Key moments

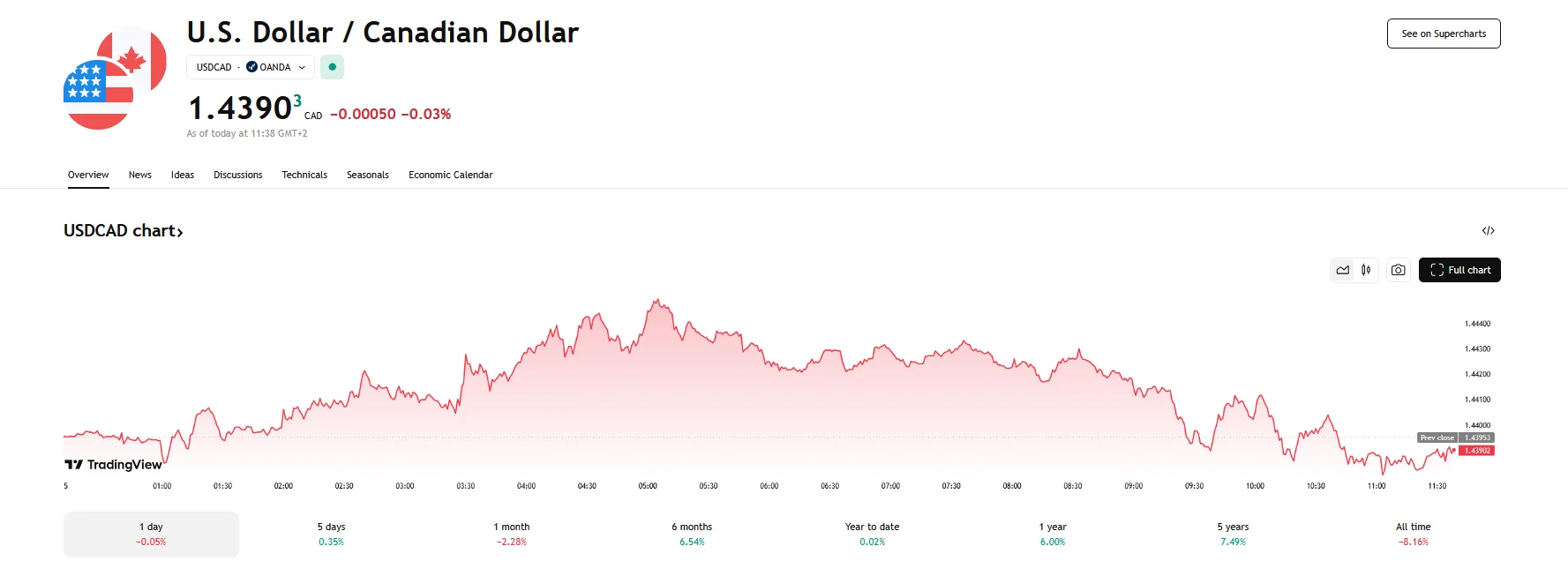

- The USD/CAD exchange rate has dropped below 1.4400.

- New tariffs enacted by the U.S. administration have generated worries about potential economic deceleration, leading to shifts in investor behavior.

- Inconsistent messaging from U.S. officials regarding tariff policies contributed to increased market volatility and a weakened U.S. Dollar.

Trade Disputes Shake USD/CAD

The dynamic interplay between economic policies and market sentiment has recently manifested in the fluctuating value of the USD/CAD currency pair, which experienced a notable dip below the 1.4400 threshold on Wednesday. The pressure exerted on the U.S. Dollar stemmed primarily from the implementation of new tariffs by the American administration. These duties, levied against goods from Canada and Mexico, alongside increased tariffs on Chinese imports, have generated widespread concern about a potential slowdown in economic growth. The impact of these policies was immediately evident in market reactions, with the USD/CAD even breaching the 1.4390 mark at one point.

Adding to the market’s volatility was the mixed messaging emanating from U.S. officials. While Commerce Secretary Howard Lutnick hinted at a possible reconsideration of the tariff policy, other reports suggested that the President remained resolute in maintaining the tariffs. This ambiguity contributed to a climate of uncertainty, further weakening the U.S. Dollar’s position.

Conversely, the Canadian Dollar faced its own set of challenges, primarily driven by growing expectations of further interest rate cuts from the Bank of Canada. Market forecasts indicated a high probability of these cuts, with projections suggesting a sustained downward trend in interest rates over the coming months. This anticipation placed downward pressure on the Canadian Dollar.

In response to the U.S. tariffs, Canada announced its own retaliatory measures, planning to impose tariffs of 25% on a substantial volume of U.S. goods. The Canadian government outlined a phased approach, with tariffs on a portion of the affected goods ($20.7 billion) taking immediate effect and further tariffs to be implemented in the coming weeks. In total, $107 billion worth of U.S. imports will be affected. Prime Minister Trudeau emphasized the detrimental effects of the U.S. tariffs, highlighting the potential for increased costs for American consumers and job losses. The Canadian government’s stance was that these tariffs would remain in place until the U.S. reversed its trade actions, underscoring the severity of the dispute.