Key moments

- VIX reached a near-three-month high, triggering a bearish signal indicating potential stock market weakness.

- Increased volatility is driving investors towards safe-haven assets like US Treasuries, gold, and certain currencies.

- Rising VIX levels are widening corporate bond spreads and causing emerging market currency depreciation.

VIX Surged to Nearly Three-Month High, Signaling Increased Market Volatility

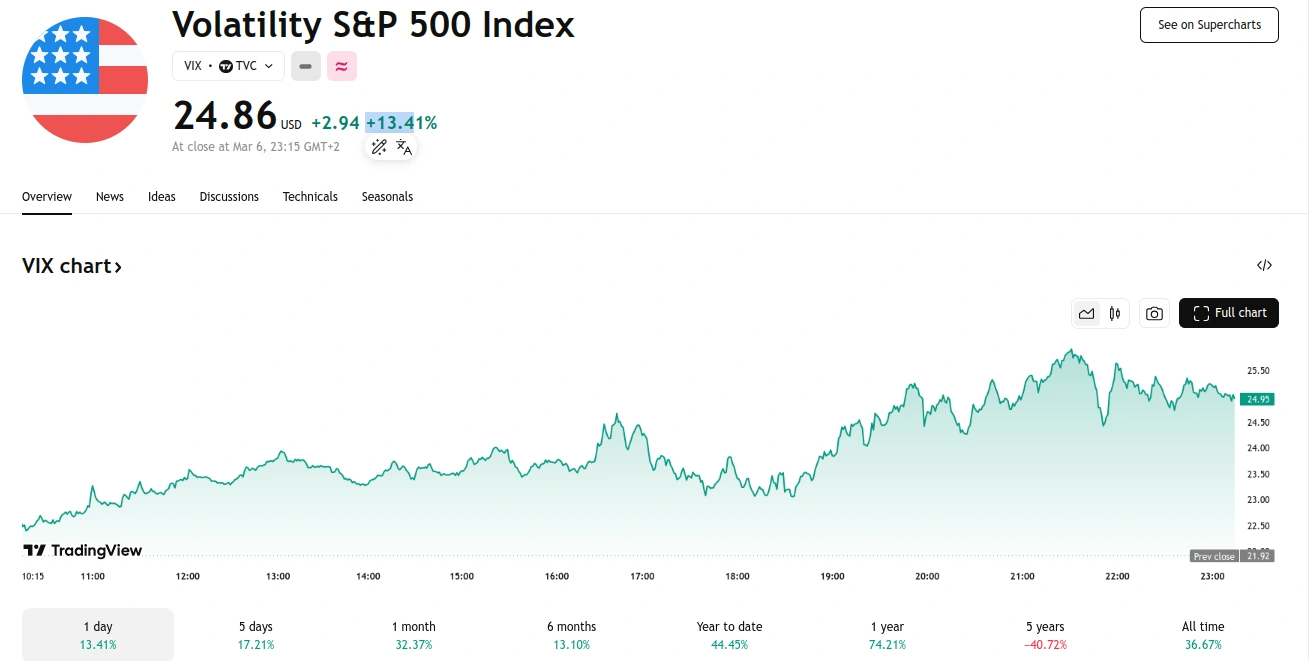

The CBOE Volatility Index (VIX), a key indicator of market anxiety, concluded trading at 24.86, its highest level in nearly three months. This surge in the VIX, often referred to as Wall Street’s “fear gauge,” coincides with a downturn in equity markets, signaling heightened investor apprehension.

A bearish signal, characterized by both the VIX and its 20-day moving average surpassing the VIX’s 200-day moving average, is now active. This signal will persist until the VIX closes below its 200-day moving average. However, a countervailing “spike peak” buy signal was generated as of March 5th’s close, remaining valid for 22 trading sessions, unless the VIX exceeds its recent high of 26.35.

The significant increase in the VIX has several notable consequences for financial markets. Typically, the VIX rises during equity market declines, reflecting heightened fear and uncertainty among investors. A substantial VIX surge often indicates panic selling and increased use of options for hedging. If the VIX remains elevated, it suggests sustained bearish sentiment, potentially leading to further stock market weakness.

During periods of heightened volatility, investors tend to shift their focus to safe-haven assets. This includes US Treasuries, where yields decrease as bond prices increase, Gold, viewed as a reliable store of value during uncertain times, and traditional safe-haven currencies like the Japanese yen (JPY) and the Swiss franc (CHF). These shifts can influence yield curve dynamics, potentially leading to further flattening or even inversion if concerns about a recession intensify.

Increased volatility often triggers a “flight to quality” within credit markets. Corporate bond spreads, particularly for high-yield or junk bonds, tend to widen as investors demand higher risk premiums. This can increase the cost of financing for corporations, potentially hindering corporate investment and overall economic growth.

Sharp VIX spikes can also lead to liquidity issues across various asset classes as investors hurriedly close positions. Bid-ask spreads tend to widen, making trading more expensive. Market makers may reduce their activity, further exacerbating price volatility.

Emerging market (EM) currencies often experience depreciation against the US dollar (USD) due to risk aversion. Investors tend to withdraw from riskier assets and return to the liquidity of the USD, strengthening the dollar. Countries with significant foreign debt denominated in USD may face additional financial pressures.