Gold surged to the strongest level in more than four months after the Russian Federation seized control of the Crimea region, spurring tensions in Ukraine and fueling demand for haven assets. Also fanning positive sentiment, assets in the SPDR Gold Trust, the biggest bullion-backed ETF, rose 0.4% in February, capping the first monthly increase since December 2012.

Gold surged to the strongest level in more than four months after the Russian Federation seized control of the Crimea region, spurring tensions in Ukraine and fueling demand for haven assets. Also fanning positive sentiment, assets in the SPDR Gold Trust, the biggest bullion-backed ETF, rose 0.4% in February, capping the first monthly increase since December 2012.

On the Comex division of the New York Mercantile Exchange, gold futures for settlement in April surged by 1.83% to trade at $1 345.80 per troy ounce by 09:30 GMT. Prices touched a session high at $1 350.30 per troy ounce, the strongest level since October 30, while day’s low was touched at $1 336.40 an ounce.

Gold futures are up 11% this year and capped the first back-to-back monthly increase in February since the two-months through August, after a recent unrest in emerging markets, including Ukraine, and signs of slowing US growth, boosted demand for haven assets.

However, the precious metal settled last year 28% lower, the steepest annual decline since 1981 as some investors lost faith in the metal as a store of value and amid speculation Fed will continue scaling back its monetary stimulus throughout 2014.

“Geopolitical risk out of Ukraine is giving gold a safe-haven bid,” Victor Thianpiriya, an analyst at Australia & New Zealand Banking Group, said from Singapore, cited by Bloomberg. “It remains to be seen if it will be sustained,” he said, citing prospects for lower physical demand in Asia.

Ukraine called for international observers in Crimea and mobilized the nations army reserves yesterday, after the Russian Federation seized control of the Black Sea region and threatened to invade in the pro-Russian region. The Russian threat of invasion in Ukraine, forced the EU foreign ministers to hold an emergency meeting today, while at the same time, the US Secretary of State John Kerry is expected to travel to Ukraine.

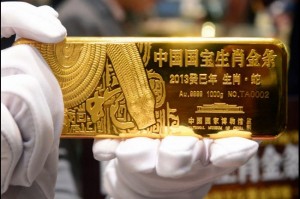

Chinese demand

On the Shanghai Gold Exchange, trading volumes for spot bullion of 99.99 percent purity declined 11 581 kilograms on February 28, the weakest level since February 12, as metal for immediate delivery traded at a discount to London prices.

Higher bullion prices have hurt demand in China, which according to data by the World Gold Council released last week, overtook India as the largest global consumer last year, consuming a record 1 066 tons.

Fed stimulus outlook

Federal Reserve Chair Janet Yellen said last week before the Banking Senate Commission that central bank’s officials were “open to reconsidering” the pace of reductions in monthly bond purchase, if the economy falters, in contrast with her comments made earlier this month, that US economy has gained enough strength in order to withstand reduction of monetary stimulus. Fed officials next policy meeting is scheduled for March 18-19th.

The central bank announced in December that it will pare monthly bond-buying purchases by $10 billion, after which it decided on another reduction of the same size at the meeting on policy in January, underscoring that labor market indicators, which “were mixed but on balance showed further improvement”, while nation’s economic growth has “picked up in recent quarters.”

Weaker-than-expected US data boosted demand for gold as it spurred speculations the US economy may slow its growth.

The US Commerce department reported on Thursday that durable goods orders, fell by 1% in January, after a revised 5.3% drop in the previous month that was larger than initially estimated. Analysts had expected that bookings for durable goods or those meant to last at least three years will decline by 1.7%.

Orders for durable goods, excluding volatile transportation items, rose by 1.1% in January, confounding experts’ forecasts for a 0.3% drop. Core durable goods orders were revised to a 1.9% decline from a previously estimated 1.6% drop.

However, durable goods orders, excluding defense, decreased by 1.8% in January, after a 3.7% slump in the previous year. Analysts had predicted a smaller decline of 1.2%.

In addition, initial jobless claims rose by 14 000 to 348 000 in the week ended February 22, exceeding analysts’ projections of 335 000 and up from 334 000 a week ago, data by the US Labor Department showed. The higher-than-expected number of Americans that filed for jobless benefits last week, fueled concerns that the labor market recovers unevenly.

Federal Reserve will probably continue to pare stimulus by $10 billion at each policy meeting before exiting the program in December, according to a Bloomberg News survey of 41 economists, conducted on January 10th.

Assets in the SPDR Gold Trust, the biggest bullion-backed ETP, were unchanged at 803.70 tons on Friday, but advanced 0.4% in February, the first monthly increase in 14 months. However, the fund has lost 41% of its holdings in 2013. A total of 553 tons has been withdrawn last year. Billionaire hedge-fund manager John Paulson who holds the biggest stake in the SPDR Gold Trust told clients at the end of last year that he wouldn’t invest more money in his gold fund because it isn’t clear when inflation will accelerate. However, a government report revealed that the owner of the largest stake in the SPDR Gold Trust, kept his holdings unchanged in the fourth quarter of 2013.