Key moments

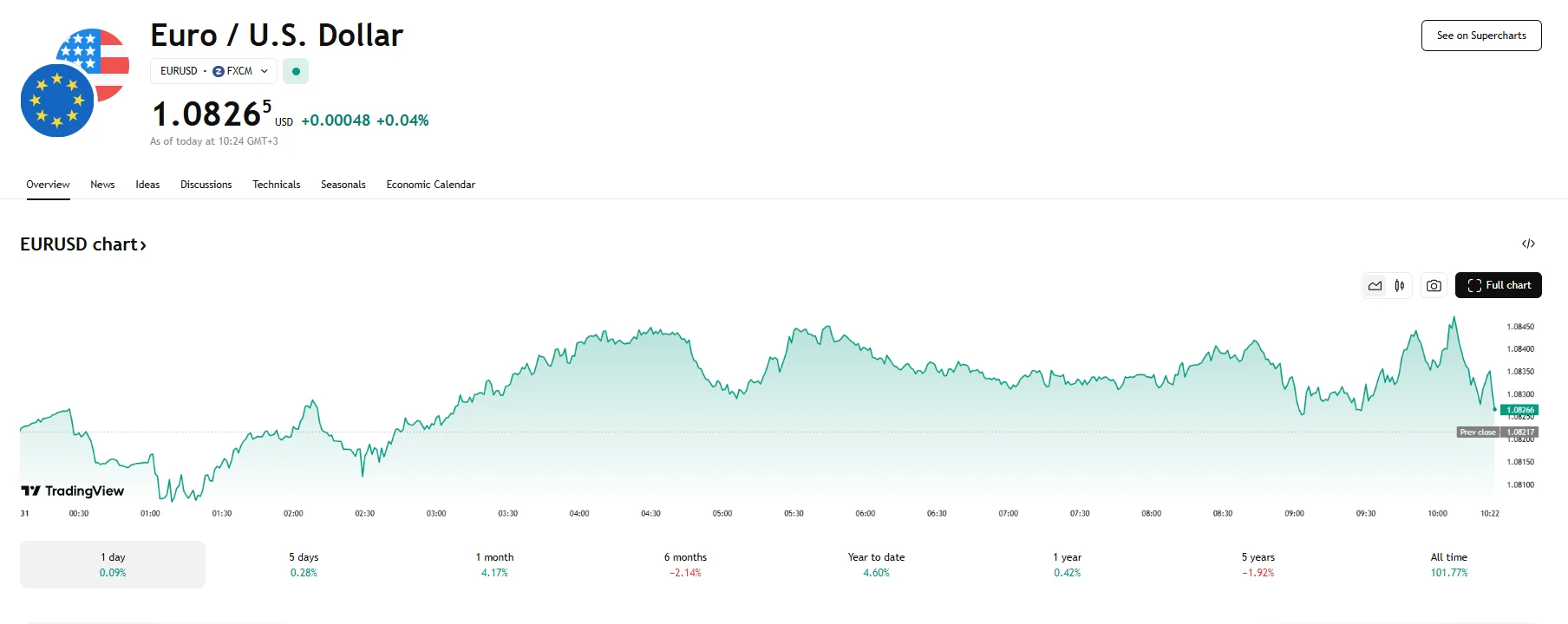

- The EUR/USD is trading near 1.0800.

- Escalating trade tensions shape investor sentiment following warnings that U.S. President Donald Trump could introduce tariffs of between 25% and 50%. The said levies would target countries that buy oil from Russia if implemented.

- ECB President Christine Lagarde has cautioned that U.S. tariff policies could stifle the Eurozone’s economy by 0.3%.

