WTI and Brent futures were lower during afternoon trade in Europe today. Iraq saw more fighting, while the US posted its weekly oil inventories report yesterday. Meanwhile, natural gas futures plummeted as the weekly US blue fuel stocks report revealed a bigger-than-expected injection.

WTI and Brent futures were lower during afternoon trade in Europe today. Iraq saw more fighting, while the US posted its weekly oil inventories report yesterday. Meanwhile, natural gas futures plummeted as the weekly US blue fuel stocks report revealed a bigger-than-expected injection.

West Texas Intermediate futures for settlement in August traded for $105.68 per barrel at 14:19 GMT on the New York Mercantile Exchange, down 0.91%. Prices ranged from $105.43 to $106.81 per barrel. The US contract added 0.44% yesterday, and so far this week WTI has lost about 0.3%.

Meanwhile on the ICE in London, Brent futures due in August stood for a 0.56% drop at $113.36 per barrel at 14:19 GMT. Daily high and low stood at $114.29 and $113.15 per barrel, respectively. Brent’s premium to August WTI stood at $7.68, after yesterday’s closing margin of $7.50. The European contract dropped 0.40% yesterday, and so far this week Brent has lost 0.7%.

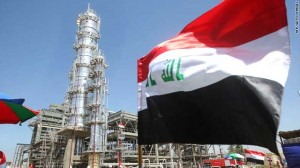

Iraq

Iraq did not see an easing of tensions yesterday. Prime Minister Nouri Maliki dismissed a widely discussed and promoted idea of a government of national unity, including more Sunni and Kurdish representation. Such calls represented a “coup against the constitution and an attempt to end the democratic experience”, he warned, the BBC reported.

Meanwhile, Kirkuk, an oilfield center, which was occupied by forces of the autonomous Kurdish government after the Iraqi military fled, saw the first episode of violence yesterday, as a car-bomb killed several and injured dozens. The Kurdish state is seen as a bulwark against the Sunni onslaught, and is yet to see major confrontations with its new ISIS-dominated neighbors in Iraq.

Also, Syrian military aircraft have bombed positions of ISIS militants near the border earlier today, in a move welcomed by PM Maliki.

Previously, insurgents took control of the country’s largest oil refinery, which supplies about a third of Iraq’s fuel demand. Elsewhere, militants seized all official border crossings in Syria and Jordan. The Jordanian army has been on full alert, protecting its borders against incursions, the Jordanian military said.

The Iraqi government insisted insurgents do not threaten Baghdad, nor the southern oilfields, which account for more than 75% of Iraqi oil output. Furthermore, the Iraqi oil minister said production and exports will actually increase over the next month.

Iraq is OPEC’s second-top oil producer, and exports some 3 million barrels per day from its main southern terminal at Basra.

US oil report

The US Energy Information Administration (EIA) posted its weekly oil inventories report for the seven day through June 20 yesterday. The log revealed a 1.742 million-barrel gain for commercial crude oil inventories, after the private American Petroleum Institute (API) had suggested a 4 million-barrel gain on Tuesday. A Bloomberg survey projected a 1.7 million-barrel draw. The previous reading, for the week through June 13, showed crude inventories had lost 0.6 million barrels.

Oil at Cushing, Oklahoma, the delivery point for the NYMEX contract and the largest hub in the US, was reported at 21.8 million barrels for a 0.4 million-barrel increase, after a gain of 200 000 was logged for the previous week. Meanwhile, hubs at the Gulf Coast added 2.0 million barrels, after 1.2 million were drawn last week. The report for the week through May 30 saw a further 6 million-barrel drop for hubs at the Gulf.

Domestic production of crude oil logged a minor drop for a reading of 8.446 million barrels per day (bpd), after minor growth was recorded in the report for the week ended June 13. Meanwhile, imports of crude were also little changed at 7.341 million bpd, after also gaining slightly last week. Inbound shipments of crude have declined by about 1.4 million bpd over the past month, almost 20% of current imports.

Gasoline inventories added 0.710 million barrels for the week through June 20, while the API had reported a 2.2 million-barrel increase, after last week saw 0.8 million barrels added. Distillate fuels stockpiles levels increased by 1.177 million barrels, while the API posted a 0.253 million-barrel drop on Tuesday. Previously, distillates inventories had added 0.4 million barrels in the week through June 13.

Refinery utilization rate was up by 1.4% for a standing of 88.5%, after an insignificant drop was logged in the previous report. Gasoline production this week decreased by almost 10%, or 0.8 million bpd for a standing of 9.054 million bpd, negating a similarly massive 0.9 million-bpd increase last week. Distillates output averaged 4.877 million bpd for a minor weekly increase, after an equally unimpressive decline was reported last week.

Natural gas

Front month natural gas futures, due in July, dropped 1.97% at the New York Mercantile Exchange to trade for $4.479 per million British thermal units at 14:43 GMT today. Prices ranged from $4.608 to $4.478 per mBtu. The contract added 0.29% yesterday, and so far this week the blue fuel has gained about 0.4%.

The EIA released its weekly natural gas inventories report today, to reveal a 110 Billion cubic feet (Bcf) for stocks. A wide array of estimates were cast ahead of the report, ranging from 93 to 107 Bcf. NatGasWeather.com had predicted a 102-107 Bcf increase, while Tim Evans, an energy analyst at Citi Futures in New York, gave a 93 Bcf figure for Bloomberg.

Stocks remain 27.4% below last years reading for the same period. The EIA, however, has suggested gains will continue to be above-average, and that most likely inventories will be completely replenished ahead of winter heating season.

“The latest forecasts suggests that the call on nat gas for cooling demand will not be atypical for this time of the year and thus inventory injections are likely to continue to outperform the historical injections,” Dominick Chirichella, senior partner at the Energy Management Institute in New York, said in a note to clients yesterday, cited by Bloomberg. He had predicted a 101 Bcf gain for nat gas inventories.