Key moments

- Coinbase stock fell 5% premarket, driven by a drop in Bitcoin’s value after Trump’s executive order and the company’s failure to be included in the latest S&P 500 rebalancing.

- Despite the stock decline, Coinbase plans to hire 1,000 new US employees in 2025, fueled by increased regulatory clarity in the cryptocurrency sector.

- Coinbase recently reported record quarterly revenue and net income, with significant increases in consumer and institutional trading volumes.

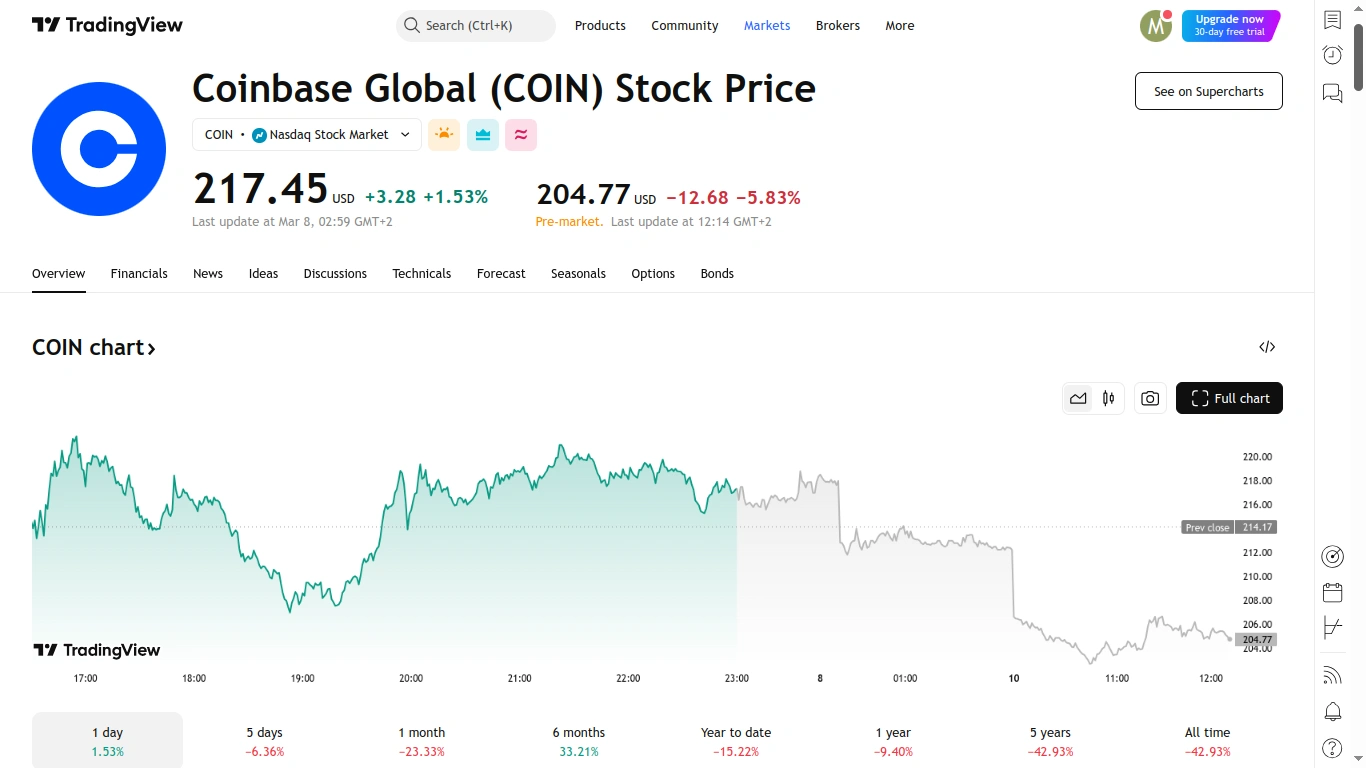

Coinbase Shares Tumbled in Premarket Trading, Reacting to Bitcoin’s Decline and Company’s Exclusion from S&P 500

Coinbase shares experienced a sharp premarket decline, mirroring a downturn in Bitcoin’s value, triggered by investor disappointment over President Trump’s executive order regarding a strategic Bitcoin reserve for the United States. The initiative will utilize Bitcoin acquired through legal seizures, rather than direct government purchases.

Coinbase’s stock price fell by 5% in premarket trading, compounded by the company’s exclusion from the latest S&P 500 index rebalancing. According to S&P Dow Jones Indices, DoorDash (DASH), TKO (TKO), Williams-Sonoma (WSM), and Expand Energy (EXE) will be added to the index.

Previously, Barclays analysts had identified Interactive Brokers, Coinbase Global, Ares Management, Robinhood Markets, LPL Financial, Blue Owl Capital, and Tradeweb Markets as potential candidates for S&P 500 inclusion, as reported by Barron’s.

The broader cryptocurrency market also saw declines, with Bitcoin (BTC-USD) dropping 2.3% to $83.7K. This downturn reflects a general risk-averse sentiment among investors, further fueled by President Trump’s recent comments to Fox News, where he did not dismiss the possibility of an economic recession.

Conversely, Coinbase is actively planning for expansion. CEO Brian Armstrong announced the company’s intention to hire 1,000 new employees in the United States during 2025. This decision is attributed to the increasing clarity of cryptocurrency regulations within the country, which provides a more stable operational environment for companies like Coinbase.

Armstrong credited the Trump administration’s refined crypto regulations as a key factor enabling Coinbase’s growth within the United States. He emphasized that the government’s efforts to establish a more transparent regulatory framework have been instrumental in fostering this expansion.

This growth trajectory marks a significant turnaround from previous years. In 2022, challenging market conditions forced Coinbase to reduce its global workforce by approximately 18%, resulting in the layoff of 1,100 employees. Now, with a more defined legal landscape, Coinbase is shifting its strategy towards investing in increased personnel.

Coinbase recently reported strong fourth-quarter financial results, exceeding market expectations and achieving its highest quarterly revenue in three years. This performance was bolstered by a post-election market rally that propelled cryptocurrency prices to record highs in late 2023.