Key moments

- CEO Auchincloss’s compensation decreased by £2.3 million to £5.4 million after BP’s profits dramatically declined in 2024.

- The company’s earnings fell 35% to £7.2 billion, negatively impacted by sliding oil and gas prices compared to the previous year.

- BP’s 5-year share performance lagged behind rivals and remained flat while Exxon Mobil’s and Shell’s shares rose 110% and 49%, respectively.

BP Share Payments Suffered 1.6 Million Decrease Last Year

BP’s recent financial reports reveal a year of significant adjustments, marked by the substantial reduction in executive compensation and a notable decline in profits. Murray Auchincloss, who assumed the CEO role in January 2024, saw his total earnings decrease to £5.4 million, a drop from £7.7 million in 2023. This reduction included significant cuts to his bonus, down to £734,000 from over £1.1 million. BP share payments also fell by £1.6 million to about £2.8 million last year, reflecting the company’s overall lackluster performance.

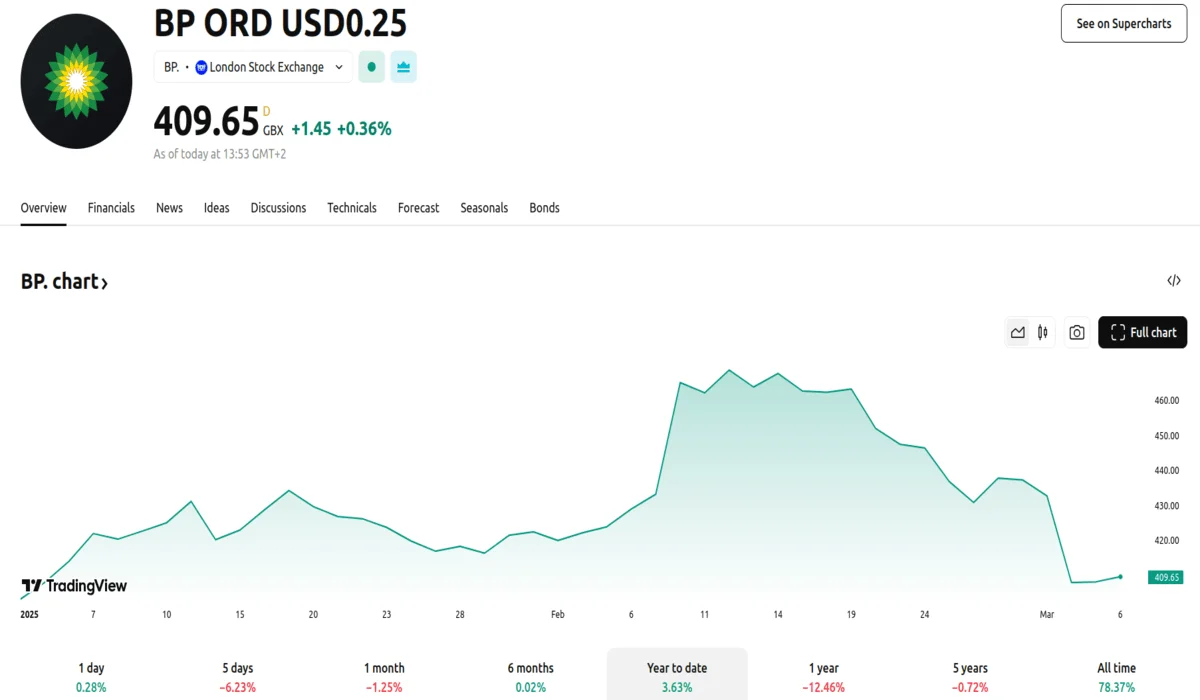

The company’s profits for the year amounted to £7.2 billion, a 35% decrease compared to the previous year. This decline is largely attributed to the normalization of oil and gas prices following the volatility experienced in the wake of geopolitical events, specifically the conflict in Ukraine. The company’s stock prices have declined by 12.46% over the last year.

BP has faced increasing pressure from investors regarding its stock performance. Over a 5-year period, its shares have shown minimal growth, contrasting sharply with the substantial gains achieved by rivals such as Exxon Mobil (up 110%) and Shell (up 49%). In response to these pressures, BP has undergone a strategic shift, redirecting its focus towards its core oil and gas business.

This shift involves a dialing back of ambitious renewable energy targets and a pledge to increase investment in fossil fuel operations. Auchincloss has acknowledged that the company’s previous green energy policies were implemented “too far, too fast.” Consequently, BP plans to significantly reduce its annual spending on renewables, despite maintaining its commitment to achieving net-zero carbon emissions by 2050.

The strategic redirection has drawn criticism from environmental groups, who argue that it contradicts global efforts to mitigate climate change. This move coincides with the company’s decision to abandon plans to reduce oil and gas output by a quarter by 2030. Auchincloss emphasized that the strategy reset is intended to enhance performance and increase returns for BP’s shareholders. The delay in the announcement of the strategy reset was due to Auchincloss needing to recover from a medical procedure.