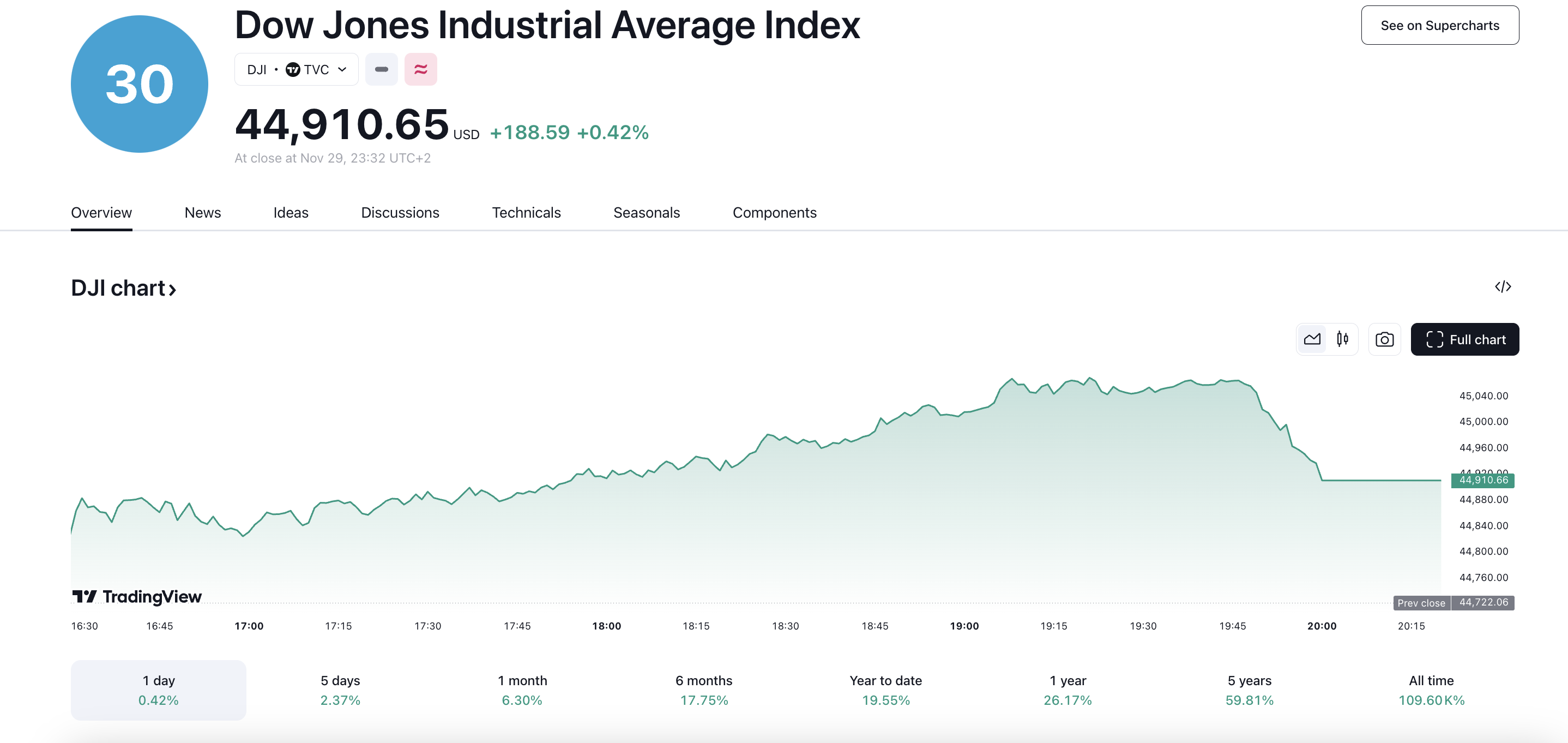

The S&P 500 and Dow Jones Industrial Average closed at record highs on Black Friday, driven by gains in technology stocks and a strong retail performance. The S&P 500 rose 0.56% to 6,032.44 points, while the Dow Jones Industrial Average climbed 0.42% to 44,910.65 points.

Technology Stocks Lead the Way

Nvidia led the charge in the technology sector, gaining 2%, while Tesla rose 3.7%. The Philadelphia SE Semiconductor index also rebounded from Wednesday’s declines, rising 1.5%.

Retail Stocks Shine on Black Friday

Retail stocks were in focus as the holiday shopping season kicked off, with Target and Macy’s rising 1.7% and 1.8%, respectively. Adobe Analytics estimated that consumers would spend a record $10.8 billion in online purchases on Black Friday, up 9.9% from last year.

Market Outlook

The market’s strong performance on Black Friday was a welcome relief after Wednesday’s declines, which were driven by concerns over the Federal Reserve’s rate cut plans. Investors are now pricing in expectations that the Fed will lower borrowing costs by 25 basis points at its December meeting, but pause rate cuts in January.

Other Market News

Crypto stocks also rose on the back of gains in bitcoin, boosting MARA Holdings by 1.9%. However, Applied Therapeutics plummeted 76% after the FDA declined to approve its drug for the treatment of a rare genetic metabolic disease.

Overall, the market’s strong performance on Black Friday suggests that investors are optimistic about the holiday shopping season and the overall economy.