Key moments

- Shopify announces transition of its U.S. stock listing from the NYSE to the Nasdaq.

- The change is scheduled to take effect at the end of March, with trading commencing on the Nasdaq on March 31.

- The company’s listing on the Toronto Stock Exchange will remain unchanged, preserving the existing ticker symbol.

Shopify’s Strategic Exchange Shift to Nasdaq

After nearly a decade of listing its Class A shares on the New York Stock Exchange (NYSE), Canadian e-commerce platform Shopify has revealed its decision to transfer its U.S. stock exchange listing to the Nasdaq. According to a filing with the U.S. Securities and Exchange Commission (SEC), the company’s shares will cease trading on the NYSE at the conclusion of trading on Friday, March 28. Subsequently, trading will begin on the Nasdaq on Monday, March 31. This strategic move signifies a shift in Shopify’s U.S. listing venue, though the company has not publicly disclosed a specific rationale within its SEC filing.

While the regulatory filing did not elaborate on the motivation behind the change, a company representative said that Shopify is looking forward to being a part of the Nasdaq and being listed among top technological companies. This statement suggests a desire to align with a platform perceived as a hub for technology and innovation, potentially reflecting a strategic effort to enhance the company’s visibility within the tech sector.

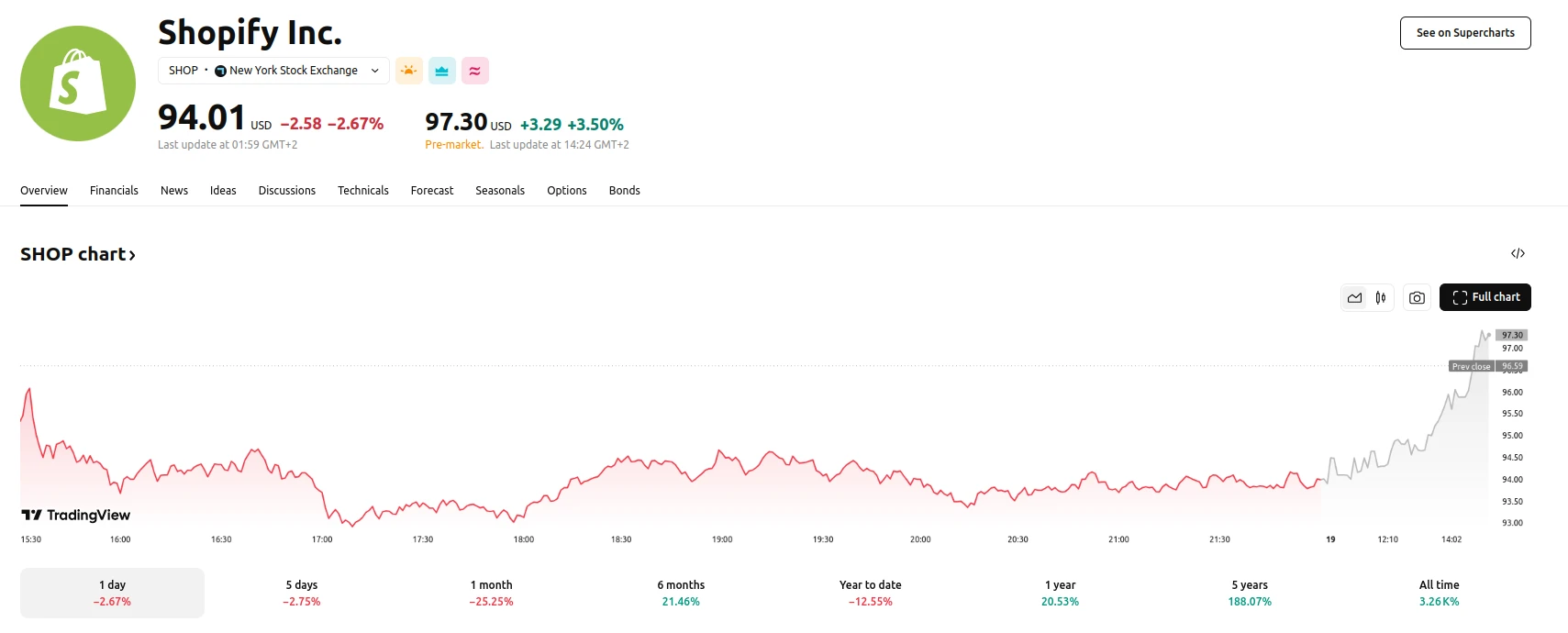

Shopify’s decision follows a period of robust financial performance. In February, the company reported its fourth-quarter 2024 results, exceeding market expectations with a year-over-year revenue growth of 31%, reaching $2.8 billion. Furthermore, Shopify’s market capitalization has seen a substantial increase, currently standing at $121 billion, marking a 55% rise compared to the same period in the previous year. As for Shopify’s share price, it has registered a decline of 2.67% over the last trading day and an increase of 21.46% over the last six months. Notably, the company’s existing listing on the Toronto Stock Exchange will remain unaffected, with the ticker symbol SHOP continuing to be used on both the Canadian and the newly adopted U.S. exchange.