Key moments

- Sinclair, a media broadcasting company, met Wall Street’s revenue expectations in Q4 CY2024, with sales up 21.5% year on year to $1 billion.

- The company’s GAAP profit of $2.61 per share was 30.8% above analysts’ consensus estimates, and its adjusted EBITDA of $330 million was 2.7% above estimates.

- Despite the strong Q4 performance, Sinclair’s revenue guidance for Q1 CY2025 was less impressive, coming in 3.5% below analysts’ estimates at $772 million.

Sinclair, a leading media broadcasting company, has reported a strong Q4 CY2024 performance, with revenue increasing by 21.5% year on year to $1 billion. This growth was driven by the company’s continued dominance in the broadcast TV market, with its network of 185 stations broadcasting 640 channels across 86 markets. The company’s GAAP profit of $2.61 per share was also significantly above analysts’ consensus estimates, demonstrating its ability to generate strong earnings.

The company’s adjusted EBITDA of $330 million was 2.7% above estimates, and its operating margin of 26.5% was a significant improvement from the same quarter last year. However, despite the strong Q4 performance, Sinclair’s revenue guidance for Q1 CY2025 was less impressive, coming in 3.5% below analysts’ estimates at $772 million. This guidance suggests that the company may face some challenges in the coming quarter, and investors will be closely watching its performance to see if it can maintain its momentum.

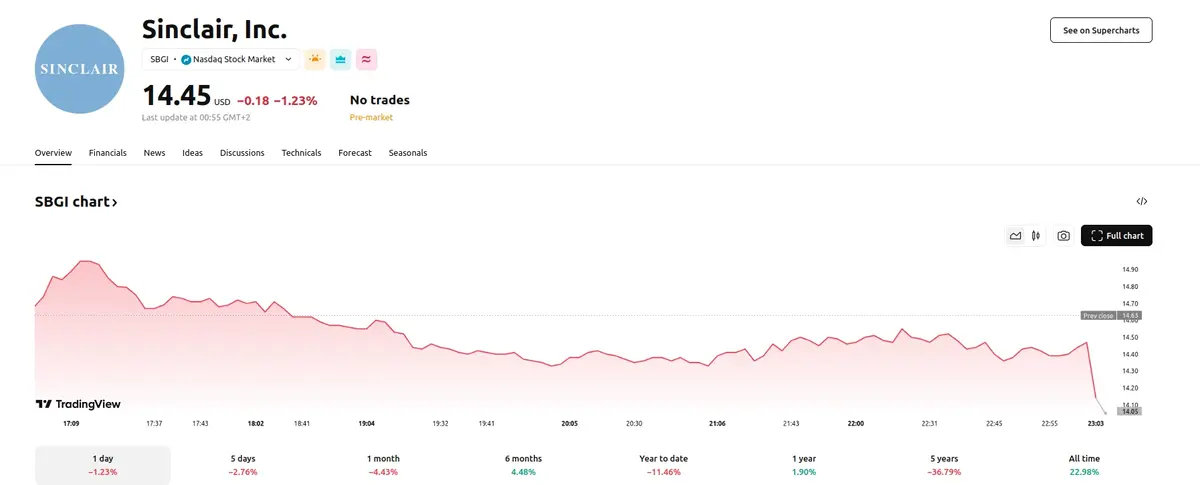

Sinclair’s long-term growth prospects are also a key area of focus for investors. While the company’s recent performance has been strong, its sales growth over the last five years has been weak, with a decline of 3.5% annually. The company’s distribution and advertising revenue segments have also experienced declines over the last two years, with average year-on-year declines of 4.9% and 3.9%, respectively. However, the company’s recent Q4 performance suggests that it may be turning a corner, and investors will be closely watching its future results to see if it can sustain its growth momentum.