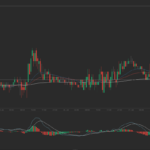

Yesterday’s trade saw GBP/USD within the range of 1.4188-1.4280. The pair closed at 1.4189, shedding 0.50% on a daily basis. It has been the 40th drop in the past 73 trading days and also the sharpest one since April 5th, when the pair went down 0.72%. The daily low has been a lower-low test of the low from April 12th. GBP/USD has fallen 1.61% so far during the current month, after going up 3.20% in March.

Yesterday’s trade saw GBP/USD within the range of 1.4188-1.4280. The pair closed at 1.4189, shedding 0.50% on a daily basis. It has been the 40th drop in the past 73 trading days and also the sharpest one since April 5th, when the pair went down 0.72%. The daily low has been a lower-low test of the low from April 12th. GBP/USD has fallen 1.61% so far during the current month, after going up 3.20% in March.

At 6:29 GMT today GBP/USD was losing 0.44% for the day to trade at 1.4127. The pair touched a daily low at 1.4123 at 6:04 GMT, or the lowest level since April 11th, and a daily high at 1.4208 during the early phase of the Asian trading session.

On Thursday GBP/USD trading may be influenced by the following macroeconomic reports and other events as listed below.

Fundamentals

United Kingdom

Bank of England policy decision

At 11:00 GMT Bank of England is to announce its decision on monetary policy. The benchmark interest rate (repo rate) will probably be left unchanged at the record low level of 0.50%. The rate has been at that level since BoEs policy meeting on March 5th 2009. At the same time, the pace of BoE’s monetary stimulus will probably be left without change as well, at GBP 375 billion. The asset-purchasing programme, financed by the issuance of central bank reserves was initiated on March 5th 2009, while the scale of this programme was increased by GBP 50 billion to the current GBP 375 billion on July 5th 2012.

The minutes from the Banks policy meeting held in March revealed that all 9 members of the Monetary Policy Committee voted in favor of keeping borrowing costs and the stock of purchased assets intact. One member of the Committee has been voting in favor of a rate hike since the summer of 2015, but abandoned such a stance, as forecasts regarding UK economic growth and consumer inflation were revised down. Policy makers noted that the uncertainty over the outcome from the referendum on EU membership may curb spending intentions and have an additional restraining effect on aggregate demand growth.

According to extracts from the Banks Monetary Policy Statement, released in February: ”Inflation nonetheless remains well below the 2% inflation target. This is due predominantly to unusually large drags from energy and food prices, which are expected to fade in the coming months. But core inflation also remains subdued, a consequence of the past appreciation of sterling, weak global inflation and restrained domestic cost growth.”

”…there appears to be increased uncertainty surrounding the forthcoming referendum on UK membership of the European Union. That uncertainty is likely to have been a significant driver of the decline in sterling. It may also delay some spending decisions and depress growth of aggregate demand in the near term. Overall, however, the Committee judges the outlook for domestic activity to be little changed from the time of the February Inflation Report, with GDP expected to grow at around average rates over the forecast period.”

”…there is a range of views among MPC members about the balance of risks to inflation relative to the central projection presented in the February Inflation Report.”

”All members agree that, given the likely persistence of the headwinds weighing on the economy, when Bank Rate does begin to rise, it is expected to do so more gradually and to a lower level than in recent cycles.”

United States

Initial, Continuing Jobless Claims

The number of people in the United States, who filed for unemployment assistance for the first time during the business week ended on April 8th, probably increased to 270 000, according to market expectations, from 267 000 in the preceding week.

The 4-week moving average, an indicator lacking seasonal effects, was 266 750, marking an increase by 3 500 compared to the preceding weeks unrevised average.

The business week, which ended on April 1st has been the 57th consecutive week, when jobless claims stood below the 300 000 threshold, which suggested a healthy labor market. This has been the longest streak since 1973.

Initial jobless claims number is a short-term indicator, reflecting lay-offs in the country. In case the number of claims met expectations or increased further, this would have a moderate bearish effect on the US dollar.

The number of continuing jobless claims probably dropped to the seasonally adjusted 2 183 000 during the business week ended on April 1st from 2 191 000 in the preceding week. The latter has been the highest number of claims since the business week ended on March 4th, when a revised down 2 218 000 claims were reported. The figure also represented an increase by 19 000 compared to the revised down number of claims reported in the week ended on March 18th. This indicator reflects the actual number of people unemployed and currently receiving unemployment benefits, who filed for unemployment assistance at least two weeks ago.

The Department of Labor is to release the weekly report at 12:30 GMT.

Consumer inflation

The annualized consumer inflation in the United States probably accelerated to 1.2% in March, according to market expectations, from 1.0% in February. In monthly terms, the Consumer Price Index (CPI) probably rose 0.2% in March, following a 0.2% drop in the preceding month.

In February upward pressure came from cost of services less energy (up 3.1% year-on-year and following a 3.0% surge in January). Within the category, cost of shelter went up 3.3% year-on-year, cost of medical care rose 3.9% and cost of transportation services increased 2.6%. Additionally, consumers paid more for food in February (up at an annualized rate of 0.9%, accelerating from a 0.8% surge in January), according to the report by the Bureau of Labor Statistics. The largest downward pressure on the annual CPI came from prices of energy (down 12.5% in February from a year ago, or a steeper decline compared to January).

The annualized core consumer inflation, which is stripped of prices of food and energy, probably remained at 2.3% for a second consecutive month in March, according to expectations. It has been the highest core inflation since May 2012.

If the general CPI tends to approach the inflation objective, set by the Federal Reserve and considered as providing price stability, or a level below but close to 2%, this will usually bolster the appeal of the US dollar, as it heightens the probability of monetary policy tightening.

The Bureau of Labor Statistics is to release the official CPI report at 12:30 GMT.

Fed Speakers

At 14:00 GMT the Fed President for Atlanta, Dennis Lockhart, and Fed Board of Governors member, Jerome Powell are expected to take a statement. These events will be closely watched by market players for hints over how the central banks tightening cycle will develop in the future.

Daily and Weekly Pivot Levels

By employing the Camarilla calculation method, the daily pivot levels for GBP/USD are presented as follows:

R1 – 1.4197

R2 – 1.4206

R3 (range resistance) – 1.4214

R4 (range breakout) – 1.4240

S1 – 1.4181

S2 – 1.4172

S3 (range support) – 1.4164

S4 (range breakout) – 1.4138

By using the traditional method of calculation, the weekly pivot levels for GBP/USD are presented as follows:

Central Pivot Point – 1.4151

R1 – 1.4295

R2 – 1.4466

R3 – 1.4610

S1 – 1.3980

S2 – 1.3836

S3 – 1.3665