Key moments

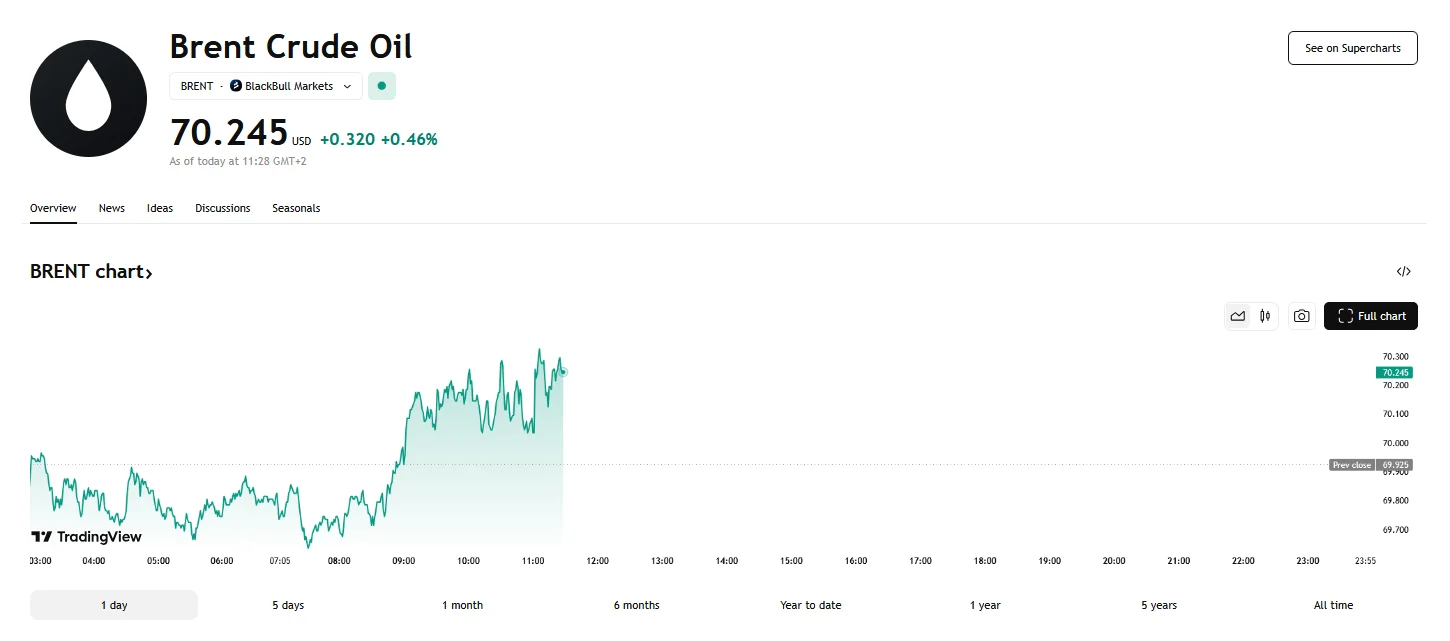

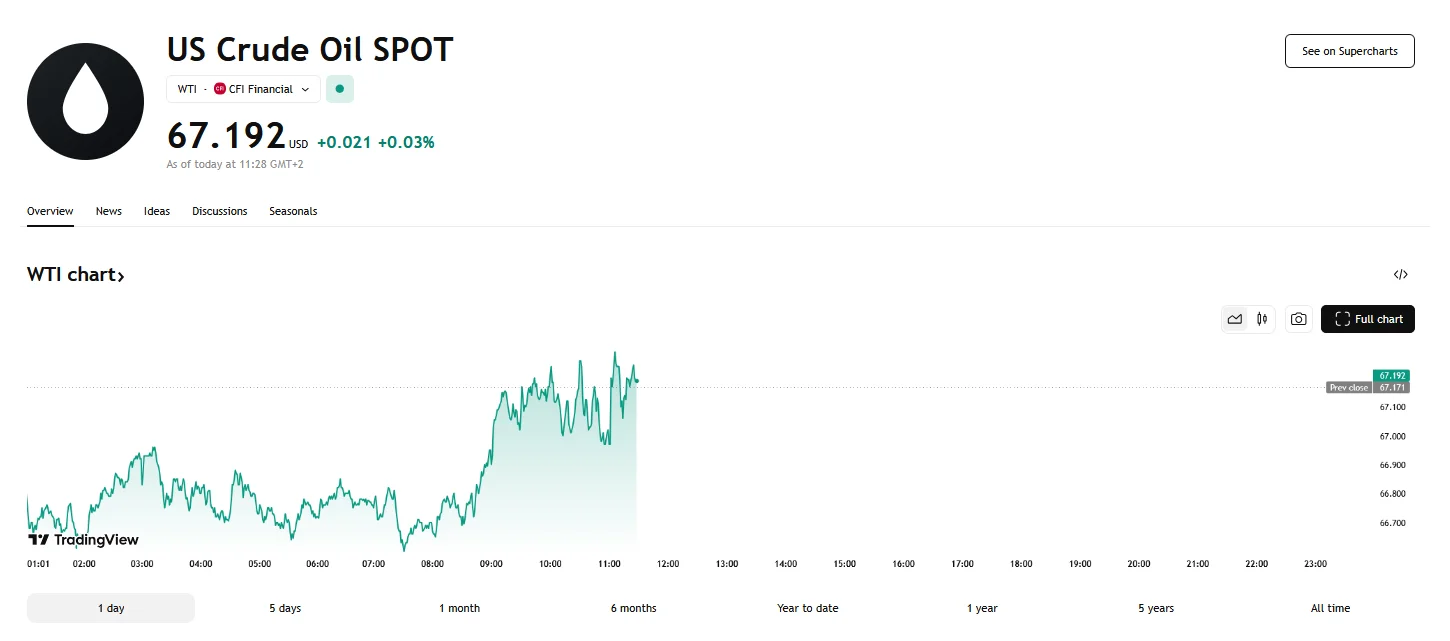

- Global oil prices took a significant hit on Monday, with Brent crude falling to around $70 per barrel and WTI dropping to approximately $67.

- The developments surrounding tariffs initiated by the Trump administration sparked widespread anxiety in the oil market.

- Increased oil production by the Organization of the Petroleum Exporting Countries and its allies (OPEC+) played a crucial role in Monday’s price decline.

A Wave of Trade-Related Anxiety Crashed Over the Global Oil Market

Monday saw a discernible downturn in the global oil market, with both Brent and West Texas Intermediate (WTI) crude prices registering declines. Market participants reacted with caution, as the imposition and threatened implementation of import tariffs by the Trump administration cast a shadow over projected economic growth and, consequently, the anticipated demand for fuel.

Brent crude oil’s value receded to around $70 per barrel. Additionally, at a certain point during the trading session, it even plummeted to $69.635.

At press time, WTI crude prices also feel the pressure, sliding below the $68 threshold to settle at around $67. At its lowest point, WTI touched $66.601.

Anxieties surrounding the potential ramifications of escalating trade tensions between the United States, its neighbors, and China, coupled with retaliatory measures from the affected nations, created a climate of uncertainty that directly impacted investor confidence. The fear was that these trade disputes would ultimately stifle global economic expansion, leading to a diminished appetite for energy resources.

Beyond the immediate impact of tariff talks, the market also grappled with the implications of increased production from the Organization of the Petroleum Exporting Countries and its allies (OPEC+). This decision to augment supply, while intended to stabilize the market, contributed to a softening of prices, further amplifying the downward trend.

Adding another layer of complexity, discussions surrounding the potential easing of U.S. sanctions on Russia’s energy sector, contingent upon a resolution to the conflict in Ukraine, introduced an element of speculation and potential market disruption. The possibility of increased Russian oil supply, should sanctions be lifted, weighed on investor sentiment.

The market’s reaction also reflected broader economic concerns, including signals of deflation from China and adjustments to crude oil pricing by Saudi Arabia for Asian markets. These factors, combined with the tariff-related anxieties, created a confluence of pressures that pushed oil prices lower.