Key moments

- Saudi oil giant Aramco’s net profit fell to $106.25 billion in 2024, a 12% decline from $121.3 billion in 2023.

- The decline was largely driven by lower oil prices and reduced global demand.

- Aramco plans to pay $85.4 billion in dividends for 2024, significantly lower than previous years.

Aramco Dividend Payment Plummets to $85.4 Billion

The Saudi Arabian oil giant, Aramco, has disclosed its financial results for 2024, revealing a notable decline in profitability. The state-owned company ended the fiscal year with net revenue of $106.25 billion, a figure that is 12% lower than the $121.3 billion reported in 2023. This decrease can be attributed to a combination of factors, primarily the fluctuation of global oil prices and shifts in market demand.

Aramco’s total revenue streams also experienced a marginal contraction, with total revenue reaching $436.6 billion, slightly less than the $440.8 billion recorded in the preceding year. The company’s fourth-quarter dividend allocation includes a base dividend of $21.1 billion, with a performance-linked dividend of $220 million. This stands in contrast to the third quarter, which saw a base dividend of $20.3 billion and a performance-linked dividend of $10.8 billion.

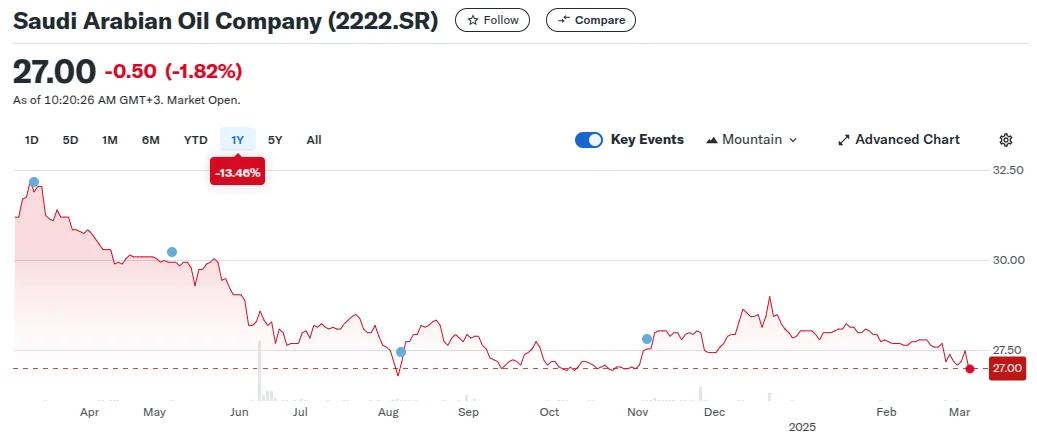

The average price of Brent crude oil in 2024 was $80 per barrel, a $2 decrease from the 2023 average. The company’s stock value has also seen a decline, currently trading around $7.33 per share, down 15.8% from a previous high of $8.71. Aramco, which has a market capitalization of $1.74 trillion, maintains its position as one of the world’s most valuable companies.

Future dividend projections indicate a total of $85.4 billion for the year, a reduction that will impact the funds available to the Saudi Arabian government. The company’s CEO, Amin H. Nasser, emphasized the company’s resilience despite these financial shifts.

The results are announced as OPEC+ has agreed to increase oil production, which is expected to further influence global oil prices. Saudi Arabia’s low-cost oil production capabilities provide it with a significant advantage, with potential gains of $40 billion annually for every $10 increase in oil prices. The Saudi government, which holds a substantial portion of Aramco’s shares, will be impacted by the changes in dividend payouts. The company has also been considering offering additional shares to the public. The Kingdom will need to acquire debt to fund large scale projects and planned events.