Key moments

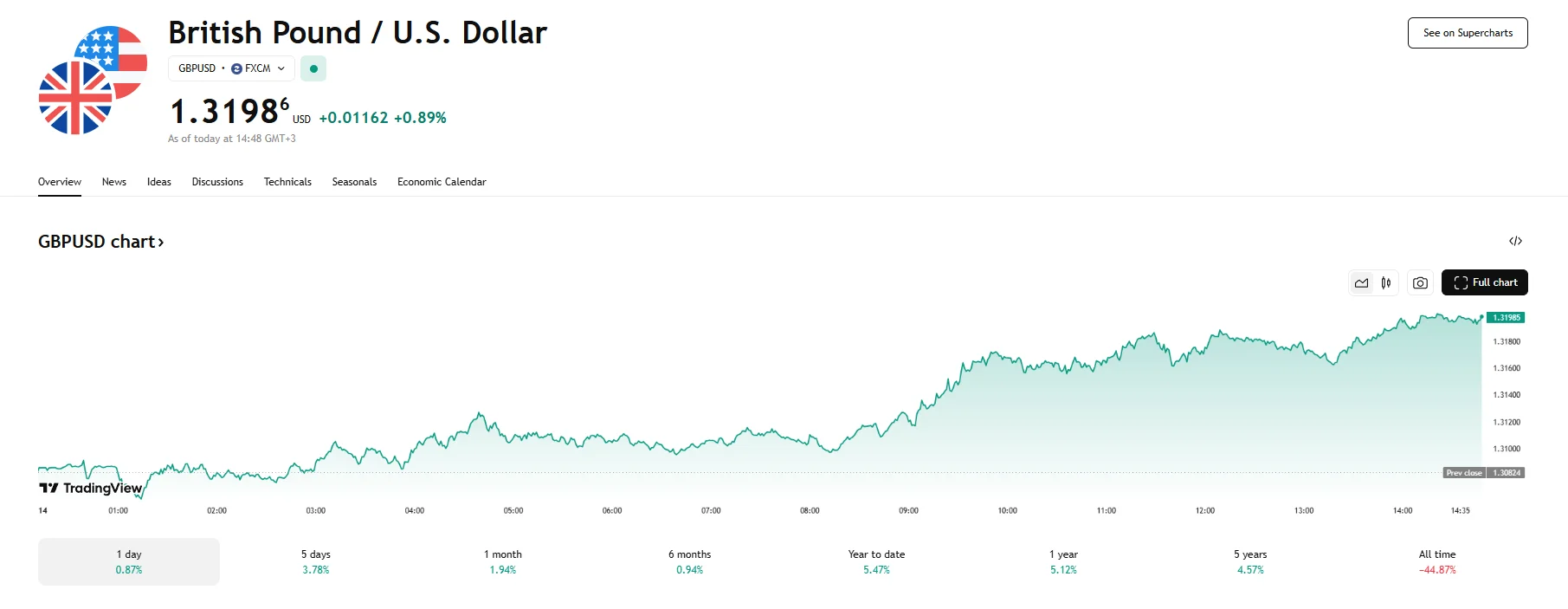

- The GBP/USD pair climbed 0.89% on Monday, nearly reaching 1.3200.

- Economic uncertainty has pressured the US dollar downwards.

- Analysts remain confident that the BoE will implement further interest rate cuts in 2025.

GBP/USD Rockets to 1.3198, Marking a Significant Half-Year Milestone

The British pound has experienced a notable upswing against the US dollar, breaching levels unseen in the preceding six months. This upward trajectory culminated in a 0.89% surge, propelling the GBP/USD exchange rate to 1.3198. This significant climb marks a clear departure from the currency pair’s performance over the past half-year.

The primary catalyst behind this strengthening of sterling appears to be a declining US dollar as the uncertainty swirling around the Trump administration’s trade policies continues to mount. Recent pronouncements and actions concerning tariffs, particularly those involving China, have created a volatile trading landscape for the greenback.

Specifically, the temporary reprieve granted by the US administration on tariffs for certain Chinese electronic goods, including smartphones and computers, initially offered some relief. However, this positive sentiment proved to be short-lived as market participants quickly recognized that other duties, potentially targeting crucial components like semiconductors, were still on the horizon. This ambiguity surrounding the future of US trade relations has fostered a climate of unease, leading investors to reassess their dollar holdings. Consequently, a move away from dollar-denominated assets and into other currencies, such as the pound and the euro, has been observed.

Despite the recent buoyancy of the pound, it is noteworthy that market expectations regarding the Bank of England’s (BoE) monetary policy remain largely unchanged. A significant 75-basis-point in interest rate reductions is still anticipated by traders throughout the remainder of the year. This suggests that while external factors are currently bolstering sterling, underlying expectations for the UK’s economic trajectory continue to lean towards a more accommodative monetary stance.

Looking ahead, market attention is now firmly fixed on upcoming releases of crucial UK economic data. Employment figures and inflation statistics, scheduled for publication later in the week, are expected to provide further insights into the health of the British economy. These data points will be closely scrutinized for any indications that might either reinforce the recent strength of the pound or suggest underlying vulnerabilities that could temper its upward momentum.