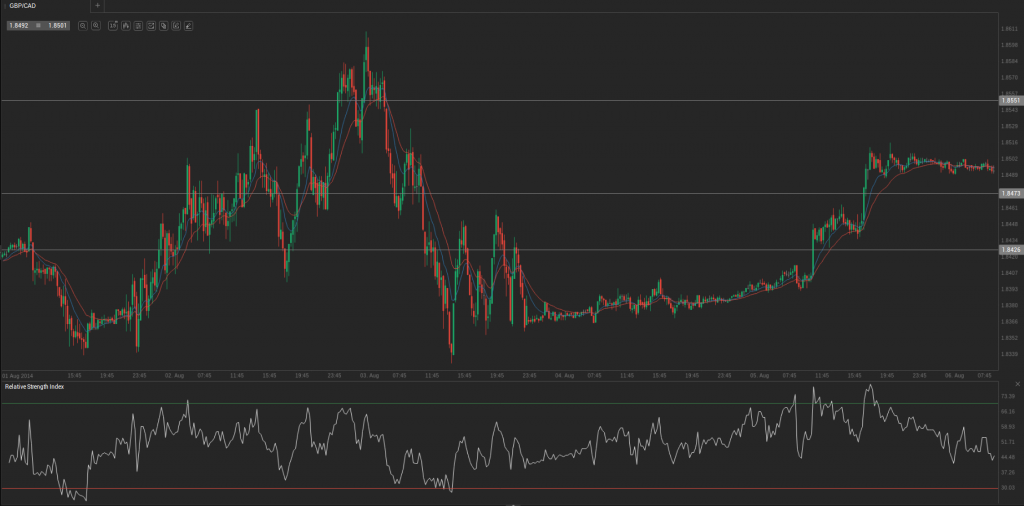

During yesterday’s trading session GBP/CAD traded within the range of 1.8394-1.8520 and closed at 1.8504, adding 0.59% for the day.

During yesterday’s trading session GBP/CAD traded within the range of 1.8394-1.8520 and closed at 1.8504, adding 0.59% for the day.

At 6:55 GMT today GBP/CAD was losing 0.07% for the day to trade at 1.8496. The pair touched a daily low at 1.8494 at 1:20 GMT.

Fundamental view

United Kingdom

Annualized industrial output in the United Kingdom probably expanded 1.6% in June, following another 2.3% increase during the preceding month. In monthly terms, industrial production probably increased 0.6% in June, following an unexpected 0.7% slump in the previous month., that was the biggest since August 2013. The index presents the change in the total inflation-adjusted value of production in sectors such as manufacturing, mining and energetics.

In addition, UK’s annualized manufacturing production, a short-term indicator which accounts for almost 80% of nation’s industrial output, probably expanded 2.1% in June. In May manufacturing output rose at an annualized pace of 3.7%. In monthly terms, production probably increased 0.6% during last month. As it is a key component of country’s Gross Domestic Product, in case manufacturing production expanded more than projected, this would have a bullish effect on the sterling.

The Office for National Statistics (ONS) will release the official figures at 8:30 GMT.

Canada

The deficit on Canadian trade balance probably contracted to 0.100 billion CAD during June from 0.152 billion CAD in the prior month. The trade balance, as an indicator, measures the difference in value between nation’s exported and imported goods and services during the reported period. It reflects the net export of goods and services, or one of the components to form country’s Gross Domestic Product. Exports probably increased to 45.00 billion CAD in June from 42.17 billion CAD in May, while imports probably shrank to 44.00 billion CAD from 44.32 billion CAD in the previous month. Generally, exports reflect economic growth, while imports indicate domestic demand. In case the trade balance deficit shrank more than expected, this would provide support to Canadian dollar. Statistics Canada will release the official figure at 12:30 GMT.

Technical view

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 1.8473. In case GBP/CAD manages to breach the first resistance level at 1.8551, it will probably continue up to test 1.8599. In case the second key resistance is broken, the pair will probably attempt to advance to 1.8677.

If GBP/CAD manages to breach the first key support at 1.8426, it will probably continue to slide and test 1.8347. With this second key support broken, the movement to the downside will probably continue to 1.8299.

In weekly terms, the central pivot point is at 1.8380. The three key resistance levels are as follows: R1 – 1.8442, R2 – 1.8522, R3 – 1.8584. The three key support levels are: S1 – 1.8300, S2 – 1.8238, S3 – 1.8158.