Key moments

- LME copper went up almost 1% on Tuesday, bringing its price close to $8,800 per metric ton.

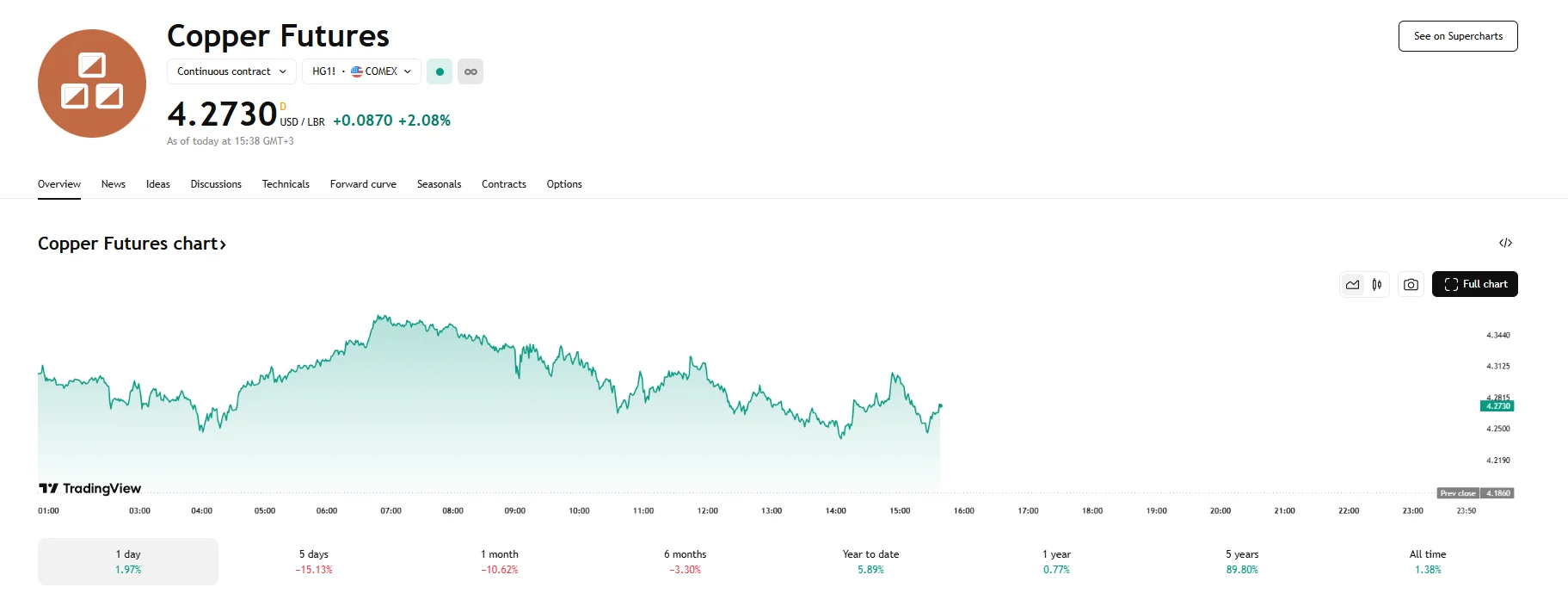

- COMEX copper futures also went up, rising by 2.08% to $4.2730.

- The recent price volatility in copper markets can be largely traced back to the trade tensions that have gripped global markets.

Tuesday Witnesses Copper Futures Find Footing

Following a significant downturn at the start of the week, Grade A copper futures traded on the London Metal Exchange (LME) experienced a recovery on Tuesday. Its price gained 0.95% to trade near the $8,800 mark. However, this recovery comes after a period of considerable weakness for the metal.

COMEX copper futures mirror this recovery, climbing 2.08% to $4.2730. This upward movement provided a degree of respite after Monday’s steep decline, which had seen COMEX copper prices fall below the $4.16 level.

Copper’s price fluctuations can be largely attributed to the recent trade policies enacted by the Trump administration. Tariff tension saw LME copper, a key benchmark for global pricing, falling below the critical $9,000 threshold, and it has struggled to regain that level amidst growing concerns about the potential for a widespread economic slowdown triggered by these trade barriers. The tariffs, particularly those targeting Chinese goods, raised fears of reduced demand for industrial commodities like copper.

According to Craig Pirrong, a finance professor at the University of Houston, declining copper prices could serve as a leading indicator of a broader deceleration in the global economy. Given copper’s extensive use across various sectors, from construction and infrastructure to emerging technologies like electric vehicles and artificial intelligence, its price movements are often seen as a barometer of overall economic health. A sustained drop in copper demand could, therefore, signal a weakening of economic activity worldwide, especially in major consuming nations like China.

While copper itself was reportedly excluded from the initial round of reciprocal tariffs, the broader trade tensions and the threat of further escalating duties have undoubtedly weighed on market sentiment. The potential for additional tariffs on other goods, the retaliatory measures planned by China, and Trump’s threats of further duties have created an environment of uncertainty across markets.