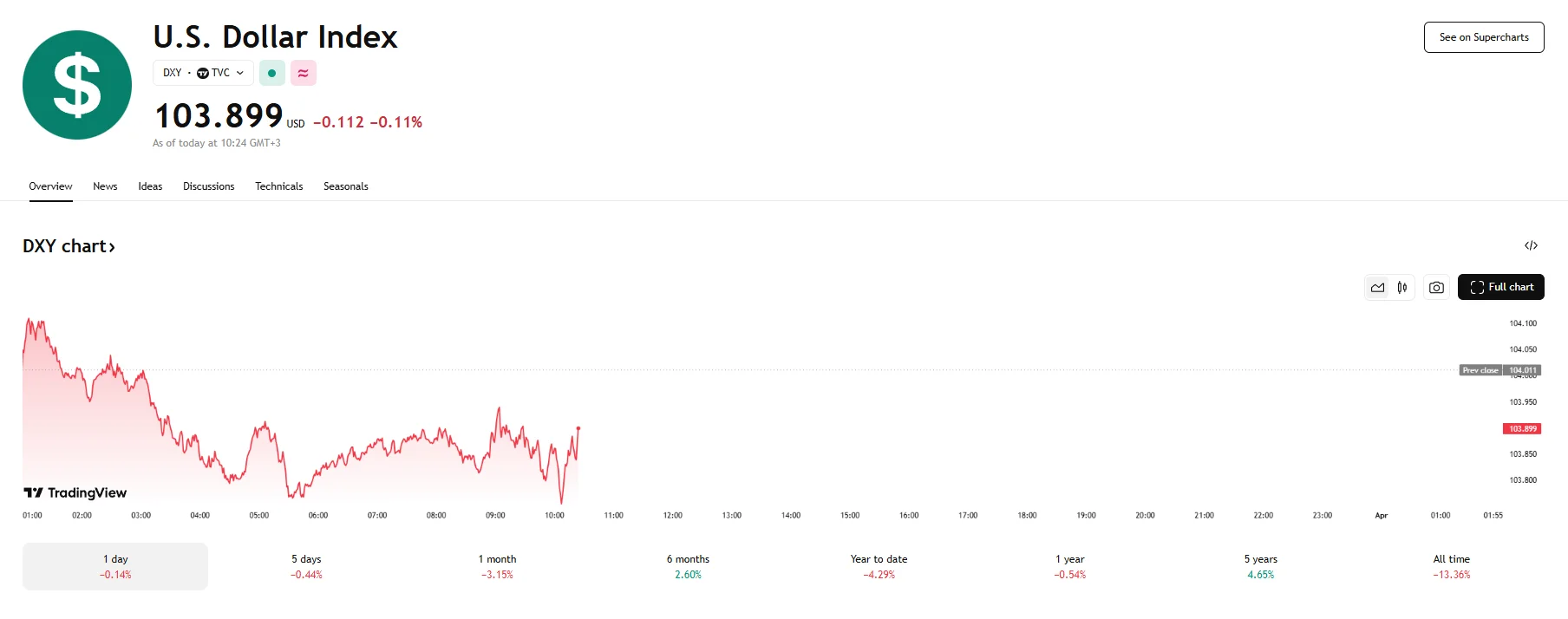

Dollar Index Dips as Trade Tensions Mount

The EUR/USD pair has consolidated above the 1.0800 threshold, continuing its recovery from last week’s drop below 1.0770. This upward trend came as the U.S. Dollar Index experienced a decline, falling below 103.900, while the dollar was subjected to increased selling pressures. The euro’s stability, however, is being tested by growing market anxieties surrounding potential tariffs and their economic ramifications.

Despite the euro’s upward trajectory, its growth faces headwinds. According to Christine Lagarde, President of the European Central Bank (ECB), the Eurozone’s growth could decline by no less than 0.3% as a result of President Trump’s tariffs. This forecast has amplified existing concerns about the economic consequences of escalating trade tensions. The dollar has also been grappling with its own set of challenges, as the U.S. Dollar Index’s descent below 103.900 reflects mounting anxieties about the U.S. economy being affected by the impending tariffs.

President Donald Trump’s aggressive trade stance, including his latest threats of imposing tariffs of up to 50% on countries that purchase oil from Russia should Russian leadership hinder war-ending efforts, has heightened market uncertainty. Reports by WSJ of the Trump Administration considering a blanket 20% tariff on all imports, along with the potential for retaliatory measures such a move could trigger, have exacerbated fears of a global trade war.

Traders will closely monitor a series of key economic events scheduled for this week. Tuesday’s ISM Manufacturing PMI and Friday’s Non-Farm Payrolls (NFP) report are expected to provide crucial insights into the health of the U.S. economy. According to economists, the Bureau of Labor Statistics is likely to report 139,000 new job positions, which will fall short of the 150,000+ that were included in the data released last month. Wages are expected to grow by 0.3% month-on-month. Additionally, forecasts predict an unemployment rate of 4.1%.