Key moments

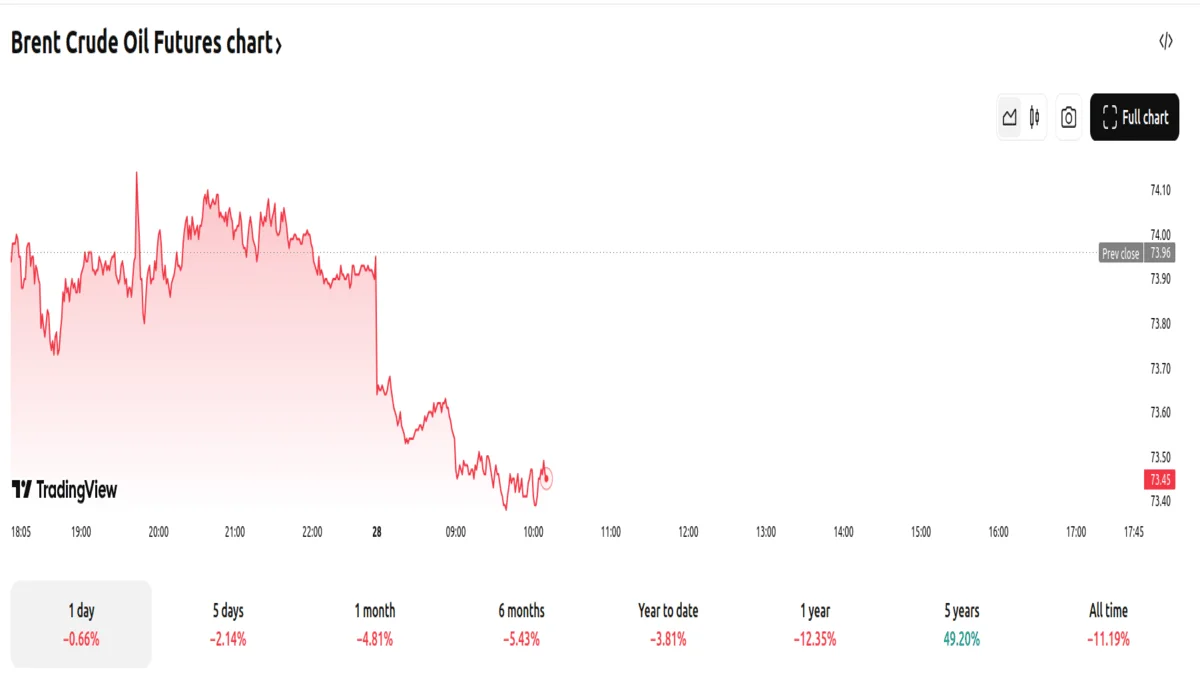

- Oil prices surged over 2%, with Brent and WTI crude oil futures settling at $74.04 and $70.35 per barrel following President Trump’s revocation of Chevron’s Venezuela license.

- Chevron, which exports 240,000 bpd of Venezuelan crude, may now negotiate with PDVSA to ship oil to non-U.S. markets.

- OPEC+ is reconsidering its planned April output hike due to supply uncertainties caused by U.S. sanctions on Venezuela, Iran, and Russia.

Chevron’s Exit Shakes Oil Markets: 240,000 bpd in Limbo

Oil prices rebounded sharply on Thursday, with both Brent and West Texas Intermediate (WTI) crude benchmarks climbing more than 2%. The rally followed U.S. President Donald Trump’s decision to revoke Chevron’s license to operate in Venezuela, raising concerns about potential supply disruptions. Brent crude futures rose 2.1% to settle at $74.04 per barrel, while WTI crude gained 2.5% settling at $70.35. This recovery came after both benchmarks hit two-month lows in the previous trading session.

Chevron, which exports approximately 240,000 barrels per day (bpd) of crude from Venezuela—more than a quarter of the country’s total output—will no longer be able to ship Venezuelan oil under the new restrictions. Analysts warn that this could lead to a decline in Venezuela’s production, potentially forcing U.S. refiners to seek alternative, costlier sources of heavy crude oil. The move also opens the door for negotiations between Chevron and Venezuela’s state-owned PDVSA to export oil to non-U.S. destinations, according to sources familiar with the matter.

The decision has added uncertainty to global oil markets, already grappling with geopolitical tensions and economic headwinds. OPEC+ members are reportedly debating whether to proceed with a planned output increase in April or maintain current production levels, given the fresh U.S. sanctions on Venezuela, Iran, and Russia.

The oil market’s volatility is further compounded by ongoing geopolitical developments, including efforts to broker a peace deal between Russia and Ukraine. President Trump announced that Ukrainian President Volodymyr Zelenskiy would visit Washington to sign an agreement on rare earth minerals, though the success of such talks remains uncertain.

Meanwhile, economic data from the U.S. has added to the cautious sentiment. Fourth-quarter economic growth slowed, and early indicators suggest the trend has continued into the first quarter of 2025, driven by cold weather and concerns over the impact of tariffs on consumer spending. Additionally, unemployment claims rose more than expected last week, though mass layoffs of federal workers have yet to significantly impact the broader labor market.

As oil markets navigate these challenges, analysts remain divided on the near-term outlook. While some predict OPEC+ will delay production increases to stabilize prices, others warn of potential price spikes if supply constraints tighten further. Investors are closely monitoring developments in Venezuela, OPEC+ decisions, and geopolitical negotiations for clearer signals on the market’s direction.