Recognising good traders

This lesson will cover the following

- Community feedback

- Trading history and gains

- Portfolio, profile and risk management

Social trading is based on the premise that you will use the information provided by other traders so you don’t have to learn all the required skills yourself. But how do you know whether the information is any good? You can’t simply take everything on trust, right? Of course you can’t. However, you’re asking the wrong question here. You can’t know whether the information is good until you either test the data presented or decipher the charts and gather the information yourself. Even then, there is no guarantee that you will get it right.

Sometimes even trends lie. Sometimes the unforeseen occurs. This is why you can never be sure of the information you’re provided with, whether you obtain it through technical analysis or other traders. A better question is: how can you be sure that a trader is good? Sure, we all make mistakes, but a good trader will make far fewer mistakes than someone who seems confident and knowledgeable but is actually full of himself. In this section, we’ll help you answer that question.

Community feedback

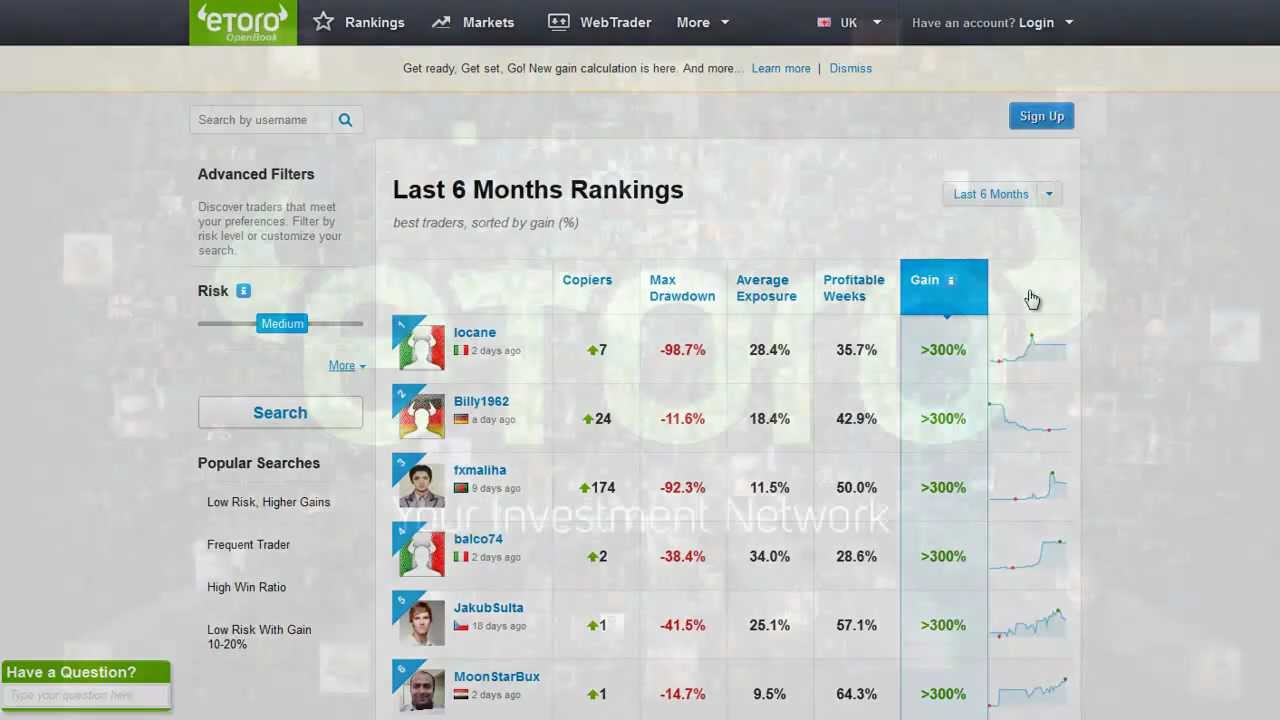

One of the most popular ways to evaluate a trader’s performance in the social trading sector is community feedback. If there have been traders who have followed the one you’re looking at in the past, they will have left some form of feedback through comments and ratings. Many platforms even have their own top tens based on the number of followers a trader has (and other factors, of course). The point is, this is definitely one of the indicators you can look for. Successful traders usually have many followers and are copied by many. This means you will have plenty of feedback to rely on when you’re deciding whether to take their advice or copy them.

However, community feedback can only take you so far. Sometimes a trader looks much more successful than he is because of the community. It’s not impossible for people to leave good comments because they like the trader’s style, even though he may have lost some of their money (they might even be convinced that the short-term losses are part of a long-term winning strategy). On the other hand, a trader can be good yet unpopular. There might be negative comments because someone didn’t like his attitude, or simply because he didn’t achieve the 500% profit the users who copied him were counting on.

The point is, community feedback can serve as an indicator, but don’t let it be the only one. Use it to confirm or disprove what you’re already thinking.

