Key moments

- Indian Rupee experiences an uptrend during the Asian trading session.

- Potential RBI intervention and a weaker US Dollar provide support to the INR.

- Market focus shifts to the release of Indian and US CPI inflation reports.

Indian Rupee Strengthens Ahead of Key Inflation Data

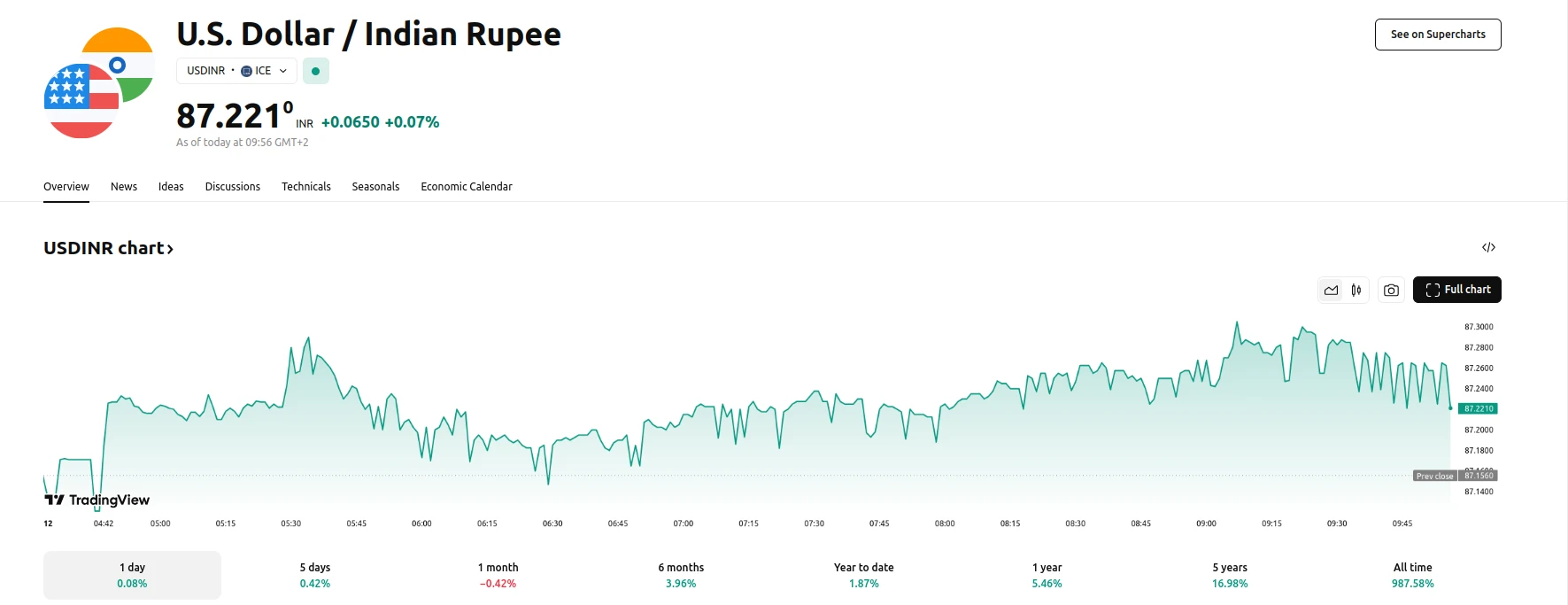

The Indian Rupee (INR) has shown signs of strengthening during Wednesday’s Asian trading session, driven by a combination of factors. Anticipation of intervention by the Reserve Bank of India (RBI) in the foreign exchange market is playing a significant role in bolstering the INR. Historical data confirms the RBI’s active engagement in stabilizing the currency through strategic interventions. Furthermore, a general weakening of the US Dollar is contributing to the INR’s upward momentum. The strength of other Asian currencies, particularly the offshore Chinese Yuan, is also providing additional support.

However, the INR faces potential headwinds. Ongoing outflows of foreign funds from Indian equity markets continue to exert selling pressure. The significant withdrawal of capital by foreign investors this year, approaching record levels, is a factor that could potentially weaken the Rupee. Additionally, a resurgence in crude oil prices presents a challenge, given India’s position as a major oil consumer. Increased oil prices typically have a negative impact on the INR’s value.

Traders are now closely monitoring the upcoming release of the Consumer Price Index (CPI) inflation reports for both India and the United States. These reports are expected to provide crucial insights into the economic health of both nations and will likely have a significant impact on the USD/INR currency pair. While the INR is currently showing strength, the technical analysis of the USD/INR pair indicates a continuing bullish trend. Key resistance and support levels remain important indicators to watch.