Key moments

- Viant Technology’s revenue for Q4 reached $90.1 million, showcasing impressive double-digit growth.

- The company’s earnings per share were $0.15, exceeding analysts’ predictions of $0.14.

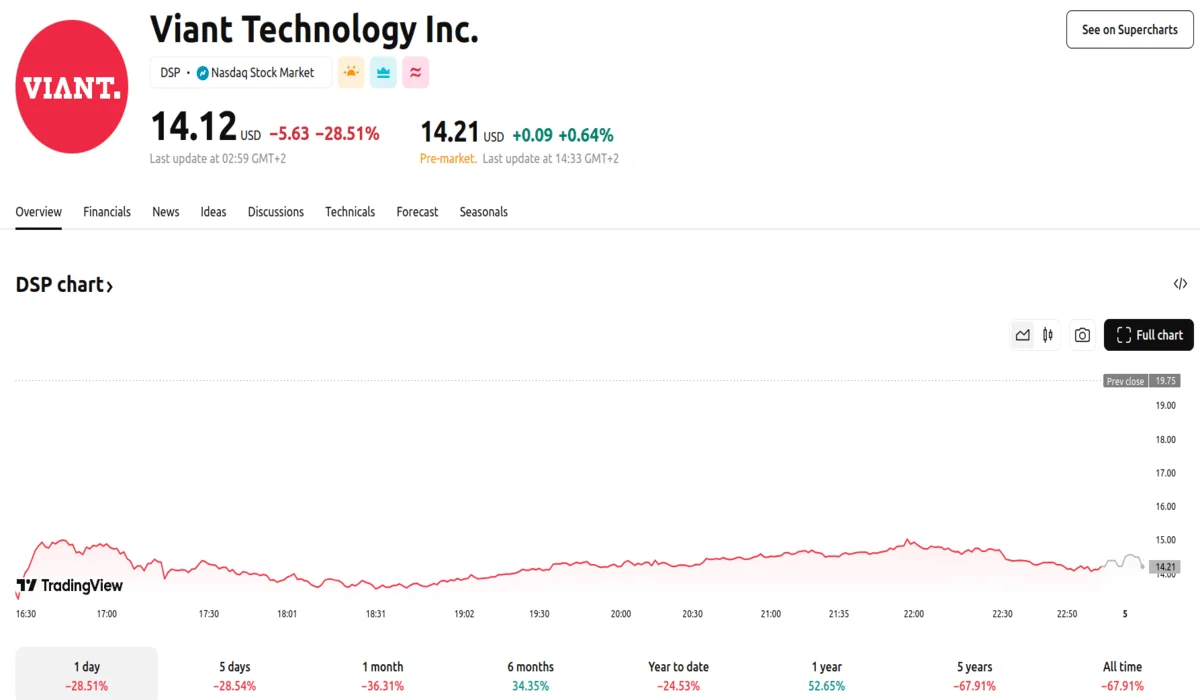

- Despite the positive financial results, Viant’s stock suffered a dramatic decrease, falling 28.51% to $14.12.

Viant Reported 40% Revenue Growth to $90.1 Million in Q4

Viant Technology Inc. announced its financial results for the fourth quarter of 2024, revealing substantial growth in key financial metrics, yet experiencing a significant drop in its stock value. The company reported revenue of $90.1 million, marking a 40% increase compared to the $64.36 million recorded in the same quarter of the previous year. This revenue figure also surpassed analysts’ expectations, which had projected a figure of $52.38 million.

In terms of profitability, Viant Technology reported earnings per share (EPS) of $0.15, exceeding the forecasted $0.14. This positive EPS performance, coupled with the robust revenue growth, underscored the company’s strong operational performance. The company’s adjusted EBITDA reached $17.1 million for a 31% increase from the prior year’s $13.05 million.

Despite these strong financial results, Viant’s stock price experienced a dramatic decline. Shares fell to $14.12, a decrease of 28.51% from the previous closing price of $19.75. This market reaction came as a surprise to many, given the company’s positive earnings report.

Viant Technology has been actively expanding its capabilities through strategic initiatives, including the rollout of Viant AI, which now powers 80% of the ad spend on its platform. The company also launched AI planning tools to enhance campaign efficiency. Furthermore, the acquisitions of Iris TV and Locker are expected to bolster Viant’s position in identity and addressability within the open internet.

However, the company’s non-GAAP operating expenses increased by 26% year-over-year in Q4, partially due to the Iris TV acquisition. Viant’s revenue guidance for Q1 2025 is set at $65 to 68 million, which would represent a 25% year-over-year increase from the $52 million in the same quarter of the previous year. The company’s market capitalization currently stands at $1.24 billion.