Key moments

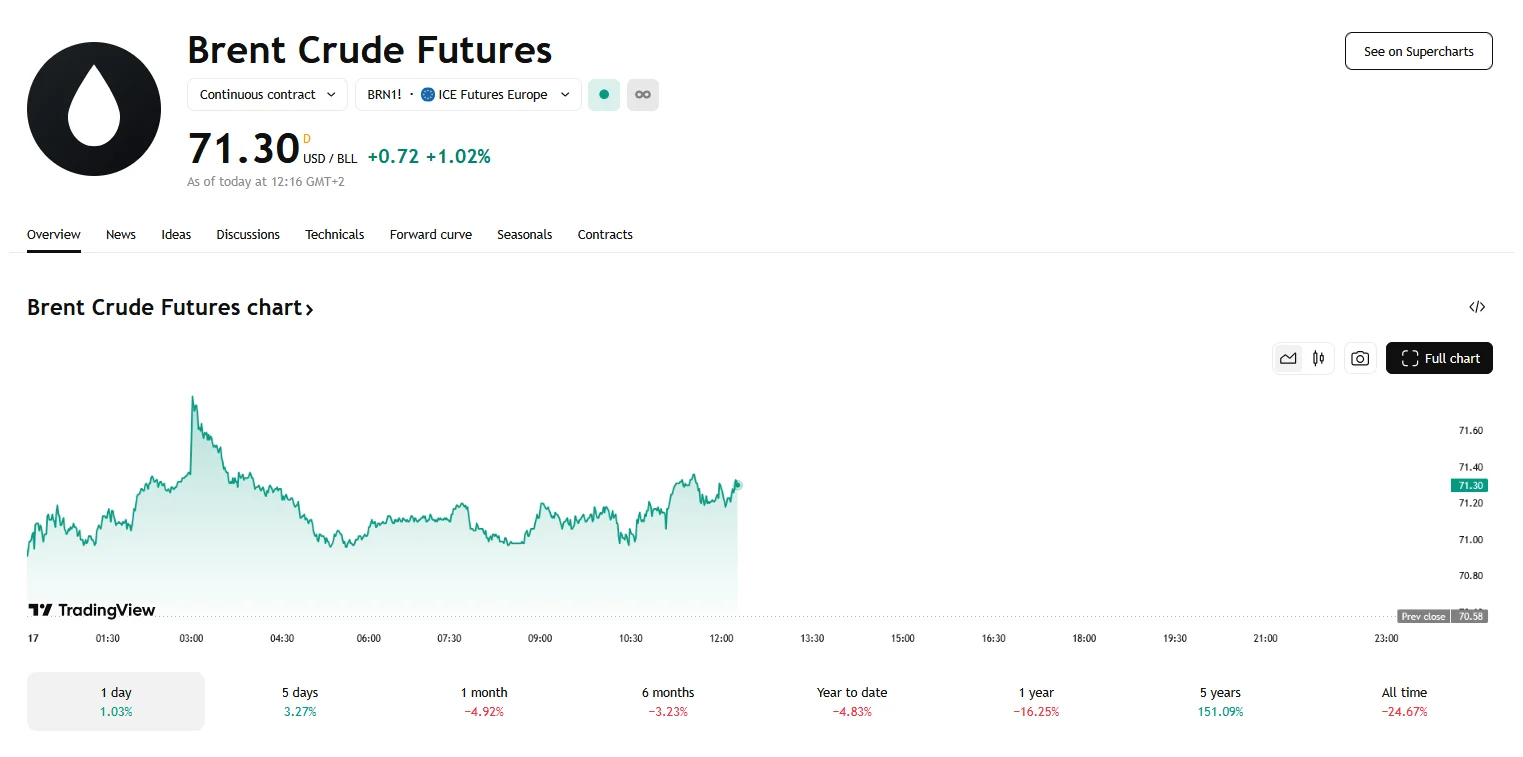

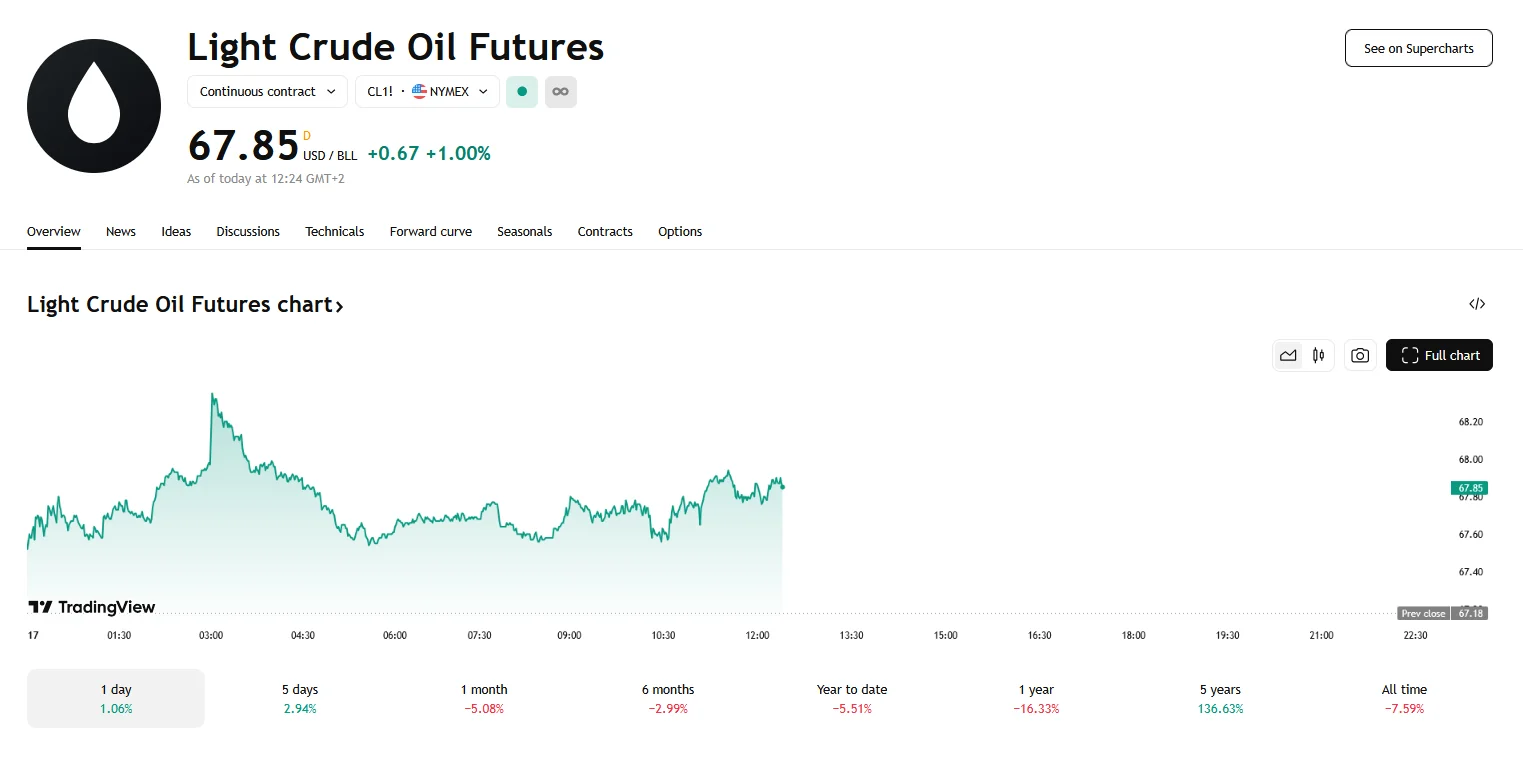

- Crude oil prices experienced a significant rise on Monday. Brent oil prices increased by 1.02%, achieving a value of $71.30 per barrel, while U.S. WTI crude futures saw a 0.9% gain, reaching $67.77 per barrel.

- The U.S. military’s retaliation against Houthi rebels in Yemen following the group’s sabotage of commercial shipping served as the main driver behind the surge.

- Alongside geopolitical tensions, economic indicators from China have played a crucial role in pushing oil prices upwards.

US Strikes in Yemen Drive Oil Higher

The global oil market witnessed a notable surge in prices as a new trading week commenced, fueled by escalating geopolitical tensions and encouraging economic indicators from a major consumer. Brent crude oil experienced a 1.02% increase, pushing its price to $71.30 per barrel, while U.S. West Texas Intermediate (WTI) crude futures rose by 0.9%, reaching $67.77 per barrel.

The catalyst for this price hike was the U.S. military’s decision to launch strikes against Houthi rebels in Yemen, a response to their ongoing attacks on commercial shipping in the Red Sea. The U.S. Department of Defense has indicated that these strikes will persist until the Houthi attacks cease, raising concerns about potential disruptions to vital maritime trade routes. This situation has added significant logistical costs to the maritime transport industry as ships reroute around Africa, extending journey times and increasing fuel consumption.

Concurrently, economic data emanating from China, the world’s leading crude oil importer, has also contributed toward the positive movement of oil prices. While industrial production figures revealed a slowdown in the early months of the year, retail sales demonstrated robust growth, indicating a potential strengthening of consumer demand. This positive trend, coupled with Chinese refinery production exceeding levels from the previous year, suggests a sustained appetite for crude oil within the Chinese market.

It is also important to note that a new refinery added 200,000 barrels per day to the overall demand, and it will add another 200,000 this month. This increase in demand is also attributed to holiday travel.

The prospect of continued U.S. military action in Yemen and the ongoing evolution of Chinese economic policy will likely continue to influence crude oil prices in the coming weeks. Traders and analysts will closely monitor these developments to assess their potential impact on the global energy market.