Trading history and gains

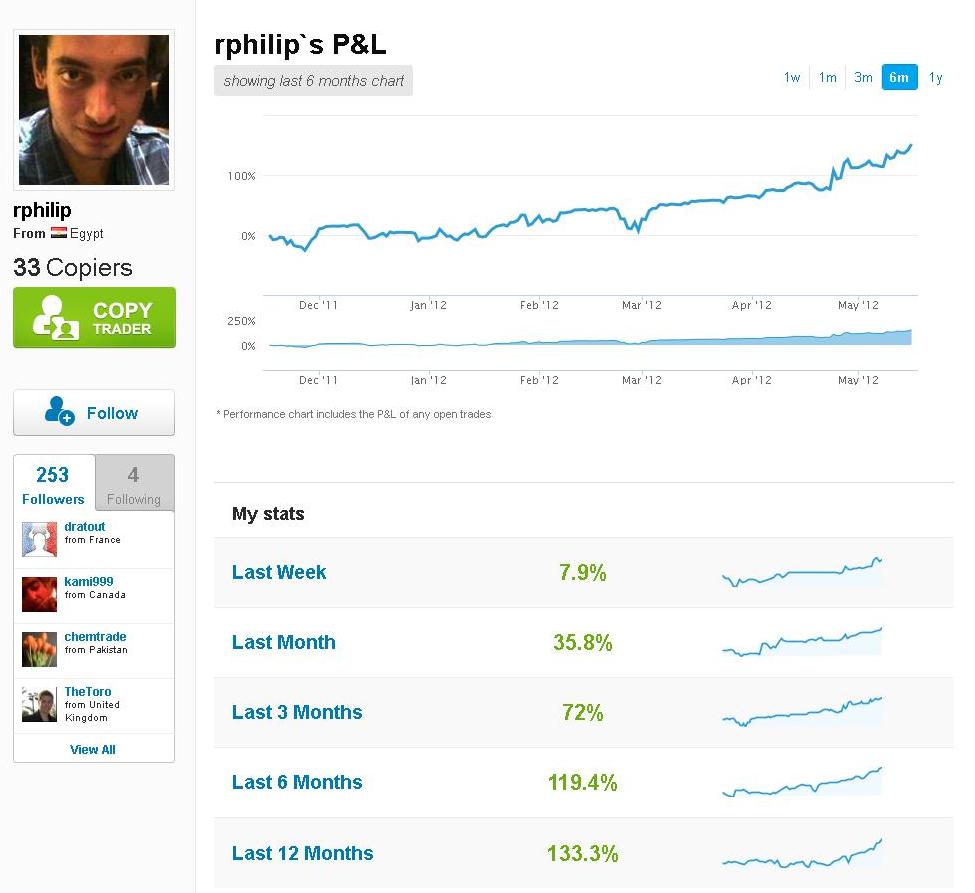

Some platforms allow you to look at a trader’s investment history and current portfolio. You can see exactly how much they’ve gained (usually shown as a percentage) so you can judge how good they are. However, this is also not completely reliable. There are many traders with over 400% gain in the last six months who have many losing trades. One tactic they might use to boost their ratings is to leave losing trades open. If you see that a trader has many losing trades open, this is usually a bad sign (unless it is part of a very long-term strategy).

That being said, it’s still not a bad idea to study those numbers. Learn as much as you can about the trader. Look at their previous and current actions. For example, if someone claims that certain stocks or a currency pair is about to rise sharply but is not buying anything, they probably don’t believe their own information. If they make the claim and back up their words with action but have suffered considerable losses in the past few months, you may still decide not to follow their advice.

Portfolio, profile and risk management

As we’ve said, the portfolio can tell you a lot about a trader. If he is backing up his words with action, then at least he believes in what he’s saying. If he doesn’t have many open losing trades, it’s quite possible that he even knows what he’s doing. Everything we’ve discussed so far should be used together to form a better understanding of the trader’s nature so we know whether he is trustworthy and competent enough for us to follow and copy.

The profile can tell you a lot as well. A good trader who wants to be followed will take the time to complete his profile. If the profile is incomplete, this might indicate that the trader is relatively new, or that he doesn’t take much interest in his own profile. If that’s the case, it’s better to find someone else to follow. In many cases, the profile will tell you whether a trader is using real money or virtual money. Don’t take any action before you’ve confirmed that real money is being traded. Anyone can take huge risks with virtual money.

Finally, a good trader has good risk management. Make sure you find someone whose approach to risk matches your own. You would be surprised how often people are willing to risk far more than you would like them to, so if you don’t want such surprises, ensure the trader’s risk profile aligns with yours.

Final words

Even if you find the right people, there is no guarantee that they will make you money. However, you can be almost certain that the wrong people will lose you money, so go that extra mile and don’t be lazy – find exactly whom you’re looking for to give yourself the best chance.