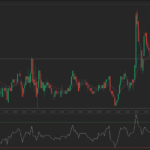

Spot Gold was mostly steady on Wednesday, while holding in proximity to the $2,650 mark, as investors awaited a speech by Fed Chair Jerome Powell later in the day, which may provide more clues regarding the central bank’s policy path next year.

Another highlight this week will be the key US Non-Farm Payrolls report that may offer more insight into macroeconomic conditions.

Employers in all sectors of the US economy, excluding farming, probably added 200,000 job positions in November, according to market consensus, following a job growth of 12,000 in October.

Yesterday data showed US job openings had risen at a faster than expected pace in October, suggesting continuing labor market resilience. The number of job openings rose by 372,000 to 7.744 million in October from a revised down 7.372 million in September.

Several Fed officials are also scheduled to make speeches this week. Fed policy makers had said they continued to believe inflation was heading towards the 2% objective and indicated support for more rate cuts in the future.

Markets are now pricing in about a 73% chance of a 25 basis point rate cut at the Federal Reserve’s December meeting. About 80 basis points of Fed rate cuts are now expected by the end of 2025.

Spot Gold was last inching down 0.07% to trade at $2,641.91 per troy ounce.

Gold Futures for delivery in February were edging down 0.14% on the day to trade at $2,664.06 per troy ounce.