Key moments

- Microsoft stock demonstrated strength, recovering from intraday losses with a notable rally on Wednesday.

- Microsoft announced a partnership with the Kuwaiti government to establish an AI-powered Azure Region.

- The partnership aims to provide advanced cloud services, attract global businesses, and launch a skilling initiative to equip Kuwait’s workforce with AI and cybersecurity skills.

Despite Early Volatility, Microsoft Stock Surged on Wednesday and Maintained Momentum

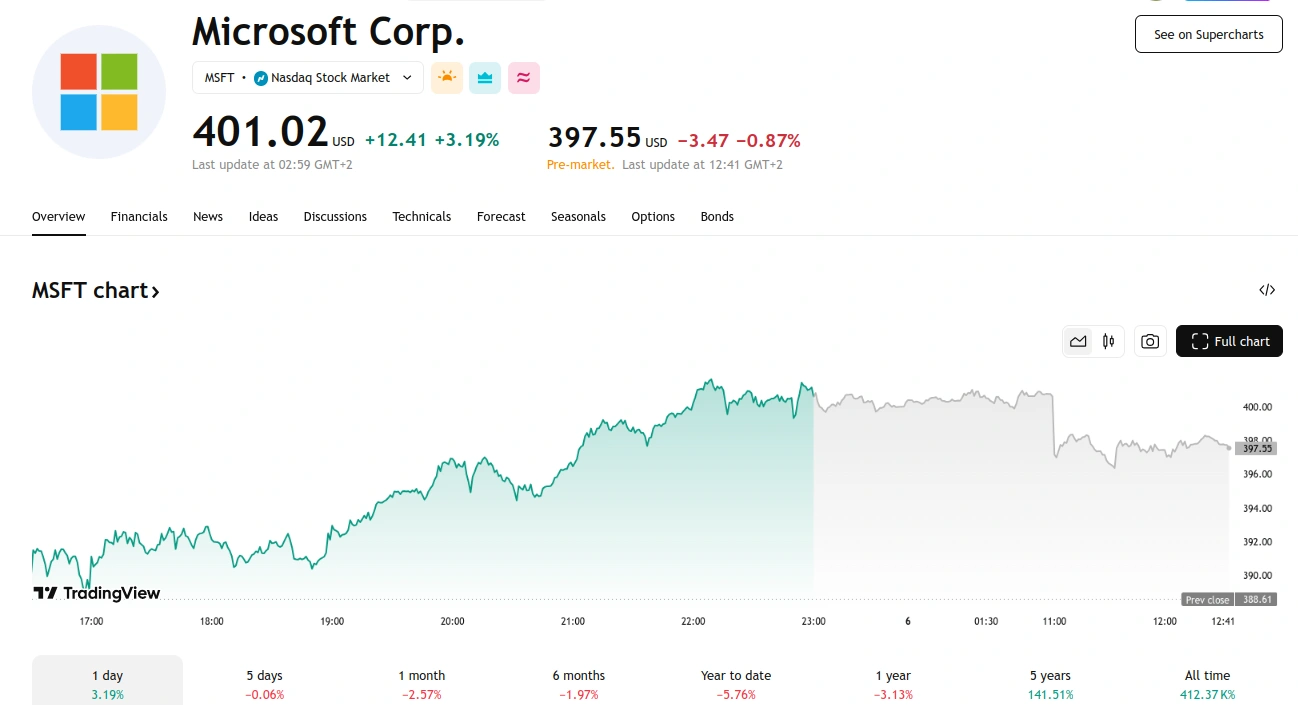

Microsoft (MSFT), a megacap tech giant with 7.43 billion shares outstanding and a $2.91 trillion market capitalization, demonstrated notable resilience this week. Despite an intraday dip of as much as 2%, the stock recovered, rallying over 1% to $392.58 in late-afternoon trading. Ultimately, amidst a broader market pullback, MSFT closed at $388.61, a modest 12-cent gain. Trading volume surged 29% above the 50-session average.

On Tuesday, the Nasdaq experienced significant volatility, finishing down nearly 0.4%. The S&P 500 underperformed, declining by 1.2%. Wednesday saw Microsoft’s stock outperform market indexes once again, climbing 3.2% and reaching a session high of $401.66. Trading volume increased by 3% compared to the 50-session average.

Thursday’s announcement of a strategic partnership with the Kuwaiti government to establish an AI-powered Azure Region fueled further positive momentum. The partnership, involving the Central Agency for Information Technology (CAIT) and the Communication and Information Technology Regulatory Authority (CITRA), aims to advance Kuwait’s digital transformation in line with its Vision 2035.

H.E. Omar Saud Al-Omar, Minister of State for Communication Affairs, stated that the partnership represented a “transformative milestone” in leveraging AI for economic diversification and strengthening Kuwait’s position in innovation. He added that the AI-powered Azure Region would address national and local challenges, fostering an AI ecosystem to drive economic growth, improve public services, and prepare the workforce for the future.

Microsoft, in a press release, indicated that the new Azure Region would provide “scalable, highly available, and resilient cloud services” across Kuwait. Samer Abu-Ltaif, President of Microsoft EMEA, affirmed the company’s commitment to supporting Kuwait’s cloud transformation and utilizing AI to enhance public sector productivity and efficiency. He stressed that the partnership would strengthen digital infrastructure and promote sustainable economic growth.

The collaboration aims to attract global businesses and researchers, cultivate a technology startup ecosystem, and encourage collaboration among researchers, universities, and companies to drive AI innovation. A comprehensive skilling initiative will also be launched to equip Kuwait’s workforce with skills in AI, cybersecurity, and emerging technologies.