Key moments

- Robyn Denholm recently sold another 112,390 shares of Tesla stock through Merril Lynch.

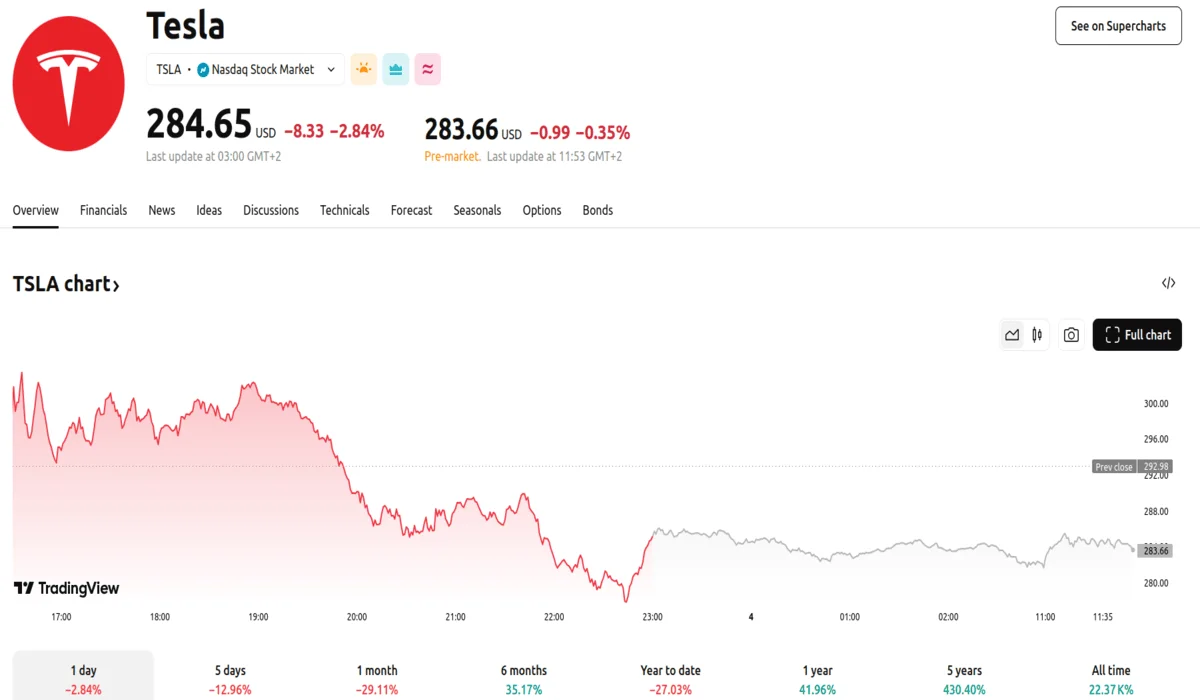

- The company’s stock experienced a 2.84% decrease on Monday, impacted by a wider tech sector sell-off.

- Morgan Stanley analyst predicts Tesla shares could reach $430 through diversification into artificial intelligence and robotics.

Denholm Has Disposed of Over $100 Million in Tesla Stock in the Last 3 Months

Tesla’s chairwoman, Robyn Denholm, has executed another substantial sale of Tesla stock, disposing of 112,390 shares valued at over $33 million. The transaction comes after Denholm disposed of another $43.2 million worth of Tesla equities in February, bringing the combined value of her sold Tesla stocks to over $100 million over the past three months. Alongside Denholm, Elon Musk’s brother, Kimbal Musk, and Tesla’s Chief Financial Officer, Taneja Vaibhav, have also recently sold shares.

These sales have occurred amidst a period of market volatility for Tesla. On Monday, Tesla’s stock price declined by 2.84%, mirroring a broader downturn in the technology sector. This comes after Tesla shares plummeted nearly 28% in February due to reduced electric vehicle sales. However, Morgan Stanley analyst Adam Jonas presents a bullish outlook for Tesla, predicting that the price of the company’s shares could rise to $430. He bases this projection on Tesla’s strategic diversification into artificial intelligence and robotics, viewing this as a significant growth opportunity.

Jonas anticipates that Tesla’s 2025 vehicle deliveries may decrease compared to the previous year, which he believes could create an attractive entry point for investors. He also reinstates Tesla as a top pick for the auto sector, with a potential bull case of $800. Jonas posits that Tesla’s shift from a purely automotive focus to a diversified AI and robotics company is crucial. He believes that the commercial potential of “embodied AI” applications beyond autonomous vehicles is substantial.

Tesla’s board of directors, including Denholm and Kimbal Musk, has faced scrutiny regarding executive compensation and its relationship with CEO Elon Musk. Denholm previously testified that her tenure on the board had generated approximately $280 million in earnings for her. The company has also been involved in legal challenges regarding director compensation, with a recent settlement requiring the return of funds to resolve allegations of excessive payments.

Tesla’s stock has retraced nearly all of its 40% post-election gains, having reached a high of $479.86 in mid-December. Analysts have pointed out that Tesla faces increased competition and the effect of Elon Musk’s political involvement on sales.