What is social trading?

This lesson will cover the following

- Social trading basics

- Sharing information and learning

- Examples

Social Forex and stock trading is the next step in the social media evolution. It’s a relatively new way of trading, allowing users instant and constant access to information about the market through the power of the Internet. Unlike fundamental and technical analysis, the information in social trading is generated by other users, which allows novices in the field to make trades without having to perform the analyses themselves. In essence, you base your investment decisions on the data and analyses performed by others. The process enables you to seek or give help to others in your field, introducing a new social element of trading never seen before. Not only is social trading beneficial for new and experienced traders alike, but it also shortens the learning curve for newcomers.

Social trading basics

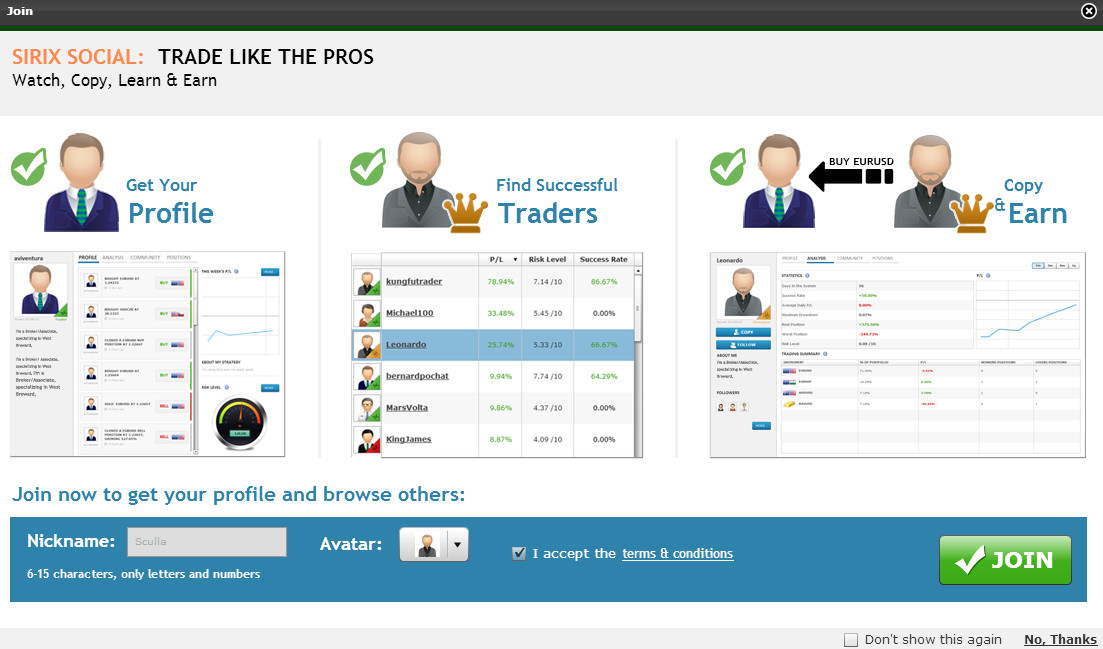

Social trading enables users to share information with other members of the community in real time. As this is one of the inherent benefits of the process, it allows new investors to witness and then replicate the trades performed by veterans. This way, newbies can see how experienced traders do business, why they take certain actions, and what they look out for. Thus, social trading allows newcomers to learn faster and in a real environment. Not only that, but it also gives them the opportunity to trade with ‘training wheels’ or a ‘safety net’. In the past, it wasn’t uncommon for a new trader to blow all their funds before they learned how to trade. Social trading reduces the chance of such an occurrence, although it doesn’t eliminate it completely.

Examples are the best way to illustrate a point

To help you better understand what we are talking about here, imagine that you received useful information on your Facebook feed. For example, a friend of yours conducted research concerning a new product that a prominent electronics company is about to release. This is sure to send their shares skyrocketing, which means that the best time to buy is probably now. Another friend informs you that, due to a political controversy involving another company, it’s expected that their shares will decrease in price. Since you hold shares there, maybe now is the time to sell. You get the picture. Now expand this on a more global scale. We are sure that you might get such information on your feed anyway, but what you read on Facebook isn’t always reliable (although if the people you know in the financial sector share information via Facebook, it might be just as good). There are, however, many specialised platforms where you can register and constantly receive updates on your feed in real time. The real beauty of these specialised trading platforms is that you can easily check the credibility of the source by taking a look at their profile.

This makes it really easy to determine whether they are telling the truth. For example, if someone claims that the shares of a company are about to skyrocket but hasn’t bought a single share (and, on the contrary, is selling), this probably means that the individual is lying. If they are buying shares, you can check their portfolio – if it’s good, then the information is probably legitimate and you can do the same. If the portfolio is poor, that might indicate that the person doesn’t really know what they’re talking about, so stay away. As you can see, it’s relatively easy to access information and verify it. You can obtain the same information from forums, Twitter, Facebook, Google+ and other social networks, but determining its legitimacy there is more difficult. For this reason, we urge you to use actual social trading platforms as a source of information instead of unofficial channels. This way, you know that the people providing information are in the field and you can easily determine how much experience they have and how well they’ve done so far.

Final words

Sharing information and learning from the best is just the first step in social trading. In time, you can copy traders (a process called copy trading, which we will explain in the next section), as well as work with other like-minded individuals in a group for mutual benefit. You will learn, trade, create new friendships and make money. Social trading opens the door to endless possibilities. It significantly shortens the learning curve from a beginner to an intermediate-level trader. Before you know it, you will be able to make your own trades and even help newcomers on their journey to becoming traders.

You will learn how to read charts, make sound predictions and profit from the market. You should never forget that there are risks, though. Losses lurk right around the corner and, the moment you’re not careful, you will experience their ghastly involvement in your daily routine. Nothing ruins your day like suffering enough losses to completely erase the profits from the previous day. You will have to learn proper money management to ensure that rarely happens. Luckily for you, there is a whole community you can rely on and, of course, you can always count on us as well. We will provide you with everything you need.