Key moments

- Victory Capital Management Inc. Reduces Holdings by 2.3%.

- Diverse Institutional Investors Adjust Positions.

- Equifax Financial Metrics and Earnings Performance.

Institutional Investment Shifts Observed in Equifax Stock

Recent filings with the Securities and Exchange Commission (SEC) indicate adjustments in institutional investment positions within Equifax Inc. (NYSE:EFX). Notably, Victory Capital Management Inc. decreased its holding of Equifax shares by 2.3% during the fourth quarter. This reduction involved the sale of 1,068 shares, resulting in a total holding of 45,214 shares, valued at $11,523,000 as of the filing date. This adjustment reflects a strategic decision by Victory Capital Management to modify its portfolio allocation regarding the credit services provider.

Conversely, other institutional investors have demonstrated varied approaches to Equifax stock. Mirae Asset Global Investments Co. Ltd. significantly increased its stake by 39.0%, purchasing 3,043 additional shares and bringing its total holdings to 10,843 shares, valued at $2,775,000. Barclays PLC also augmented its position, albeit at a more moderate pace, increasing its holdings by 2.8%, adding 5,097 shares and reaching a total of 184,890 shares, valued at $54,329,000. Further adjustments include Intech Investment Management LLC, which increased its stake by 84.1% to 6,861 shares, and NS Partners Ltd, which boosted its holdings by 2.3% to 95,010 shares. Additionally, Strategic Financial Concepts LLC acquired a new stake valued at $3,572,000. Overall, institutional investors currently hold 96.20% of Equifax stock.

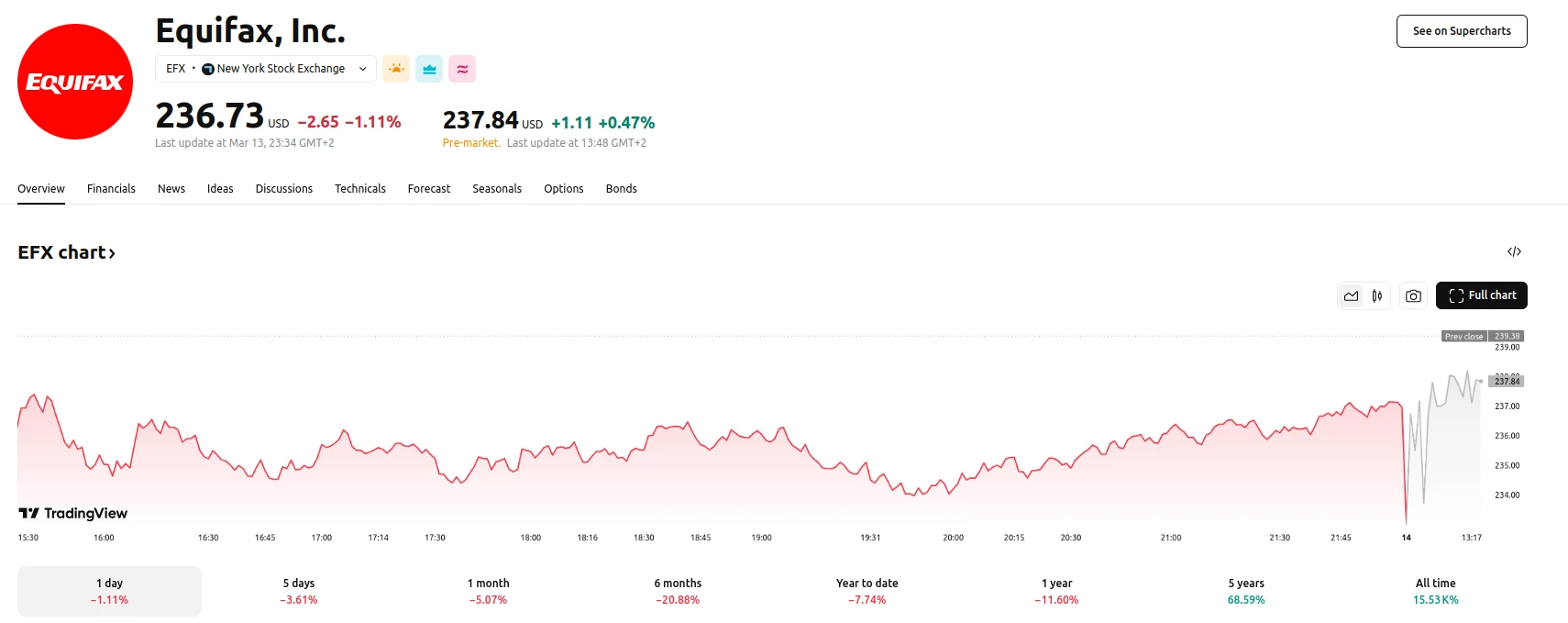

Equifax’s financial performance and market metrics provide context for these investment decisions. The company reported earnings per share of $2.12 for the recent quarter, meeting consensus estimates. Equifax maintains a net margin of 10.63% and a return on equity of 19.13%. The stock has displayed a 52-week trading range between $213.02 and $309.63, with recent trading around $236.73. The company’s financial ratios include a debt-to-equity ratio of 0.90, a current ratio of 0.75, and a quick ratio of 0.88. Analysts project an earnings per share of $7.58 for the current fiscal year.Key financial metrics for the company include a $29.41 billion market cap, a 49.10 P/E ratio, a 2.79 PEG ratio, and a 1.65 beta.