The basic US indices advanced yesterday boosted by the general optimism in the tech sector, as well as the online retailing. The Nasdaq reached a new record hi at 15448.12, with a daily gain of 1.39%, the DJIA and S&P500 added respectively .68% and .98% to their market values. Oil did not manage to correct deeper and recovered values with WTI and Brent closing at USD82.09 and USD84.46 respectively. 10 Treasuries’ yields made a huge recovery to 1.57% from 1.548%, proving that Wednesday’s bond market reaction to the BOC moves was too overstated. Investors also took note of the trailing q/q US GDP data, showing a .2% growth, missing expectations of 2.6%. The slow-down in the q/q growth rate is more or less expected, considering the wild post pandemic recovery of the US economy, with 6.3% y/y in Q1 and 6.7%y/y in Q2, nourished by the multi-trillion fiscal and monetary measures injected by the Fed and the US government.

The yesterday session by industries looked like this:

As predicted in my previous article, Ford /F/ made a huge 8.7% daily gain, making up for the unjustified losses on brilliant financial statements reported. The only thing the company needed was a favorable general market trend, the green one that was exhibited at the broad US indices yesterday. The company has reached the impressive 10.1% operating margin and has managed handling the semiconductor shortage. TSLA also added 3.78% to its market value.

The big optimism in the tech sector was triggered by resolving the reputational stigma of FB /+1.5%/, as the company renames itself to Meta and will be traded under the ticker MVRS since December 1st. The Meta brand name is not just a pure wording change, to escape the unfavorable corporate identity, caused by the piling up regulatory scandals recently. It underlines the virtual reality focus of the tech giant business, versus the scandals with handling personal data of worldwide users. FB is introducing the “Horizon Home”, a revolutionary feature, in addition to the Oculus Quest 2 headset, letting users interact as digital avatars in virtual homes, where they could watch videos or play games together.

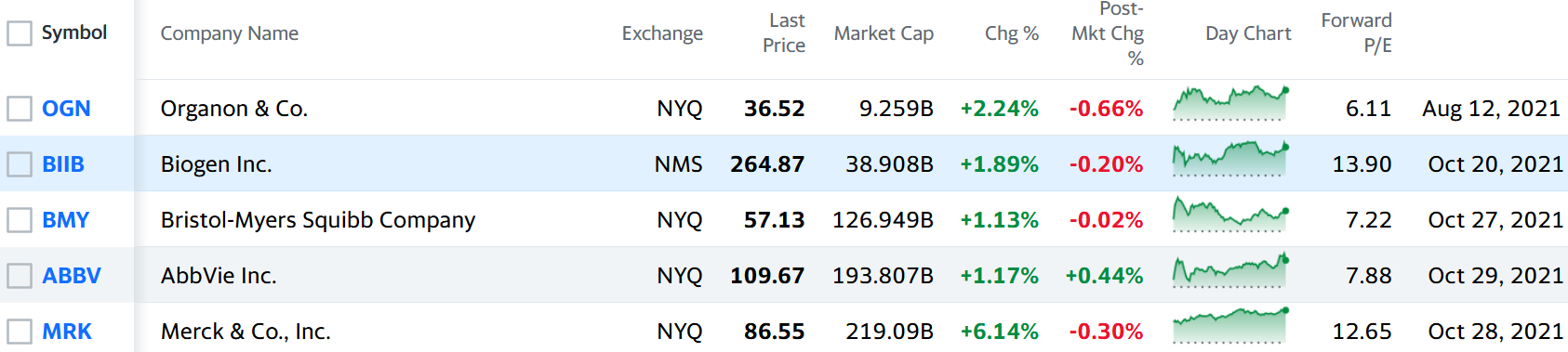

Merck /MRK/, added the impressive 6.14% to its market cap, after forecasting that its potential sales of Molnupiravir, the first ever pill invented to treat specifically serious cases of Covid patients, would boost company revenues with USD7B. Its quarter sales and net income also surpassed analyst’s expectations. Provided below is a list of US drug manufacturers which surpassed the broad indices yesterday, with their earnings date:

Today at 8:30 EST we have the Core PCE m/m Price Index, a very closely watched indicator nowadays, both from the investment and trading society, as well as the Fed. Provided with the index data, there is also information on Personal Income and Spending m/m, which has already been preceded by the Consumer Sentiment, and information respectively priced in the different asset classes.