Key moments

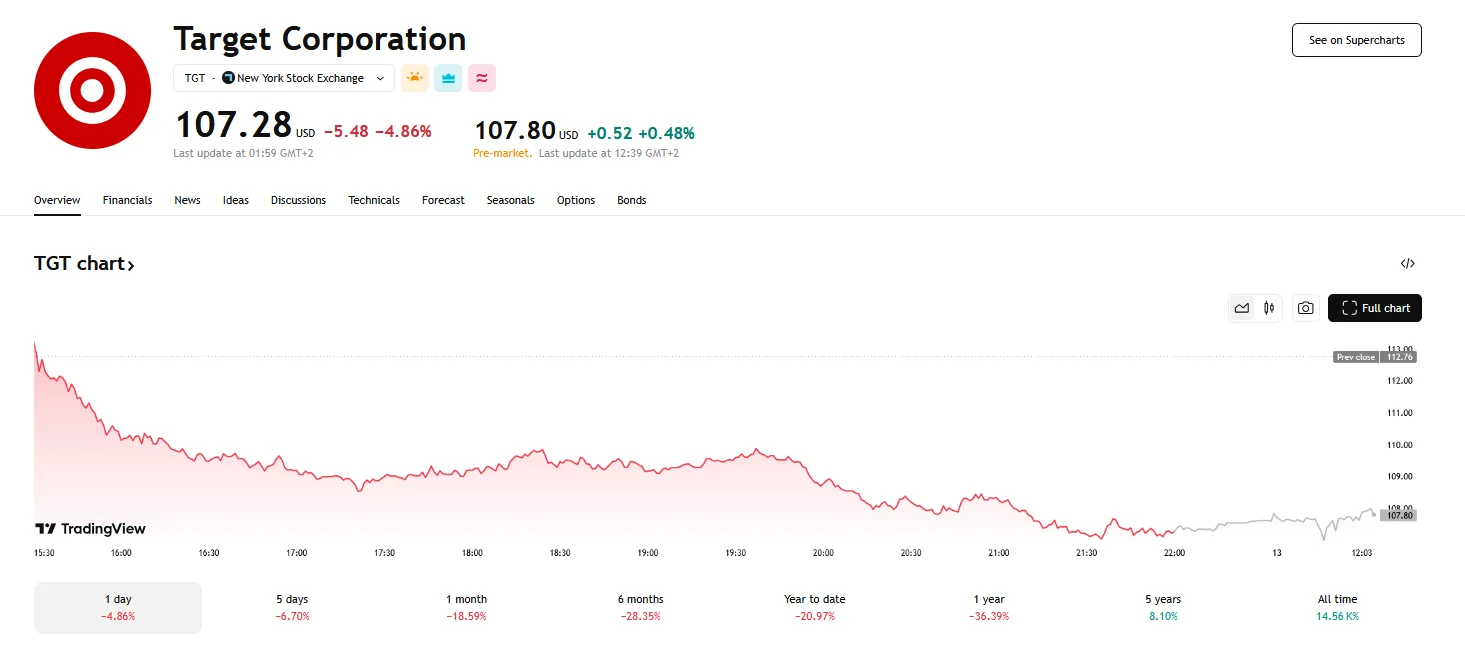

- Target’s stock closed at $107.28 as investors grew increasingly apprehensive.

- Pre-market trading on Thursday rose slightly to just shy of $108.

- As disclosed by an SEC filing, CEO Brian C. Cornell recently sold 45,000 Target shares.

Target’s Stock Has Fallen Significantly in March

Target Corporation’s stock price dropped to a significant extent on Wednesday, closing at $107.28, which marked a 4.86% decline. This movement reflects a growing sense of caution among investors regarding the retailer’s immediate prospects despite its long-term strategic initiatives. While pre-market trading on Thursday saw the stock dip to $107 at one point, a slight recovery later in the day pushed it 0.48% to $107.80.

The stock’s current performance places it significantly below its April 1st peak, a 41% decrease, indicating a substantial shift in market perception. This downturn has prompted critical analysis from financial experts. Notably, CNBC’s “Fast Money” contributor Courtney Garcia has voiced concerns, expressing reluctance to invest until clear evidence of a turnaround materializes. Compounding these worries, a recent SEC filing revealed that on March 11th, Target CEO Brian C. Cornell sold 45,000 shares (valued at around $5.1 million), further fueling market speculation.

Despite these challenges, Target is actively reinforcing its market presence through strategic initiatives. The company is focusing on growth through innovation, utilizing both its brand strength and diverse offerings, expanding its physical and digital presence, incorporating AI for efficiency, and boosting services like same-day delivery. Moreover, its Target Plus marketplace has achieved sales of over $1 billion.

Despite positive sales growth, financial metrics paint a complex picture. Trading at a 12.16x forward P/E, Target’s valuation sits well below the industry norm and its own 14.93 median P/E from the past year. This discrepancy, while potentially signaling undervaluation, also reflects investor caution amidst rising costs and competitive pressures that impacted recent margins.

Investor enthusiasm has been further subdued by Target’s cautious fiscal year outlook, which highlighted consumer uncertainty and weak February sales. Consequently, analysts have adjusted their price targets, with some retaining “buy” ratings despite these downward revisions, reflecting concerns over volatile demand, potential tariffs, and expense timing.