin outflows of $751 million.

Bitcoin Weakens Amid Tariff Jitters

On Wednesday, the price of Bitcoin fell 0.48% to $83,288 as investors grappled with the United States’ evolving tariff policies and ongoing trade conflict with China. This week also saw the release of CoinShares data showing that Bitcoin was recently hit by significant institutional outflows.

The fluctuating stance of the US administration on trade tariffs has injected a considerable degree of uncertainty into global markets, with various assets experiencing declines. While there have been announcements of some Chinese electronics being exempt from certain tariffs, the administration has simultaneously indicated its intent to pursue levies on critical sectors such as semiconductors and pharmaceuticals.

Furthermore, substantial tariffs remain in place on a range of goods originating from China. This inconsistent trade environment has fostered a sense of risk aversion among investors, leading them to become more hesitant toward crypto assets as they are perceived as speculative.

Interestingly, Bitcoin, which is often touted as a potential safe-haven asset during times of geopolitical and economic instability, seems to be losing some of its appeal in the face of these mixed signals emanating from Washington. The traditional inverse correlation between risk-off sentiment and Bitcoin’s price action appears to be weakening, suggesting that the current tariff-induced uncertainty is creating a unique dynamic in the cryptocurrency market.

In addition, data released by CoinShares highlighted substantial outflows of institutional capital from Bitcoin investment products. The figures revealed that recent Bitcoin outflows total $751 million. The said figure represents the vast majority of the $795 million that exited the broader cryptocurrency market last week. This significant withdrawal marks the third consecutive week of negative flows for Bitcoin-related institutional products, raising considerable concerns about the prevailing sentiment among large-scale investors. The CoinShares report further highlighted that cumulative outflows from digital asset investment products between February and April amount to a significant $7.2 billion.